Higher Inflation Means Extended Rate Pause In Russia, Hawkish Shift Unlikely

Russian inflation is likely to hit 4.7% this year, exceeding initial forecasts, which should keep the central bank on hold. However, it is unlikely to tighten as inflation should reverse after 1Q21 and touch 3.5% by the end of 2021. Based on inflation expectations, Russia's real rate exceeds the mid-range of peers, leaving room for a small cut in 2021.

Russian Central Bank Governor Elvira Nabiullina attends a press conference, Moscow, Russia

Key rate to remain on hold, dovish stance to remain

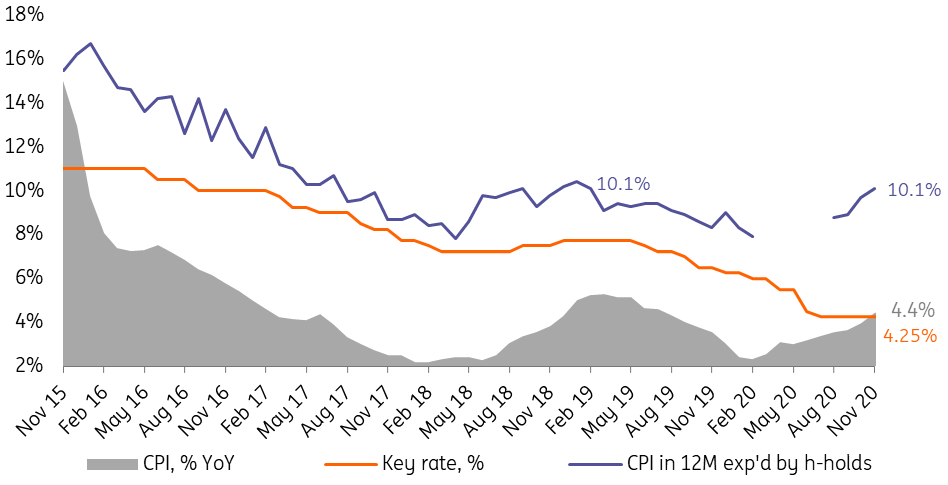

Rising inflation in Russia from 4.0% year-on-year in October to 4.4% YoY in November and 4.5% YoY in the first week of December is a negative surprise that is likely to affect the Bank of Russia's key rate decision at the upcoming meeting on 18 December.

In a way, it strengthens our earlier call for an unchanged key rate at 4.25% this month. However, a more important question is whether the pick-up in inflation will affect the medium-term guidance, which is currently moderately dovish and suggests a small downside to the key rate with prospects of a rate hike in 2021. We don't expect a strong hawkish shift, as we forecast inflation should reverse after 1Q21 along with stabilising global agriculture prices after their November spike, 3Q20 RUB devaluation pass-through ending and removal of low base effect for the CPI.

Additional arguments against any tightening in the near- to medium-term include a positive ex-ante real key rate of 0.5-1.0%, slowdown on net private capital outflow in November, resumed inflow of foreign portfolio investments into state bonds (OFZ), solid growth in the Russian banks' retail and corporate funding relative to lending, as well as modest expectations of economic recovery for 2021.

Our expectations for the key rate in 2021 remain in the 3.5-4.0% range (core CBR meetings in February and April seem to be the most likely candidates for a first-rate cut) assuming expected CPI of 3.0-3.5%, though the recent CPI developments and our persistent expectations of looser than expected fiscal policy at the regional level suggest that the risks are tilted towards the upper border of the forecast range.

Global agro inflation and RUB depreciation causing CPI to rise

Indeed, the recent data on CPI and expectations suggest a deterioration in the near-term trend.

Consumer inflation picked up from 4.0% YoY in October to 4.4% YoY in November, exceeding our 4.3% YoY expectations, and it keeps accelerating in December, making our initial year-end expectations of 4.2% YoY (and CBR's 3.9-4.2%) unrealistic.

Moreover, household's 12-month CPI expectations deteriorated by 0.4 percentage points in November and hit a 17-month high of 10.1% (the level itself is not as important as the vector). The pickup in CPI has caused a negative response by the president and the government, who are now looking into ways of addressing the deterioration of purchasing power of households, especially in the most socially-sensitive items, such as basic food products.

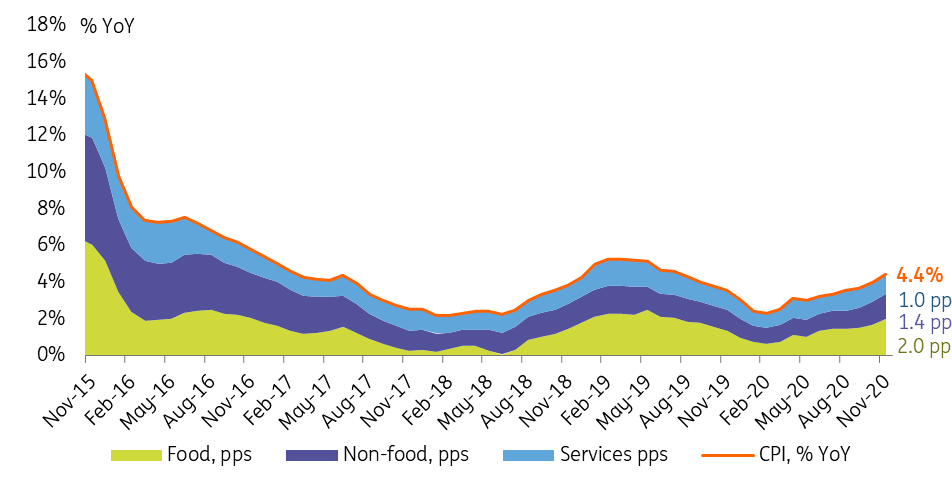

Meanwhile, looking more closely at the structure of the consumer price growth in Russia, we can see that the primary causes are external and most likely temporary.

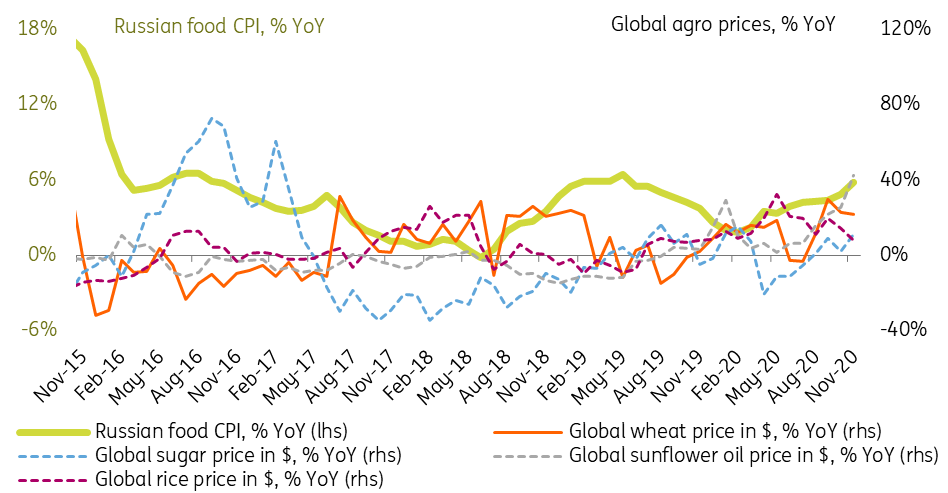

- Acceleration of food price growth from 4.8% YoY in October to 5.8% YoY in November (out of which 0.5 pp is the result of base effect) assured 0.3 pp out of 0.4 pp acceleration of the overall inflation in November. The non-technical factors contributing to higher food CPI include the November spike in global prices for the key agricultural commodities such as wheat, sugar, and sunflower oil. We have repeatedly stressed Russia's sensitivity to global agriculture prices and indicated it as one of the key challenges to the sustainability of inflation targeting in Russia. The good news, however, is that the local spike in the global agriculture prices seems to be over, which will help the government in its efforts to contain local prices for sugar and vegetable oil in the coming weeks and months. More good news is that the overall low base effect for the overall CPI will evaporate after 1Q21, also helping the government to seem successful in its disinflationary efforts.

- The pickup in non-food price growth from 4.2% YoY in October to 4.5% YoY in November contributed the final 0.1 pp to the overall CPI acceleration in November and is driven by the RUB depreciation passed through consumer electronics and increased demand for pharmaceuticals. To remind, the ruble gradually depreciated to US$ by 10% in July-October inclusive, which should add 0.3-0.5 pp to the overall CPI trajectory over the course of several quarters. Again, the good news is that since November the FX trend seems to have improved which should limit the pro-inflationary pressure in 2021.

- Services CPI remained stable in November at 2.5% YoY which is partially a result of restrained demand and partially reduced supply of offline services such as foreign tourism. We do not exclude that services CPI may pick up in 2021 along with recovery in household activity, however its relatively small 28% weight in overall CPI should statistically limit the impact.

Overall, we now see CPI picking up to 4.7% YoY as of year-end stabilising in 1Q21 and then slowing down to 3.0-3.5% by the end of 2021, unless there are new external shocks. If the central bank shares our view (preliminary statements point in this direction), its communication will contain indications of increased near-term inflationary risks combined with assurances in the sustainability of the long-term CPI target of 4%.

Figure 1: Russian CPI and expectations have picked up, calling for a pause in key rate cut

(Click on image to enlarge)

Source: Bank of Russia, Rosstat, ING

Figure 2: Food remains the primary factor of CPI volatility

(Click on image to enlarge)

Source: Bank of Russia, Rosstat, ING

Figure 3: Local food CPI has been propelled by global price spike

(Click on image to enlarge)

Source: Rosstat, Reuters, ING

Russian ex-ante real rate remains elevated by global standards

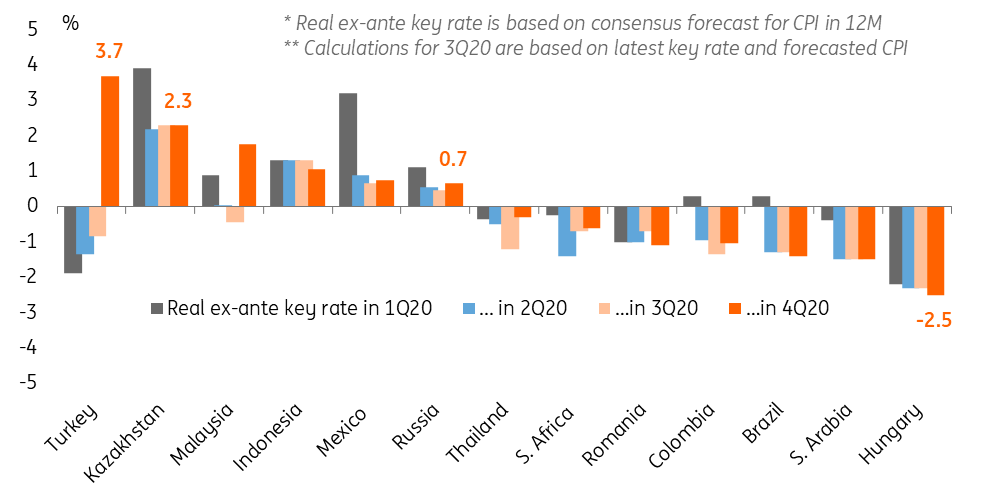

Although based on current inflation numbers, it seems that the real key rate has now turned negative, so 12-month expected CPI is a more appropriate metric for determining the real rate.

Based on our expectations of CPI for year-end 2021, which do not differ materially from consensus, it appears that the Russian ex-ante real key rate remains securely in the positive territory in 0.5-1.0% range. This puts Russia near the middle of the peer range, which is between -2.5% in Hungary and +3.7% in Turkey (the latter is a recent development following the CBT's sharp hike in the nominal key rate from 10.25% to 15.0% in November). Net of Turkey, the range is between -2.5% to +2.3%, putting Russia above average, accounting for the country's elevated foreign policy risks.

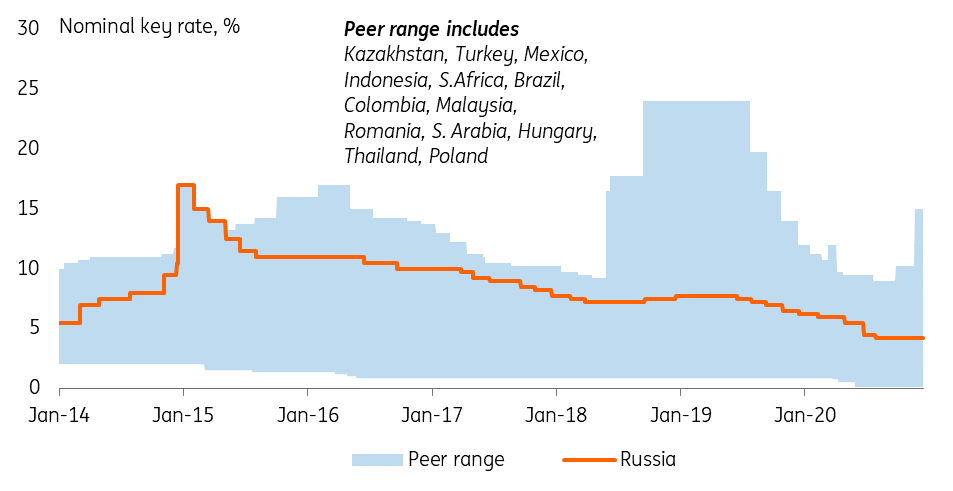

Looking at the global nominal key rate trends, with the exception of Turkey, the most popular decision is 'hold' since September, reflecting the stabilisation of inflationary trends and expectations. According to ING's recent key rate forecasts, most of Russia's peers are expected to maintain current rate levels for the next 12 months. Russia's staying in the middle of the peer range gives the CBR some flexibility in terms of key rate decisions.

Figure 4: Russia's ex-ante real key rate remains in the positive territory, slightly above peer average

(Click on image to enlarge)

Source: National sources, Reuters, FocusEconomics, ING

Figure 5: Russia remains mid-range in terms of nominal key rate, peers are not expected to ease further at this point

(Click on image to enlarge)

Source: National sources, Reuters, ING

Russian capital account does not require additional reinforcement

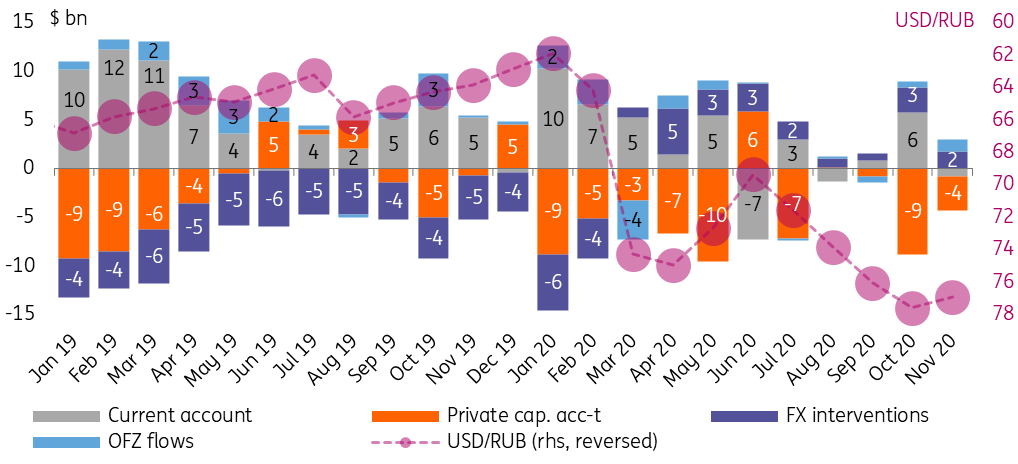

The more positive news is that Russian balance of payments, while generally, a cause of concern on the capital account side, at the moment does not seem to require additional reinforcement. Based on the monthly CBR data released earlier this month, net private capital outflow slowed in November, confirming our earlier call on the one-off nature of the October spike. In addition, preliminary data suggest that the net portfolio investments into the local currency public bonds (OFZ) has more than doubled, catching up on the improvement in the global mood.

Although the current account demonstrated a surprising weakness in November, it follows a highly positive October number, and the final quarterly estimate may indicate a more even monthly distribution. Moreover, the recent increase in the oil prices and relaxation of the OPEC+ constraints lower the concerns regarding the current account and support our constructive view on RUB.

Figure 6: Capital account improved in November on both private flows and portfolio investments into OFZ

(Click on image to enlarge)

Source: Bank of Russia, Reuters, NSD, ING

Russian banks' market funding growth solid despite lower rates

Another argument against tightening by the central bank is the state of the banking sector.

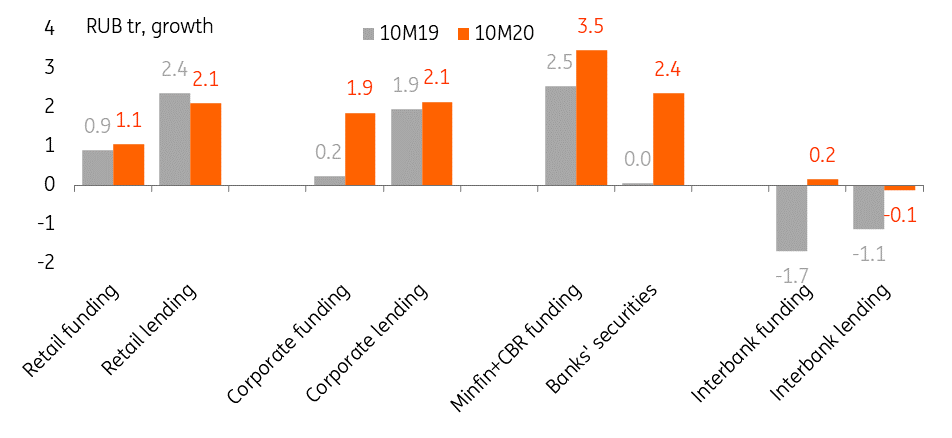

Even though the retail funding side is under the pressure of outflows into cash and higher-yielding stock market instruments, the 10M20 (latest available) dynamic of the RUB portion of the banks' balance sheet suggests that the funding side remains solid both on the retail and corporate sides.

- In 10M20, the growth in RUB retail deposits totalled RUB1.1 trln, exceeding the 10M19 figure of RUB0.9 trln, while retail lending growth slowed by RUB0.3 tr, as the pickup in mortgage lending was offset by redemption in consumer loans;

- Corporate funding inflow picked up materially from just RUB0.2 trln in 10M19 to RUB1.9 trln in 10M20 amid lack of material acceleration in the corporate lending due to restrained CAPEX activity;

- The increased pressure on the banks' balance sheet is coming from the purchase of OFZ by banks, however, this process seems to be mirrored by an increase in banks' funding from the CBR and placement of Minfin's deposits with banks.

Figure 7: Banks' corporate and retail funding growth solid despite lower rate

(Click on image to enlarge)

Source: Bank of Russia, ING

Russian GDP growth prospects for 2021 remain modest

Finally, uncertainties regarding growth prospects should also be a contributing factor against a hawkish shift anytime soon.

The recent GDP data for 3Q20 has been positive, with dynamics recovering from -8.0% YoY in 2Q20 to -3.4% YoY in 3Q20, with improvement in the trade being the most powerful contributing factor (it assured 1.6 pp out of total 4.6 pp improvement of the GDP growth rate in 3Q20 vs. 2Q20). Still, the trade sector output remains 1% below the pre-crisis level, and the recent high-frequency data suggests that the recovery stalled in October and may have even reversed in November (the latest consumer data on Friday is yet to confirm this).

The agile recovery of manufacturing and transportation sectors also seen in 3Q20 is also positive news, however, fiscal consolidation at the federal level and a shift in priorities toward social support may be a factor restraining recovery at the corporate level in 2021. We remain cautious on 2021 GDP growth, expecting only 2.5% YoY recovery.

Some positive surprises may follow if fiscal policy proves to be growth supportive at the regional level ahead of the upcoming parliamentary elections.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more