GBP Jumps On UK Chancellor’s Mini-Budget. What’s Next?

The British pound has been in demand in recent weeks on optimism regarding the UK Chancellor Rishi Sunak's plan to minimise the long-term economic damage caused by the coronavirus pandemic. On the day of the announcement which shows that UK public borrowing will exceed £350 billion, the British pound jumped higher against most other major currencies.

But, with Brexit negotiations at a deadlock and the possibility of a no-deal lurking is there more room to the upside? Read on to find out more.

The details of UK Chancellor's economic gamble

In Wednesday's mini-budget, the Chancellor announced a series of measures in the House of Commons designed to get the economy moving again. These include:

- £1,000 bonuses for each furloughed worker brought back to work and retained through January and at earning at least £520 per month.

- A temporary holiday in stamp duty tax for properties worth up to £500,000, designed to get housing activity up again.

- A 50% discount for people who eat out Monday to Wednesday for the month of August to help the restaurant and hospitality sector pick up.

- A £2 billion 'kickstart scheme' to subsidise six-month work placements for young people (16-24) who are at risk of unemployment.

- The jobs retention scheme which has subsidised the wages for more than 9 million workers will be tapered down and end in October.

The details were received with mixed reaction. Estate agents, house builders and those in the property sector welcomed the potential for an increase in demand. However, many analysts still fear that the ending of the furlough scheme in October is far too soon and will give rise to a deep unemployment crisis.

While Sunak stated that the furlough scheme "can't and shouldn't go on forever", global market strategist Mike Bell of JP Morgan Asset Management said the proposals are likely to benefit the economy but it still won't be enough to cover the severe impact from ending the furlough scheme.

The British pound has been in demand in the run-up to these proposals with traders further adding to positions shortly after the announcement. However, the shine may wear off soon as the Brexit negotiations approach a critical point in September. The British pound against the US dollar (GBPUSD) was one of the better performers on the day of the announcement, helped by a weak US dollar.

How to trade GBPUSD

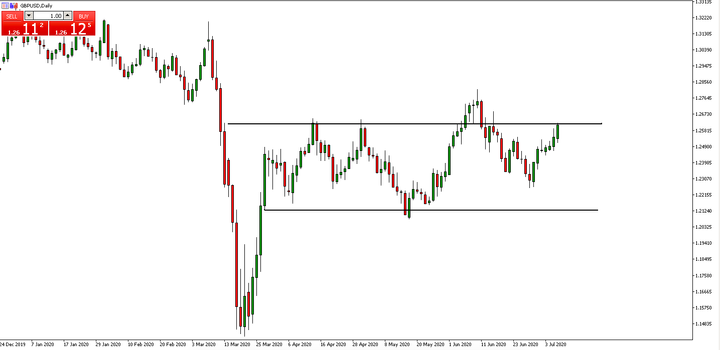

Below is the recent daily chart of the British pound against the US dollar (GBPUSD):

Source: Admiral Markets MetaTrader 5, GBPUSD, Daily - Data range: from 24 December 2019 to 8 July 2020. Please note: Past performance is not a reliable indicator of future results.

The following is the performance of GBPUSD over the past five years. 2019 = +3.95%, 2018 = -5.54%, 2017 = +9.43%, 2016 = -16.26%, 2015 = -5.38%, 2014 = -5.97%.

In the chart above it's clear to see the range that has developed on the currency pair. This is highlighted by the black horizontal support and resistance lines drawn on the chart. The key test for GBPUSD is whether or not traders still have the appetite to buy beyond the horizontal resistance line around the 1.2640 price level. Historically, buyers have failed to break above this level with one attempt in early June fizzling out and turning back down.

While a break above the top horizontal resistance line may show the strength of buyers in the market, some traders - who may be holding a bearish view when the attention turns back to Brexit negotiations - may well be looking for a reversal pattern to form as a sign that buyers are failing to push the currency higher with sellers potentially taking control once again.

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter "Analysis") ...

more