GBP/USD Forecast Jan. 18-22 2021

GBP/USD showed some strong movement but ended the week only slightly lower than a week earlier. The upcoming week has six releases, including retail sales and PMIs. Here is an outlook for the highlights and an updated technical analysis for GBP/USD (FXB).

In the UK, GDP for November contracted by 2.6%. This was better than the forecast of -4.6%, but the pound still posted sharp losses on Friday. Industrial numbers sagged in November. Manufacturing Production slowed to 0.7%, down from 1.7% beforehand. Industrial Production came in at -0.1%, its first decline since April. The pound posted gains of over 1% early in the week, after BoE Governor Bailey dismissed reports that the BoE was considering the possibility of implementing negative interest rates.

In the US, headline inflation improved to 0.4%, up from 0.2%. This was a 4-month high and could signal that inflation is at long last moving higher. Fed Chair Powell reiterated the Fed’s dovish stance, saying now is not the time to discuss exiting accommodative policy. Powell also pledged to give the markets plenty of notice before scaling back its massive QE program. The week ended with dismal retail sales numbers for December. The headline figure came in at -0.7%, which followed a -1.1% read a month earlier. Core retail sales fell to -1.4%, down from -0.9% beforehand. This was its lowest level since April..

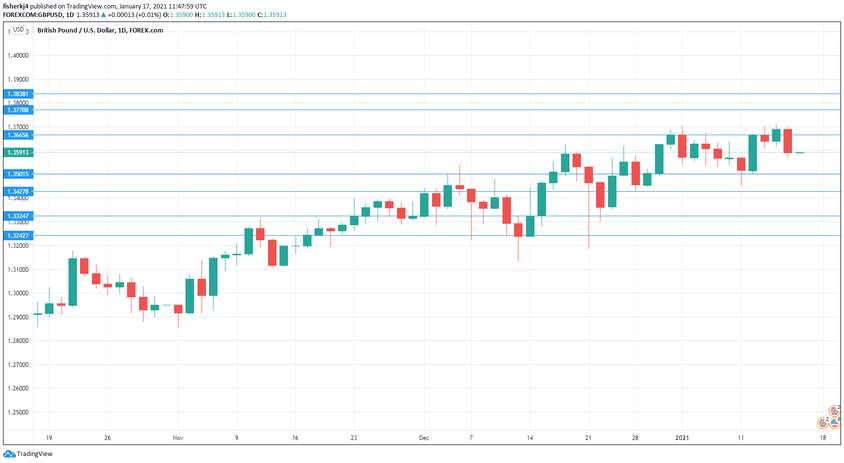

GBP/USD daily graph with resistance and support lines on it.

Inflation Report: Wednesday, 7:00. After rising to 0.7% in October, CPI slowed to 0.3% in the November reading. The forecast for December stands at 0.5%. Core CPI improved to 1.1% in November and is projected to rise to 1.3% in December.

- CBI Industrial Order Expectations: Thursday, 11:00. The Confederation of British Industry index indicates that manufacturers expect order volume to decrease more sharply in January. The indicator improved to -25 in December and is projected to fall to -35 in the January release.

- BOE Credit Conditions Survey: Thursday, 9:30. The Bank of England’s quarterly report details lending conditions and investors will be interested to know the impact of the current lockdowns on credit levels. The survey provides projections for the next three months.

- GfK Consumer Confidence: Friday, 00:01. Consumer confidence remains mired deep in negative territory. The index improved to-26 in December, but is expected to reverse directions and fall to -30 in January.

- Retail Sales: Friday, 7:00. Retail sales fell by 3.8% in November, its first decline since April. The Christmas season is usually a robust period for consumer spending, but with lockdowns in place due to COVID, the forecast for December retail sales is a weak 0.8%.

- PMIs: Friday, 9:30. Manufacturing PMIs remain well into expansionary territory, with readings above the neutral 50-level. However, the index is expected to slow to 53.1 in January, down from 57.3 beforehand. The services sector has been in contraction for the past two months, and the December PMI was revised downward from 49.9 to 49.4. The estimate for January is 45.5, which would be the lowest reading since May.

Technical lines from top to bottom:

We start with resistance at 1.3837.

1.3770 has held in resistance since May 2018.

1.3666 is next.

1.3502 (mentioned last week) is the first line of support.

1.3428 has held in support since late December.

1.3324 follows.

1.3243 is the final support level for now..

I am bearish on GBP/USD

The US dollar (UUP) has steadied in the New Year, and the UK is under a strict lockdown, which will hamper economic activity.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more