Gold Speculators Raised Their Bullish Bets This Week To Highest Since 2016

Gold Non-Commercial Speculator Positions:

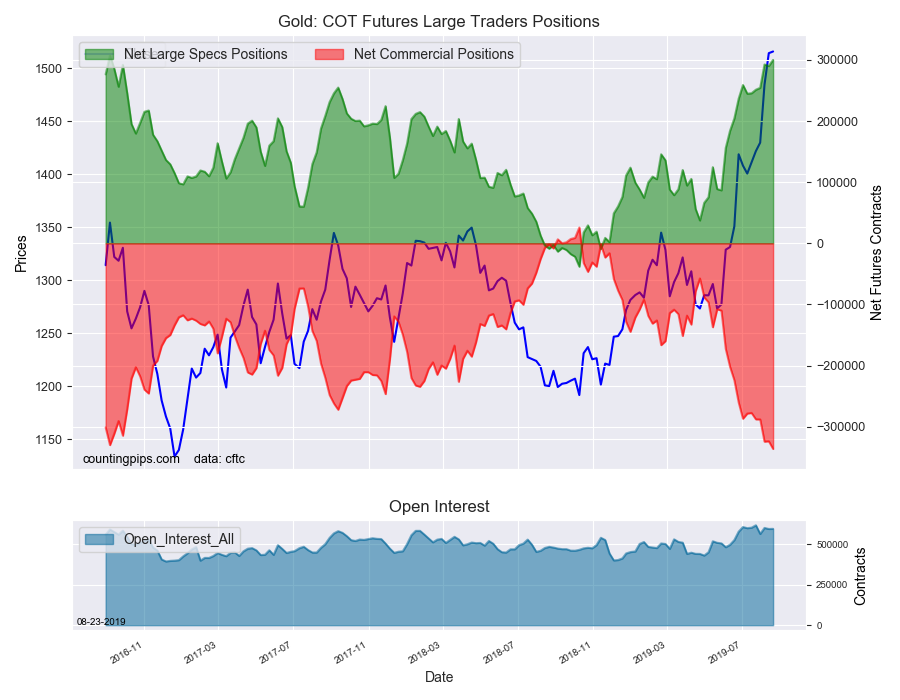

Large precious metals speculators continued to boost their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 299,993 contracts in the data reported through Tuesday August 20th. This was a weekly lift of 9,903 net contracts from the previous week which had a total of 290,090 net contracts.

The week’s net position was the result of the gross bullish position (longs) growing by 6,071 contracts (to a weekly total of 352,294 contracts) while the gross bearish position (shorts) decreased by -3,832 contracts for the week (to a total of 52,301 contracts).

Gold speculators added to their bullish bets following a slightly down week last week and for the fifth time out of the past six weeks. The trend for gold positions has been sharply higher since the beginning of June as bullish bets have increased ten times out of the twelve weeks since June 4th and by a total of +213,305 contracts.

This week’s gain brings the overall net position within a whisker of the +300,000 contract level that has not been breached since September 6th of 2016 (a span of 154 weeks) when positions totaled +307,860 net contracts.

Gold Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -336,250 contracts on the week. This was a weekly decrease of -12,523 contracts from the total net of -323,727 contracts reported the previous week.

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1515.70 which was an increase of $1.60 from the previous close of $1514.10, according to unofficial market data.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) as well as the commercial traders (hedgers & traders for business purposes) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).

Receive our weekly COT Reports by Email

Risk Disclosure: Foreign Currency trading and trading on margin carries a high level of risk and can ...

more