FTSE Price Prediction: UK100 On The Rise Amid Global Uncertainty

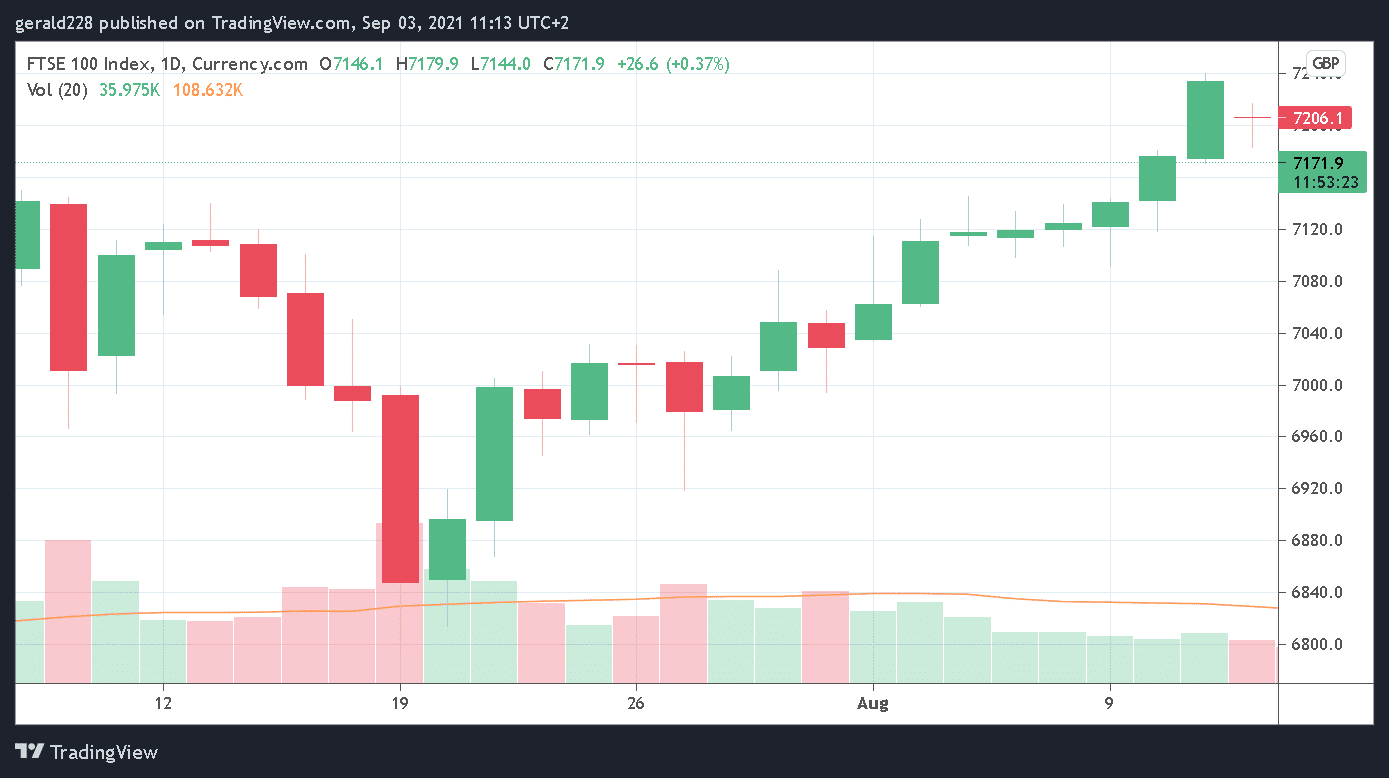

The FTSE price appears to be in bullish mode with a rise of 0.4% or 28 points over the past few hours. It is now at the 7175 level and seems to be closing off one of its most positive weeks. Although the situation in Afghanistan still remains rather fluid, investors seem to have largely priced in these concerns with bulls returning to the market.

With a lot of anticipation on today’s US Non-Farm Payrolls report, things could turn ugly if the results are worse than expected. US stock markets remain in positive territory although some are treading water. In the UK, there seems to be another push for vaccinating children aged 12-15 with a decision on that issue expected imminently. Prime Minister Boris Johnson also indicated that the vaccination rate for 16-17-year-olds was not going fast enough.

If the FTSE continues with its bullish streak, we could see more highs in the near future, but investor uncertainty remains. A rather tepid economic recovery and persistently high inflation remain worrying points for UK investors.

Short Term Forecast For FTSE Price: More Bullish Momentum As Economy Continues To Recover

(Click on image to enlarge)

The FTSE price has been on a consistent recovery since its July 20 low although there have been some pitfalls along the way. It is up almost 5% from the 6860 level although its growth rate has been markedly slower than the other US indexes.

If the bullish streak persists then we can expect that the FTSE100 will continue to rise and tag the 7200 mark very soon. If that level holds, then a push to the 7300 level would not be amiss. That would mean an almost 2% appreciation from the current price.

A bearish streak would of course invalidate this scenario. If that were to come into play, the FTSE price would once again drop to the 7100 level after which a heavy stock sell-off could push the price even further down. This seems unlikely in the current economic situation as investors return to the markets in strength.

Long Term Prediction For UK100: A Slow Rise But International Situation Remains A Concern

The FTSE price is expected to continue appreciating although the international situation remains fluid. With Covid19 concerns rising as schools restart, focus will undoubtedly now be on the vaccination of children with a decision in the Uk expected imminently. Rising inflation also remains a worry although the markets have largely priced this in.

The situation in Afghanistan remains fluid although some stability is expected with the Taliban government in place. Rising commodity prices and an impending shortage in gas supply could create a cold winter for the UK. All these factors should have an effect on the FTSE price long term.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more