Four Active Mining Companies You Should Be Watching

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

The mining industry has been very busy over the last few months with the gold price showing signs of stabilizing, financings getting completed, preliminary economic assessments being released, prefeasibility studies being updated and M&A activity increasing. The market has a buzz once again and Thibaut Lepouttre of Caesars Reportprofiles several companies that are reaping the rewards of being very active right now.

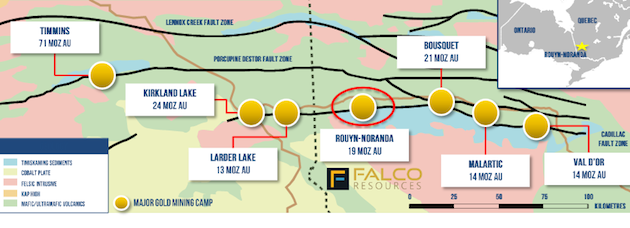

Southern Abitibi Project Map

The Gold Report: Falco Resources Ltd. (FPC:TSX.V) (FPRGF) has released its maiden preliminary economic assessment (PEA) on the Horne 5 mine. The market rewarded the company with a share price that almost doubled in the next few days and weeks. What's the reason behind this?

Thibaut Lepouttre: This PEA had been anticipated for quite a while, and Falco's shareholders were really looking forward to seeing the economics of the project after an updated resource estimate showed a total of 6.6 million ounces gold equivalent (Au eq), with the majority in the Indicated resource category.

There was a little bit of a headwind from people who weren't convinced an underground mine with an average grade of less than 3 grams per tonne Au eq would work in the current commodity price environment, so quite a few investors were holding off on making an investment decision until after the PEA.

Falco's PEA showed an after-tax NPV5% of CA$667 million (CA$667M) and an internal rate of return (IRR) of 16% based on an average production rate of 236,000 ounces (236,000 oz) gold at an all-in sustaining cost (AISC) of less than US$450/oz.

While the output and production costs are definitely meeting or exceeding the market's expectations, the IRR is indeed a little bit on the lower end of the spectrum, but I do think it's important here to emphasize that IRR is very resilient. When you see a low IRR, it usually means the project is pretty marginal and even a minor change in the gold price would "kill" the project. That's absolutely not the case with Falco. Even using a gold price of just $1,000/oz, the IRR would still be a double-digit percentage.

We talked to CFO Vincent Metcalfe and he confirmed that if an additional mineralized block could be confirmed at the Western extension of Horne 5, a part of the sustaining capex could be deferred, which would improve the overall economics of the project.

TGR: Québec has been the hot spot for "recycling" old projects. Horne 5 is a past-producing mine, but there's another company taking another look at an "old" project, right?

TL: Yes, that's correct. Integra Gold Corp. (ICG:TSX.V; ICGQF:OTCQX) has been releasing some extraordinary drill results lately and is gearing up to release an updated PEA after the summer.

This will be a very important step forward as the previous PEA was based on a mine plan covering just a fraction of the total resources at the Lamaque project. This new PEA will incorporate many more ounces, and I would expect the NPV to triple or quadruple, and perhaps the company will also reconsider its development plans.

The nameplate capacity of the mill it acquired in 2014 is 2,200 tonnes per day, so there definitely is plenty of capacity to increase the mining rate at Lamaque by mining satellite deposits (like the No. 4 Plug zone). I wouldn't be surprised to see an updated mine plan incorporating a scenario to produce 200,000–250,000 ounces per year to maximize the operating efficiencies.

TGR: You follow a company that released a second prefeasibility study (PFS) within five months of releasing the initial PFS. Why would it do that?

TL: Yes, Focus Ventures Ltd. (FCV:TSX.V) just released its second PFS. It's a pity the company had to release the inferior first PFS, as the updated version is definitely much better. Focus' consultants now had enough time to revisit every possibility to improve the economics, and this really has paid off. The IRR was boosted from 17% to over 26% while the payback period was reduced from approximately seven years to four years.

The initial capital expenditure is higher as it does make more sense to immediately start producing at 1 million tonnes per year. This production boost in the first few years of the mine life caused the after-tax NPV to increase by 81% to US$450M, so Focus Ventures is trading at just a fraction of the value of its project.

TGR: What's holding the share price back then?

TL: Focus will have to repay a loan in the second half of this year, and I think the market is waiting for Focus to solve this "issue" before reducing the discount to the NPV of the asset. The convertible loan will either have to be repaid or extended, and once this hurdle is cleared, the market will probably start to catch up.

TGR: We have seen more M&A activity lately with Goldcorp Inc. (G:TSX; GG:NYSE) buying Kaminak Gold Corp. (KAM:TSX.V) (KMKGF) and Endeavour Mining Corp. (EDV:TSX; EVR:ASX) (EDVMF) acquiring True Gold Mining Inc. Those are the big ones, but you have been watching some of the smaller ones as well. Can you tell us about one of them?

TL: Indeed. Last week, Rye Patch Gold Corp. (RPM:TSX.V; RPMGF:OTCQX) announced it entered into a definitive agreement to acquire the Florida Canyon mine in Nevada from Admiral Capital, which seized the asset after the previous owner couldn't meet its debt commitments.

A new PEA on the property has outlined a mine plan in which more than 600,000 oz gold could be recovered at an all-in cost of less than $900/oz for an initial investment of less than $30M. More details will obviously emerge in the next few days and weeks but at first sight this seems to be a really good deal. Rye Patch will be paying $15M in cash and issue 20M shares for the initial purchase, followed by $5M in either cash or shares when the commercial production restarts (planned in H1/17). Based on the share price of Rye Patch before the deal was announced, this means the total consideration was less than US$25M, which is less than 0.25 times the after-tax NPV of the project at $1,200/oz gold.

TGR: Why could this deal be important for Rye Patch?

TL: Well, acquiring an asset at less than 50% of the NPV always is accretive for one's shareholders, but what could be even more important is the fact Rye Patch will join the ranks of producers within the next 12 months; it expects to start producing gold at Florida Canyon at a rate of 75,000 oz per year from next year on.

The additional cash flow will obviously also help to fund the development of the nearby Lincoln Hill project and on top of that, Rye Patch will gain a lot of experience operating a heap-leach mine that it could then use to ensure a smooth start-up at Lincoln Hill before the end of this decade.

TGR: Thank you for your insights, Thibaut.

Thibaut Lepouttre is the editor of the Caesars Report, a newsletter and mining portal based in Belgium that covers several junior mining companies with a special focus on precious metals and base metals. Lepouttre has a Bachelor of Law degree and two economics masters degrees that have forged his analytical approach to the mining sector. Considered a number cruncher, Lepouttre focuses on the valuations of companies and is consistently on the lookout for the next undervalued mining company.

Thibaut Lepouttre is the editor of the Caesars Report, a newsletter and mining portal based in Belgium that covers several junior mining companies with a special focus on precious metals and base metals. Lepouttre has a Bachelor of Law degree and two economics masters degrees that have forged his analytical approach to the mining sector. Considered a number cruncher, Lepouttre focuses on the valuations of companies and is consistently on the lookout for the next undervalued mining company.