Four Signs Trump Could Ignite A Cold War With China

It appears the there are at least 4 signs that the trade war initiated by Donald Trump will turn into a real Cold War with China. Make no mistake, a cold war with China could turn into a hot war over Taiwan, the South China Sea, or through massive interference with US companies in China.

Here are the 4 signs that we are headed toward a serious breakdown in the relationship between the US and China. We are not there yet, but we are getting close unless cooler heads prevail:

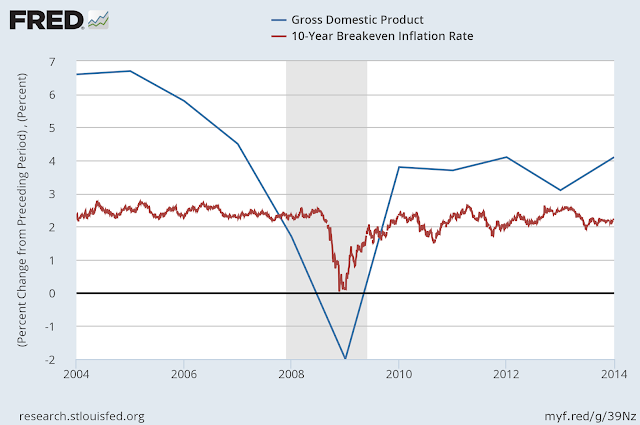

1. The US places tariffs on Chinese auto parts. US cars contain Chinese parts that are impossible to replace, quality-at-the-price wise. This shortage could be first inflationary, as prices go up, and then deflationary as demand suffers. This could be made worse if the Federal Reserve is fixated on inflation as it was in 2008, while deflationary pressures took over. The following chart shows exactly how this can happen:

|

The Fed was watching inflation in the Great Recession, which held true, while GDP and demand was already crashing. |

2. If China is forced to lower the value of its currency to offset tariffs, this could leave the US vulnerable to a strong dollar. China has assured a stable currency to prove to the US that it is a trustworthy trading partner. If there is no further partnership, this sign will be obvious. So far China has promised to keep the Yuan at less than 7 per dollar. It is at the top of the range now.

In the meantime, the Yuan has dropped relative to the Euro and the Yen. This weakens our allies ability to export to China. Purchasing power parity means that China is strong because it makes most of what it needs and can keep a standard of living simply by substituting Chinese products for Eurozone and Japanese products. This is a financial disaster for Japan and the Eurozone and could eventually catch up to the United States as well. Any spillover past 7 Yuan to the dollar will signal a significant escalation in the trade war and it is now at 6.92.

3. The US will do more to try to damage Huawei, which will indicate an escalation of the trade war. Greater damage to Huawei, however, may have an unintended consequence of hurting rural Oregon and Wyoming internet customers. As we see from Business Insider:

The Commerce Department, which had effectively halted Huawei's ability to buy American-made parts and components, is considering issuing a temporary general license to "prevent the interruption of existing network operations and equipment," a spokeswoman said.

Potential beneficiaries of the license could, for example, include internet access and mobile phone service providers in thinly populated places such as Wyoming and eastern Oregon that purchased network equipment from Huawei in recent years.

Can you imagine Wyoming voters for Trump being deprived of internet because of POTUS?

But there are bills in Congress to further limit Huawei. These bills reflect the unproven national security issue, possibly rooted in xenophobia. Most of the strongest advocates live in Republican landlocked states, often insulated from other cultures. This would go beyond the ban on Huawei equipment that is already in force for government purchasing. And the presidential executive order could slow down 5G both worldwide and in the USA.

China has prepared for a ban from the US market and has plans to endure it worldwide. The US will find it hard to dissuade allies from buying Huawei products because it lacks alternatives and it also has not made a serious case against Huawei spying. Other nations simply do not believe the USA's cries of wolf. Most of the world believes that the US simply lacks the will to compete.

It does hurt US credibility that China has invested more in the world economies than the US is doing:

Even with the passage of the BUILD Act in October 2018, which was meant to revitalize U.S. foreign aid and investment with a $60 billion package, it’s worth noting that China spent nearly $47 billion in foreign investment in Europe alone in 2018. Chinese direct investments totaled another $49.45 billion into Africa and the Middle East and $18 billion into South America, according to data from the American Enterprise Institute, compiled by Foreign Policy.

4. The trade war escalates if China limits US access to scarce minerals (rare earth metals) crucial to US production, Trump will either have two likely choices, cry uncle or war. This is not a place we should get to. Rare earth metals are key components of the world supply chain. China controls most of the mining of these metals. The USA is vulnerable and only has stronger military power to fall back on in order to overcome this escalation of the trade war, which we hope never happens.

China Purchasing Power Parity

China makes more of what it needs than does the United States. Chinese industry is 5 times larger than US industry. As one Wall Street pundit once said a long time ago, China makes things; we sell each other insurance.

China has the largest economy by purchasing power parity. That nation has initiated successful boycotts against other nations. The United States is at risk of losing China's growing customer base for years, maybe decades, maybe for all time. This includes farmers, who were counting on growth in exports to China over the years. The hope is fading.

We have only ourselves to blame. We have been conned by multiple articles with headlines showing China's weakness in a trade war with the USA. But this brainwashing is counterproductive to American prosperity.

The stock market will start to crumble if any of these four warning signs are breached. We very much hope the powers that be back away from the brink. But this path remains in doubt. Danger draws near, a real world danger. Serious damage can be inflicted because of an economic cold war with the largest and largest manufacturing nation on earth.

By now, surely POTUS understands that trade wars are hard to win:

- He postponed tariffs against European cars for at least 6 months. But he has accused Toyota and Euro car manufacturers of being a threat to national security, which is absurd.

- He begged the Fed to lower interest rates, implying it would be easier for the US to win the trade war with China that way.

- He decided to take steel and aluminum tariffs off of Mexico and Canada.

Trump has doubts. He may be consigned to lashing out as his vision of any easy win slips through his fingers.

The trust Wall Street has put into Donald Trump is working contrary to the interest of Wall Street. Selling it off by 10 percent or so would force POTUS to determine how much appetite he has for continuing as Tariff Man. Continuing to support POTUS is a losing proposition if he thinks that the stock market is shielded from the tariff wars. He has to know that once the trade war is fully on, stocks will turn negative by leaps and bounds.

Unresolved Issues with 10 Year Bonds and Meng

We still are facing the Meng issue, and the general dissolving of trust between China and the USA. The security issues are mostly about tech transfers, which are actually legal under international law, and Huawei's ability to spy, which it apparently has not done.

Now the bond tantrum boys are out in force again. They are saying that bond yields could spike. Jamie Dimon is taking the lead. But of course he did the exact same thing in 2018. In my opinion, Dimon and his friends and counterparties want to buy the bonds at slightly higher yields, knowing the yields will not explode. So they shake the weak hands out continually by fear mongering. Morgan Stanley warned 10 year bonds would go to 5 percent in 2010! How did that work out, Morgan Stanley? I am amused.

However, if there is any downturn due to China selling a massive amount of US bonds, Bloomberg's Joe Weisenthal has astutely said:

What's more plausible than spiking yields is that if word got out that China really did want to dump U.S. debt in size Yields would fall because people would assume that this 'nuclear option' represented a gigantic break in the U.S.-Sino relationship. All that would hurt the global economy, causing the Fed to be even slower with expected rate hikes. In the immediate term, there would likely be a flight to Treasuries, amid a big risk-off move in markets. The Treasury market often behaves counterintuitively

While I do not support his MMT advocacy, Weisenthal has been right about long bonds since 2009, while NY bankers and Greenspan and Singer and all the myriad of bond vigilantes have been wrong. So, if yields decline massively, be worried that the China/USA relationship is on rocky ground. Things are getting a little hot for small investors. Take profits!

Disclosure: I have no financial interest in any companies or industries mentioned. I am not an investment counselor nor am I an attorney so my views are not to be considered investment ...

Update 1: Trump's executive order to ban chips and cell designs from the USA, especially ARM designs to Huawei, does cross the line, making the trade war far more dangerous. Arm is a UK company, but with some critical USA components. China's response could be hostile. That nation could ban rare earths to the west, or simply ban Apple and Samsung sales into China. That is the biggest and fastest growing market in the world.

Great, from #tradewar to #coldwar. Could things get any worse?

We have history to teach us. Tariffs in the Great Depression led to Adolph Hitler. Trump admires strongmen. He is, so far, adverse to hot war. Perhaps this will be the only attribute that saves him and us. But he could also paint himself into a corner.

Yes, we're getting close to just that.