Global Doves Expire: China’s Big 3 Stats Put To Rest RRR Myths

The Fed has its pause. The ECB is going to conduct another T-LTRO. But of all the central bank responses to the “unexpected” global weakness of late 2018, the Chinese’s was supposed to be the leader. The most forceful pushback against a worldwide downturn was reported to have been the PBOC’s “powerful” RRR cuts. China’s central bank conducted two of them in January alone.

China’s economic data in 2019, however, is putting to rest more than just the myth of RRR “stimulus.” There’s rebalancing. Green shoots. All of them up in flames now one-third of the way through this year.

Weakness not only persists, it grows worse as if dovish central banks don’t matter. They don’t.

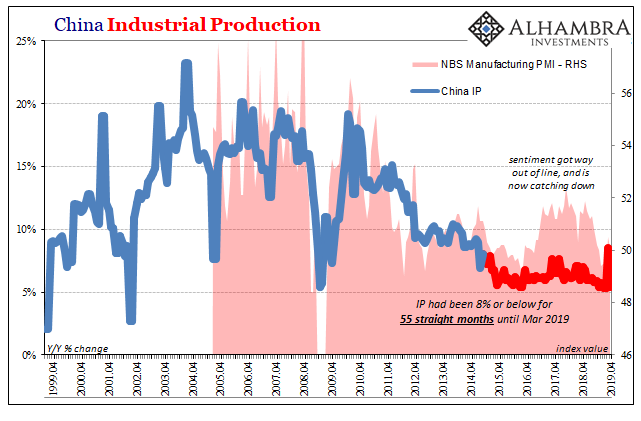

Arguably the greenest shoot of the year belonged to Chinese Industrial Production. Last month, for March 2019, China’s National Bureau of Statistics (NBS) reported growth of 8.5% year-over-year. It was the first better than 8% in almost five years. Together with a PMI reading springing back above 50, for (too) many it was confirmation the RRR’s were surely working.

Proving instead to be a clear outlier, IP in April 2019 gained only 5.4% year-over-year. It’s another month very near the weakest on record. Chinese industry expanded by only 5.3% in the first two months of this year, the lowest since the early 2000’s.

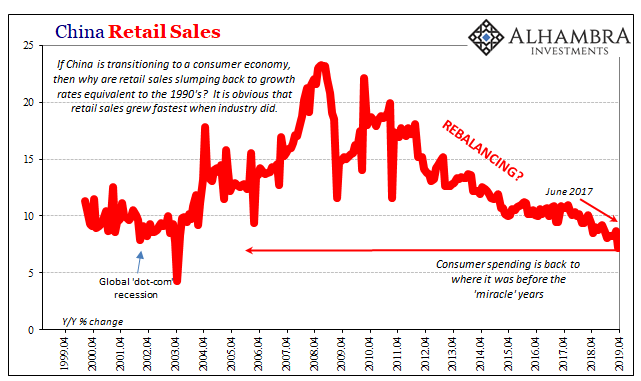

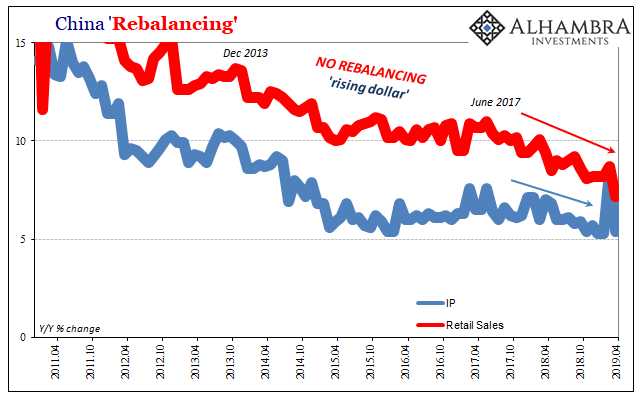

But if China’s manufacturing woes aren’t being cured by PBOC action, then rebalancing is supposed to offset external problems. For quite a lot of years now, people have been making the claim that this country is in transition. A very beneficial and opportunistic one. Echoing the Communist government, they do always fall right in line when technocrats speak, Economists have said China’s economy is becoming more internally oriented.

This shift toward a modern, service-based system more like the mature Western economies, means a very different source of growth and strength. Even if industry falters, hundreds and hundreds of millions of now middle class Chinese consumers will more than make up for it.

Like with most things Economists claim, there isn’t any evidence to support them. Despite “stimulus”, despite rebalancing, retail sales in the month of April rose only 7.2%. That’s the worst number, by far, since May 2003 and really since the Asian flu of 1998 and 1999.

Rather than an internally-based economic transition, the pre-miracle China is emerging. This is very bad news and not just for the Chinese.

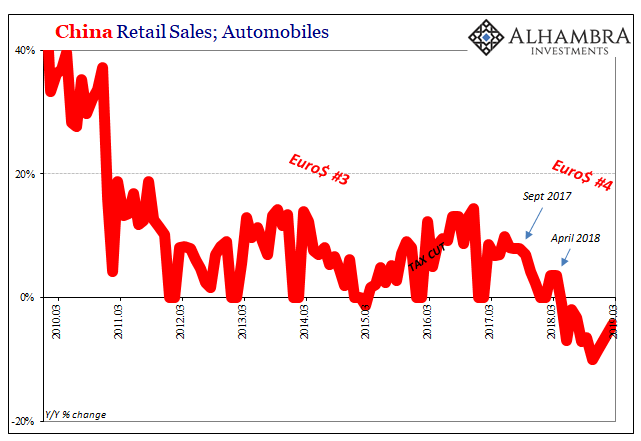

For example, clothing sales contracted last month for the first time since the Great “Recession.” As noted recently, China’s consumers aren’t buying cars anymore and haven’t for almost a year. In 2019, they’ve begun to cut back on regular household items such as personal care products. These are the kinds of signals suggesting deepening macro woes and not just in the one month.

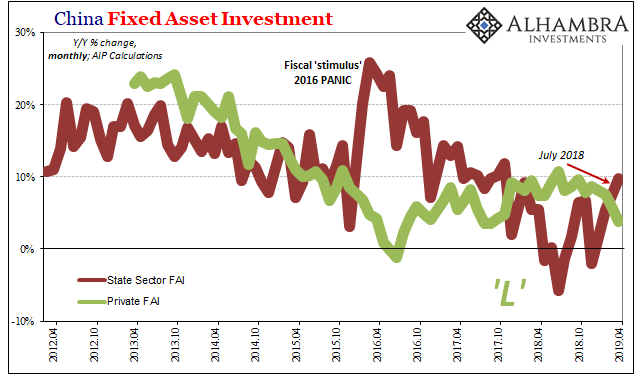

Where you would most expect to find results of RRR “stimulus” is in the most credit-sensitive economic sectors. Capital investment, for one, depends heavily on China’s banks to extend loans and buy up bonds. If the PBOC is handing Chinese banks a lot of what looks like extra liquidity, orthodox theory expects that Fixed Asset Investment (FAI) would benefit almost directly.

Instead, the only acceleration in FAI we find is through state channels. Overall FAI slowed in April on an accumulated basis, down to 6.1% from 6.3% in March. The reason was private investment.

Since the start of the year, growth in this crucial piece of China’s economy has continued to decelerate. Urban, middle-class China was built on Private FAI. Accumulated year-to-date, it was up just 5.5% last month, down from 6.4% in March. For the month of April alone, Private FAI increased by just 3.8% year-over-year.

It used to be that 20% in a single month was alarming.

Thus, we have the two parts of FAI moving in opposite directions. As the private economy slows substantially, Beijing is ramping up fiscal stimulus in addition to whatever it is the PBOC is actually doing. But it’s not a huge program. This is nothing like early 2016, much more modest suggesting the official motivation is contrary to Western imagination.

The Chinese are not trying to restart robust economic growth. Rather, it’s pretty clear what they’re after is managing decline. If that’s really possible. The direction for China’s economy is out of anyone’s hands, therefore the best that can be done is to try to keep it from spiraling out of control in a Japan 1989-type scenario.

There is resignation in all these numbers as Economists have their myths busted. Rebalancing? Nope. Green shoots? Not really. Stimulus?

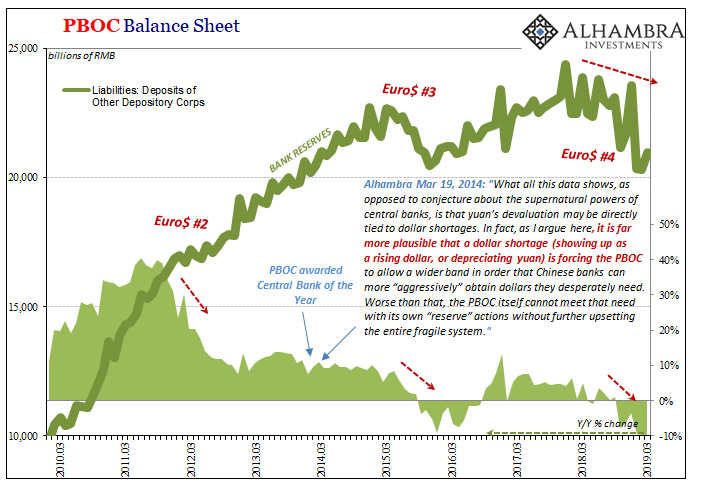

The RRR’s, as I’ve been writing since they first re-appeared early last year, are not it. They are, at best, a haphazard response to direct monetary constraint imposed upon the PBOC and therefore all of China by Euro$ #4. When you view these measures in that context, the Chinese economic statistics make sense. Nothing at all unexpected here.

I wrote back last April, at the appearance of the first RRR in the latest eurodollar cycle:

China’s central bank isn’t some all-powerful wielder of supreme monetary power, Bernanke’s printing press, it is almost a bystander trying desperately to react to forces entirely beyond its control.

And since all this predates “trade wars” by a good long while, in light of serious weakness all across China’s Big 3, we have no green shoots, no stimulus, and no rebalancing. Not a single dove in sight.

This is the eurodollar’s world, we are all just trying to live in it.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more