GBP/USD Price Pushing Lower After Fed Dashed Rate Hike Pause

The GBP/USD price fell on Tuesday morning as the dollar went up after Germany’s inflation reading brought back concerns about the pace and size of looming rate hikes. Consumer prices keep going higher as energy prices rise, causing a lot of worries (FXB).

Khoon Goh, head of Asia research at ANZ Bank in Singapore, said the global growth trajectory was not significant due to a slowdown in the US and Chinese economies, the two most significant globally. The two-week rally for exporters’ currencies has paused as the US dollar goes higher and returns to its safe-haven status.

Another reason for the rising dollar is the recent hawkish remarks from US Federal Reserve Governor Christopher Waller, which dashed some of the hope investors had for a pause in rate hikes later in the year.

“I am advocating 50-bps hikes on the table every meeting until we see substantial reductions in inflation. Until we get that, I don’t see the point of stopping.” He spoke.

These comments come before a meeting later today between Fed chair Jerome Powell and the US president Joe Biden to discuss the state of the American and global economy. Biden’s rating is falling as US citizens suffer from a higher cost of living.

On the other hand, according to Reuters, a survey on Tuesday showed an improvement in sentiment among British businesses in May, excluding consumer-facing companies more exposed to a growing cost of living problem.

Investors will be paying close attention to the CB consumer confidence in the US for May, which is expected to drop.

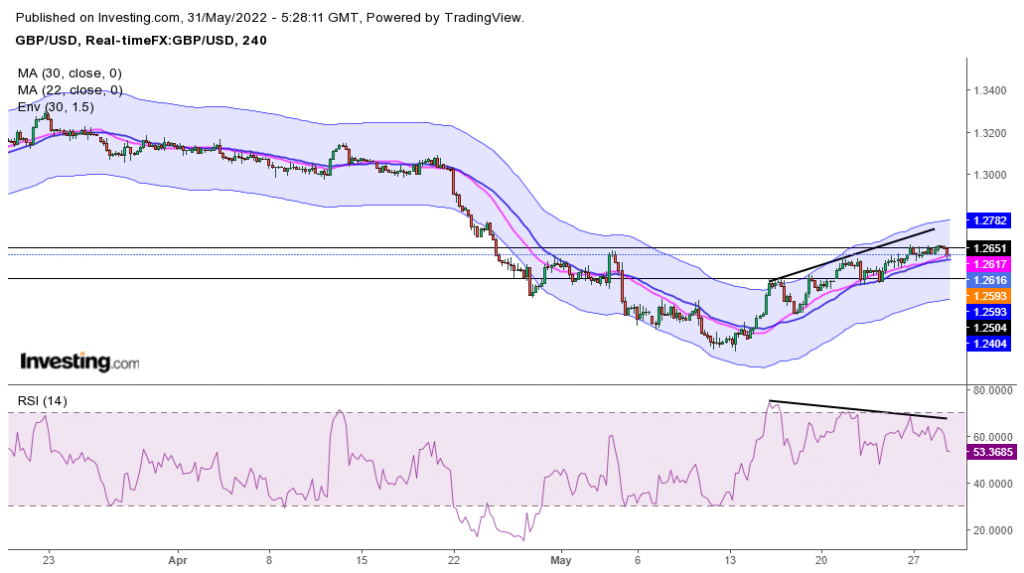

GBP/USD Price Technical Analysis: RSI Bearish Divergence Could Push To 1.2500

The 4-hour chart shows the price experiencing resistance at the 1.2650 level. The RSI shows weakness in the uptrend seen in the bearish divergence. If bears come in strong, we might see the price break below the 30-SMA. This move could be a retracement of the uptrend or a return to the previously existing bear market.

A retracement would find adequate support at the 1.2500 level, while a reversal would break through this critical level. The bias remains until price trading below the 30-SMA and RSI is getting to the oversold region below 30.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more