Hong Kong: Why Does Liquidity Look Alarmingly Tight?

Ongoing violent incidents in Hong Kong mean that market participants are looking for signs of financial risk. Interest rates, which have risen since the protests began, are a good place to start. But is this all about capital flight? A mega IPO could be playing a role, too.

Is capital flight still a tail risk?

As the number of violent incidents - and the level of violence - in the Hong Kong SAR has increased, we take a look at how the market in Hong Kong has reacted. More precisely, we explore whether the risk of capital flight has increased materially.

What has changed in the market so far?

The violence on the streets of Hong Kong started on 12 June 2019 and has become more frequent and more extreme. How has this changed market liquidity in Hong Kong?

The starting point for measuring an economy's liquidity is its interest rates. Put simply, the higher the market risk, the higher the interbank interest rate (all else being equal).

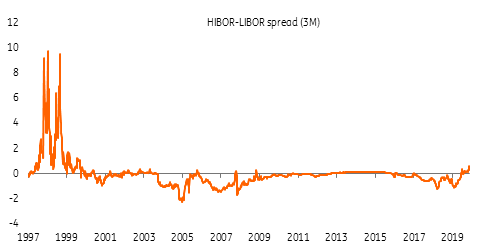

We benchmark the HIBOR to another economy's interbank rate in order to strip out the possibility that any rise in HIBOR has been driven by global events. The usual benchmark is USD LIBOR, the US's interbank interest rate.

The most common approach is to use the three-month HIBOR-LIBOR spread as an indicator of liquidity tightness in Hong Kong. HKD forward points, which drive off these spreads, are basically another way of looking at the same thing. Not surprisingly, they have also pushed higher.

The HIBOR-LIBOR spread was around 0 percentage points to -1 percentage point for most of the time since 2016. But this has moved from negative to positive since mid-June, i.e., Hong Kong dollar interest rates have gone up, which matches the date that violence began in Hong Kong.

Historical HIBOR-LIBOR spread

Source: ING, Bloomberg

Is the rise in HIBOR alarming?

On 20 November, the HIBOR-LIBOR spread was around +0.6 percentage points. However, this is not very high compared to previous episodes of financial stress in Hong Kong.

The last time we saw a large positive HIBOR-LIBOR spread was back in 1997 during the Asian Financial Crisis.

Readers may wonder why there was no spike in the HIBOR-LIBOR spread during the Global Financial Crisis in 2008-2009. But that was because the risk originated from the US, and spreads were negative. US liquidity strains were higher than those in Hong Kong.

Returning to the high positive spread back in 1997, this rose as high as 10 percentage points on 27 October 1997. The path taken by the HIBOR-LIBOR spread was very rapid. From the prevailing high of four percentage points in August 1997, the spread then fell back to around two percentage points and then jumped to 10 percentage points within just five trading days.

Against this history, the swing to the current spread of around 0.6 percentage points, even though starting from a negative base, does not look particularly alarming. Though the rapidity with which previous spikes have taken hold cautions against complacency.

Another reason for the rising HIBOR

There are also other reasons why liquidity is tightening in Hong Kong right now, other than capital flight resulting from the protests.

The "mega-IPO" from Alibaba has created tensions in interbank liquidity. The expectation that Alibaba would be listed in Hong Kong has been around for several months now. Banks and brokerages have had to prepare enough cash for margin financing for this IPO. Alibaba is selling 500 million new shares in Hong Kong, pricing them at around HKD176 per share. This marks the biggest IPO for Hong Kong since 2010.

IPO margins in Hong Kong can be up to 100%. But let's assume only half of the subscribers prefer margin to cash subscriptions. For a mega IPO like this, the subscription multiples could be two to three times for retail investors. Such IPO margin financing may lock up around HKD250-300 billion. Hong Kong's M2 is HKD7,441 billion as of the latest data. That implies a lock-up of cash of 3% of Hong Kong's deposits.

This alone would be enough to push up Hong Kong's interbank interest rates.

But the nature of a liquidity squeeze from violence-driven capital flight and IPO margin financing is very different. The latter is a lot more short-lived.

Looking further ahead, HKD 12M interest rate swaps have picked up imperceptibly relative to historical spikes. Alarm bells are not ringing here, yet.

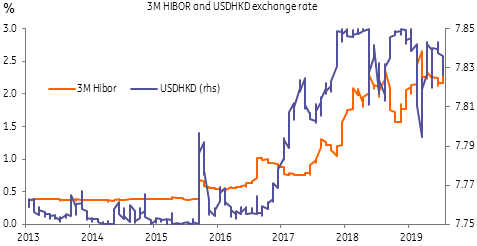

HKD has strengthened since the start of violence

Source: ING, Bloomberg

Look beyond interest rates

We can look beyond interest-rates to get hints on capital outflows from Hong Kong.

The USD/HKD is bound by the linked exchange rate system to be in the range of 7.75 and 7.85. When there is a conversion of HKD into USD the USD/HKD exchange rate will approach 7.85. This has been the case for 2018 and early 2019, the USD/HKD touched 7.85 for a period of time even though the Hong Kong Monetary Authority bought HKD in the market several times. Those actions even created a strong strength in HKD

Since the violent incidents started in mid-June, the HKD has strengthened rather than weakened. In particular, there were several IPO listings and dividend payments in early July that tightened liquidity and led to a strong HKD to below 7.80. After the short term liquidity squeeze by these stock market activities, the HKD weakened but has not touched 7.85 since then. And the HKKMA has not bought HKD in the market. Between then and now, there were several IPO listings and the HKD has recently strengthened to 7.8250.

The exchange rate does not support the story of capital outflows.

Other market indicators, such as HKD 6M implied volatility, have picked up. But this too remains low relative to historical levels. 3M risk reversals paint a clearer picture that downside risks to the HKD are worrying investors. But that does not seem to be translating into a broader market panic.

So is there anything alarming?

Looking at interest-rates and exchange rates and the timing of the mega-IPO rumour, which has been around for several months, it seems likely that there have been more funds flowing into Hong Kong's financial markets than leaving them.

But we need to be careful. It could be that the Alibaba IPO has masked the protest-related outflows. As we have stated, the nature of violent incidents on markets and IPO margin financing is very different. The IPO driven liquidity squeeze won't stay for long.

If the HIBOR-LIBOR spread increases again, and at the same time the USD/HKD exchange rate returns to 7.85, money could indeed be moving out of Hong Kong.

As history has shown, spikes in interest rates could develop into a market panic very quickly.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more