GBP/USD Weekly Forecast: Sterling On High Alert For Sunday Showdown

GBP/USD FUNDAMENTAL HIGHLIGHTS:

SUNDAY SHOWDOWN:

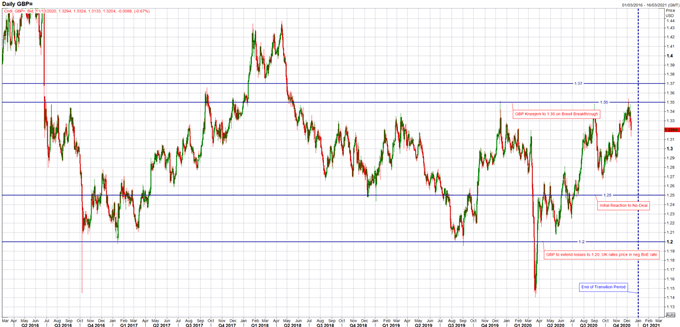

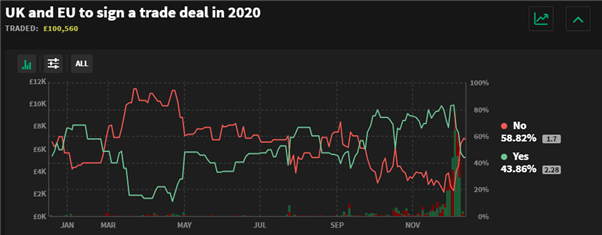

The past week has seen a significant step up in no-deal Brexit risks with UK PM Johnson warning that it is "very, very likely" that the UK will have to start trading with the EU on WTO terms (no-deal) from January 1st. EU’s Von Der Leyen had also shared this sentiment by telling EU leaders that a no-deal is the most likely outcome. In turn, bookmakers now lean towards a no-deal at 58% from 33% the prior week, according to SMARKETS (Chart Below). That said, while this would seemingly increase the importance of Sunday’s showdown, where both parties will decide on the future of trade talks. As has been the case with self-imposed deadlines previously, this is unlikely to be the key deal or no-deal moment, thus talks will likely continue throughout the upcoming week. However, should Sunday’s decision disappoint markets, GBP/USD has a lot of room to the downside with the 1.3000 handle vulnerable to a break. Heightened sensitivity over Brexit headlines means that for traders with exposure to GBP must remain disciplined.

For a comprehensive look at trading discipline, check out the traders guide to trading psychology

MONDAY’S POTENTIAL GBP MOVE:

That in mind, it is worth noting that implied volatility for GBP/USD covering Monday’s expiry signals a break-even of 200pips. This means that GBP/USD could move higher or lower by 200pips.

Source: SMARKETS

BOE UNCHANGED, BUT WATCH FOR BREXIT ASSESSMENT:

Given that the BoE expanded QE by an additional £150bln at the prior meeting, little is expected by central bank at this meeting. In turn, much of the focus will be on the BoE’s economic assessment in light of fresh lockdown measures and more importantly the recent shift in the Brexit tone. The current Brexit assumption by the BoE states that “there is an immediate move to a free trade agreement with the EU on 1st January 2021, that FTA is assumed to be of a similar scale and depth to the Comprehensive Economic and Trade Agreement in place between Canada and the EU”. However, given the recent developments, this assumption could be altered to reflect the higher probability of a no-deal Brexit.

The Bank of England: A Forex Trader’s Guide

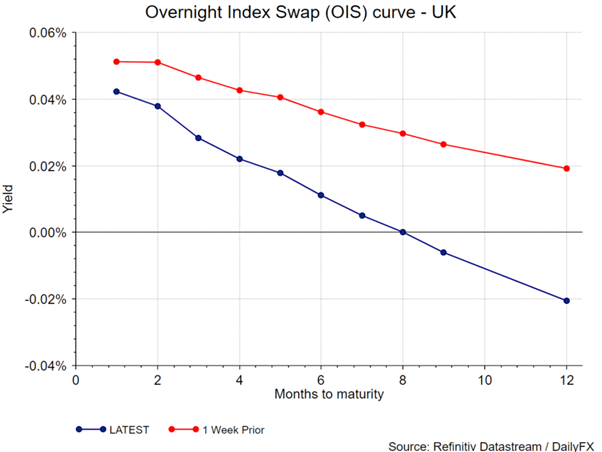

UK RATES CURVE SHIFTS LOWER ON RISING BREXIT UNCERTAINTY

Source: Refinitiv

UPCOMING BREXIT RISK EVENTS

Dec 12th: Decision on Future of Trade Talks

Dec 14-17th: European Parliament Meets for Final Time in the Year

Dec 31st: End of the Transition Period

GBP/USD LEVELS IN FOCUS

GBP/USDMIXEDData provided by IG

| CHANGE IN | LONGS | SHORTS | OI |

| DAILY | -7% | -1% | -4% |

| WEEKLY | 14% | -10% | -1% |

Source: Refinitiv

Disclosure: See the full disclosure for DailyFX here.