Gold: Deflation For The Nations Before Inflation

Summary

- The high that was made yesterday of $1,691.70 is a major area of resistance.

- The virus obviously is making an impact on the Fortune 500 companies that have an interest in China, many of which are shutting down operations in China.

- For gold, in terms of the effect, it looks like gold on yesterday’s high of $1,691.70 might have discounted the potential damage.

- The annual target was completed at $1,650, but if we get a close below $1,650 at the end of this month, it will activate the annual short trigger target from $1,650, with the annual mean of $1,417 as the target.

Gold

We use the Variable Changing Price Momentum Indicator (VC PMI) to analyze markets, including gold. Gold traded last at $1,653.90, which is confirming that the high that was made yesterday of $1,691.70 is a major area of resistance. It's a target that completed the VC PMI Sell 1 target of $1,673 and almost that $1,698 target. It completed the weekly target of $1,673 on the news that the coronavirus was continuing to spread throughout Asia, beyond China. This raises the question about the actual economic damage that the virus will cause globally. If you look at the equity markets, after the high of 3397.50 on the 19th on the E-mini, we are trading last at 3231. The low on this move was 3213. The virus is obviously making an impact on the Fortune 500 companies that have an interest in China, many of which are shutting down operations in that country. This is a black swan that is going to cause massive disruption in every economic area. It has been found in Europe, including Germany and Italy, which shows that the virus has not been contained even to Asia.

Courtesy: TDAmeritrade

In terms of the effect, it looks like gold on yesterday’s high of $1,691.70 might have discounted the potential damage. It then discounted any additional news, as the market reverted back down and activated the weekly mean of $1,628. The market came down below $1,673, but activated the weekly and daily short triggers. The daily was met today at the Buy 1 level of $1,635 at about 10:15 pm Pacific Time. It matches the trend line support short term that has been built since the market broke out on the upside on a close above $1,603. It connected all the way down to $1,584 or 5.

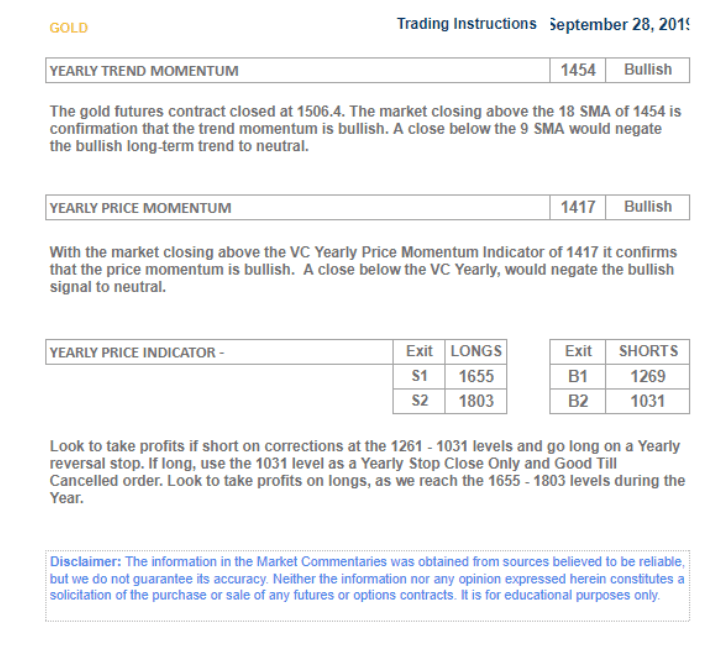

We have been recommending that our subscribers take a pause. Earlier this week I suggested selling into this rally. $1,650 is the annual target we published on Sept. 28, 2019. We have not locked in a lot of profit and we recommend that our subscribers lock in profits, and let the market resolve itself in terms of supply and demand. The key is to let the uncertainty related to the coronavirus settle in.

The annual target was completed at $1,650, but if we get a close below $1,650 at the end of this month, it will activate the annual short trigger target from $1,650, with the annual mean of $1,417 as the target. The nine-month simple moving average is $1,454.

Let’s continue to watch the short-term indicators, such as the daily and weekly indicators, to give us some opportunities to possibly counter trend this market. We may be going into a couple-of-month correction to test that lower level of support in that $1,500 to $1,550 area, which was the beginning of this breakout and of the virus.

Disclosure: I am long DUST.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold and silver, check us out on more