GBP/USD Weekly Forecast: Weak Bulls May Lead To 1.38, Eying UK GDP

The GBP/USD weekly forecast is mildly bullish. However, the bid tone dented as the pared lost some gains on the close.

The pound sterling lags behind competitors when it comes to profiting from the dollar’s sell-off. So is GBP/USD likely to gain a foothold, or is it prone to a rate change? The next steps will be determined based on data from both sides of the pond (FXB, UUP).

In August, only 235,000 new jobs were created in the US, well below already conservative forecasts. However, because the hirings were mostly for leisure and travel, the dollar’s pain was somewhat eased. In any case, if the Fed does not discuss the matter, it will choke off the market.

The dollar dropped as a result of a weaker outlook for the NFP. In addition, ADP’s private sector employment report came in below expectations as 374,000 jobs were added against over 600,000. Meanwhile, Conference Board’s consumer confidence index fell to 113.8 in August.

In spite of beating estimates at 59.9 points, the employment component declined to 49 points, which is reflective of declining hiring. This further reduced the likelihood of “tapering.”

Lloyds’ corporate survey accelerated despite bottlenecks, reaching its highest levels in about four years. In addition, Markit’s final manufacturing PMI was updated. The Pound, however, lagged behind other currencies and strengthened against the US dollar.

A Brexit-related bottleneck on supermarket shelves, along with persistently high Corona virus infection rates, slowed sterling’s gains. However, there hasn’t been a noticeable decrease in incident rates. There is a slowdown in the number of new cases in the US. It appears that the admission to the hospital in America is reaching its peak.

US And UK COVID-19 Infections

Markets did not get off the ground after the United States and the United Kingdom ended their operations in Afghanistan. As a result, economic weakness in China is reflected in Asian equity markets, not elsewhere.

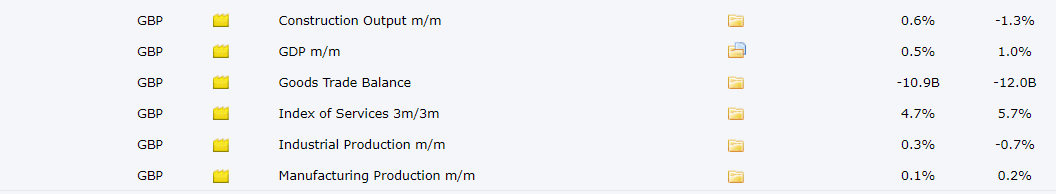

Key Events In The UK During Sep 06-10

![]()

In the wake of the widespread distribution of the Delta-COVID variant, virtually all restrictions related to COVID were lifted on July 19. Assuming the gross domestic product growth rate is the same as in June, this month’s performance will be challenging. Therefore, the publication will also include production statistics.

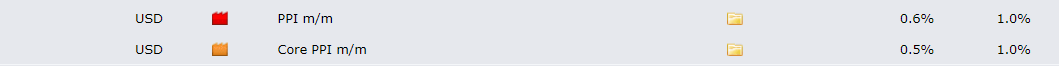

Key Events From The US During Sep 06 – 10

![]()

![]()

The important events include the JOLTS job opening due on Wednesday ahead of Fed William’s speech in the US. Moreover, weekly unemployment claims are also important to note. Other than that, US PPI m/m data may also trigger volatility due on Friday. The figure is expected to slide to 0.6% against the previous month reading at 1.0%.

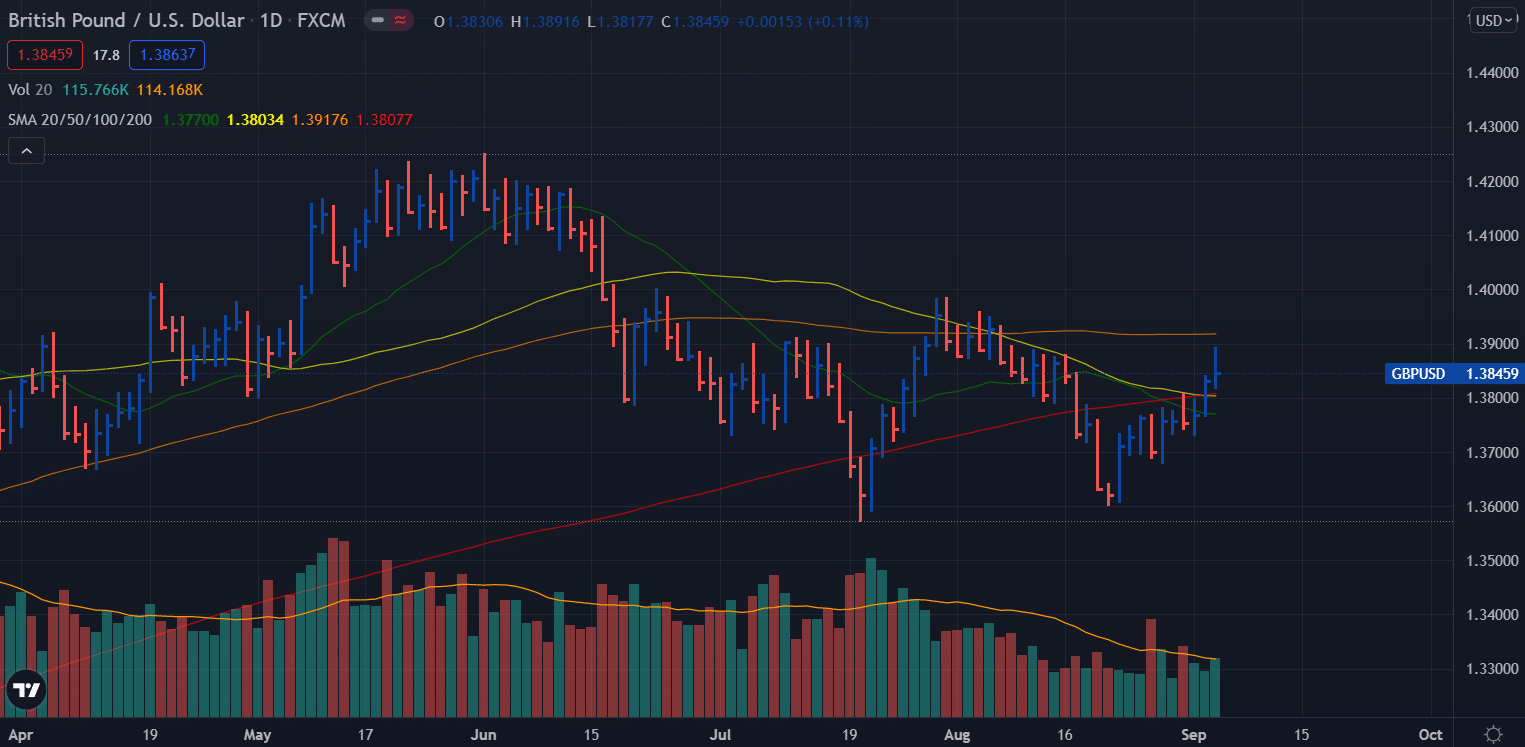

GBP/USD Weekly Technical Forecast: 1.3800 Remains The Key

GBP/USD weekly forecast – daily chart

Like other major pairs, the GBP/USD pair posted gains below the 1.3900 handle and pared off the gains. The price closed the week around mid-1.3800. The price posted an up bar on Friday, closing below the middle on a very high volume. It is very likely to have a downside retracement next week. As long as the price stays below the 1.3900 mark, bears will aim for 1.3800 ahead of 1.3770. However, the congestion of 20, 50 and 200 DMAs at 1.3800 may support the pair.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more