Hong Kong Has The Lowest Implied Growth Rate In Asia

The implied growth rate is a way to see what growth rate the market expects. In this post, we’re using the dividend discount model (DDM) to find the implied growth rate. The discount rate is estimated using the capital asset pricing model (CAPM). Betas were set to 0.75, 1.00, or 1.25 according to our previous research on beta.

Here’s the math:

V0 = DPS1/(r-g)

Where V0= value of the stock today, DPS1 = dividend per share one year ahead, r = discount rate, and g = constant growth rate of DPS.

Then,

Implied growth = r-(DPS1/Price)

Where DPS1 = Estimated dividend per share.

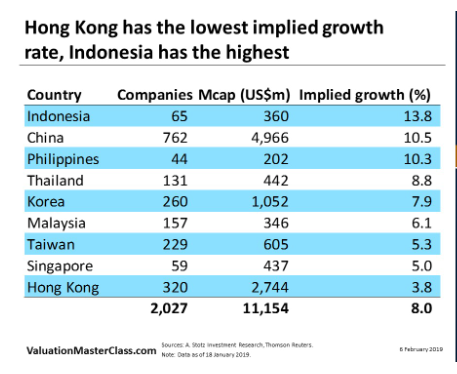

- Using DDM to find the implied growth rate for 2,000 companies in Asia

- Hong Kong has the lowest implied growth rate, followed by Singapore

- Indonesia has the highest implied growth rate, followed by China

Disclaimer: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and ...

more