GBPCAD Elliott Wave Forecasting The Path

In this technical article, we’re going to take a quick look at the Elliott Wave charts of GBPCAD Forex Pair. As our readers know, we were forecasting GBPCAD to trade higher within the cycle from the September 11th low.

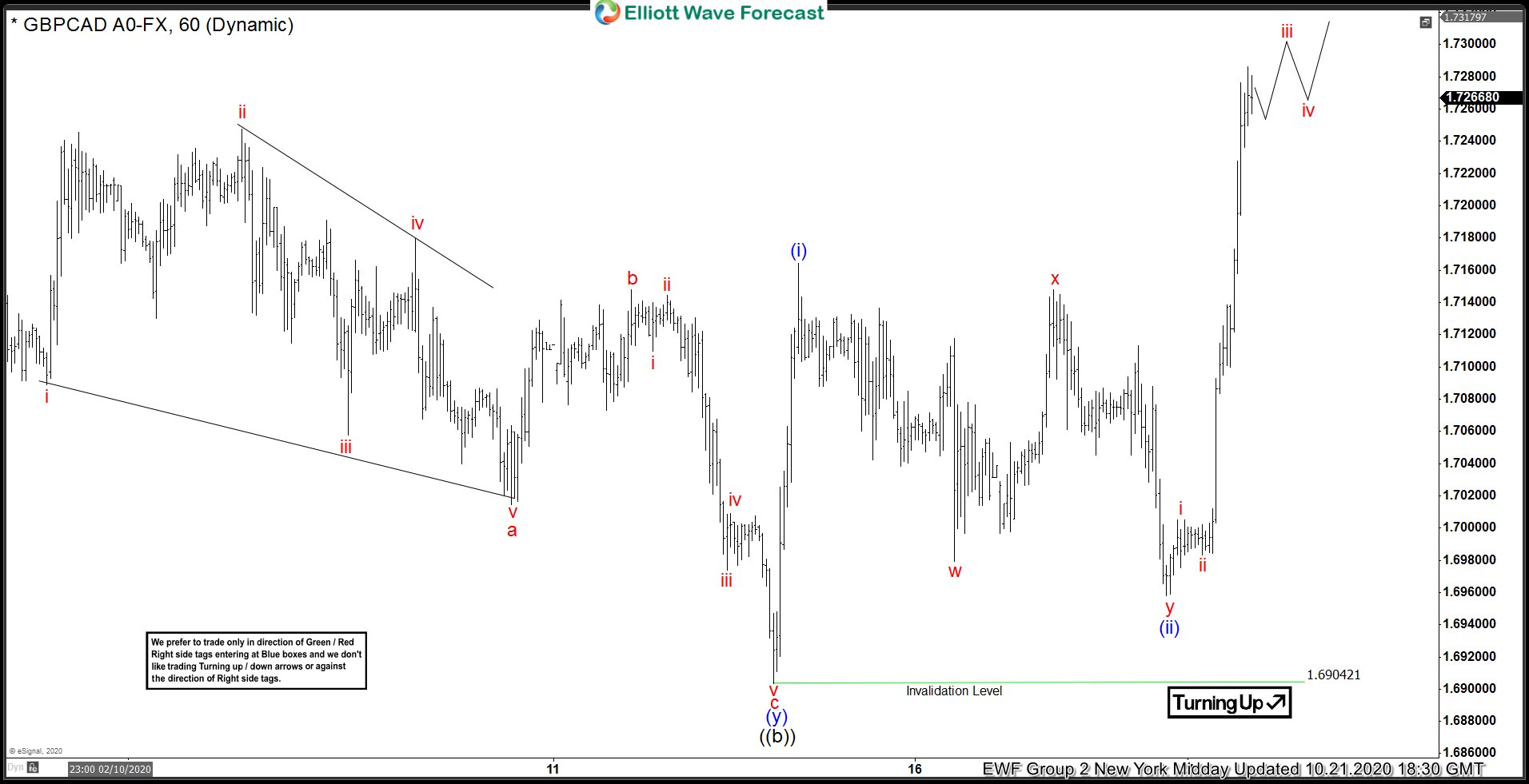

GBPCAD 1 Hour Elliott Wave Analysis 10.20.2020

The pair is doing a short term pullback against the 1.6904 low. At this stage, we assume that correction is still unfolding as Elliott Wave Double three Pattern, also known as 7 swings structure. Pull back is expected to make another leg down in y red of (ii) blue to complete 7 swings before turn higher takes place. At this stage, we cannot be completely sure if (ii) is going to end up as Double Three Pattern. As wave x red was very deep, alternatively (ii) can end up as Flat pattern with abc red labeling instead of wxy.

(Click on image to enlarge)

GBPCAD 1 Hour Elliott Wave Analysis 10.21.2020

GBPCAD made another leg down in wave (ii) pullback and found buyers as expected. We got turn higher and now trading higher in wave (iii). Wave (ii) ended as Elliott Wave Double Three as it shows clear 7 swings.

(Click on image to enlarge)

GBPCAD 1 Hour Elliott Wave Analysis 11.2.2020

Eventually, GBPCAD ended 5 waves in the cycle from the 1.6906 low and now correcting it. Wave (b) pullback looks incomplete at the moment and we expect another leg down to reach the 1.7118-1.7015 area. As the September cycle is still incomplete, we expect the pair to remain supported and resume rally toward new highs ideally. Buyers should ideally appear in the blue box for a 3 waves bounce at least.

Keep in mind that the market is dynamic and the presented view could have changed in the meantime. You can check the most recent charts in the membership area of the site. The best instruments to trade are those having incomplete bullish or bearish swings sequences.

(Click on image to enlarge)

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more