Forget GDP: Here Is The Scariest Data From China

Yesterday, shortly before China's data deluge, we reported that a Beijing-based think tank became the first Chinese economic research institute linked to the government to predict that China’s economic growth rate will slow below 6.0% next year. Specifically, The National Institution for Finance and Development (NIFD) on Wednesday said that China’s economic growth rate will slow to 5.8% in 2020 from an estimated 6.1% this year, a number which is already quite ambitious, not to say artificially goalseeked.

“The economic slowdown is already a trend,” said former central bank adviser Li Yang, who heads the institute that is affiliated to the Chinese Academy of Social Sciences (CASS). “We must resort to deepened supply-side structural reform to change it or smooth the slowdown, rather than solely rely on monetary or fiscal stimulus.”

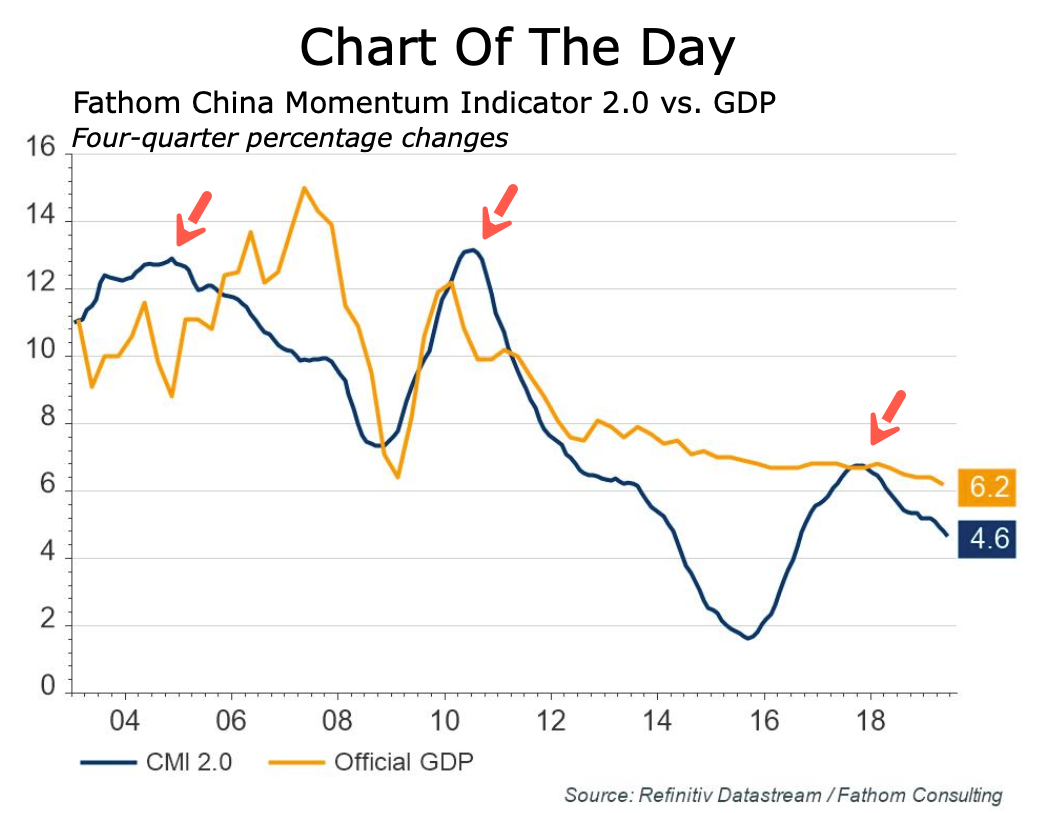

The problem is that even a sub-6% number is wildly optimistic and misrepresents the true state of China's economy considering that back in August, Fathom Consulting calculated that growth in the second-largest economy had already shrunk to 4.6% and was declining.

Source: Bloomberg

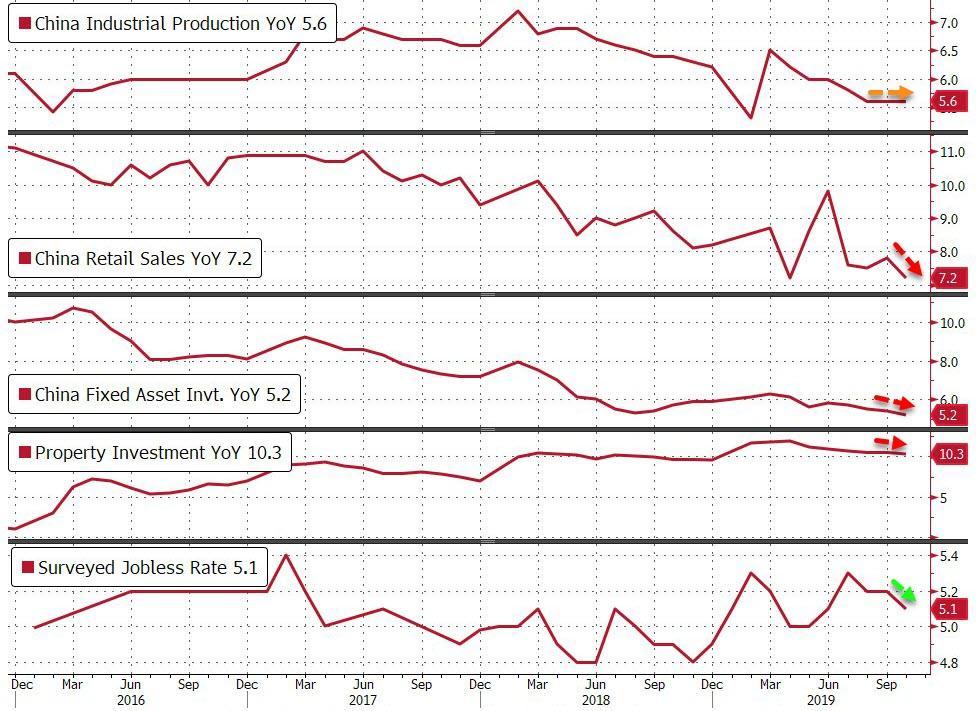

Of course, shortly thereafter China released its latest retail sales, fixed investment and industrial production data, all of which missed badly and worse, the data showed the weakest retail sales growth since 2003 and the weakest Fixed-Asset Investment growth since 1998.

Source: Bloomberg

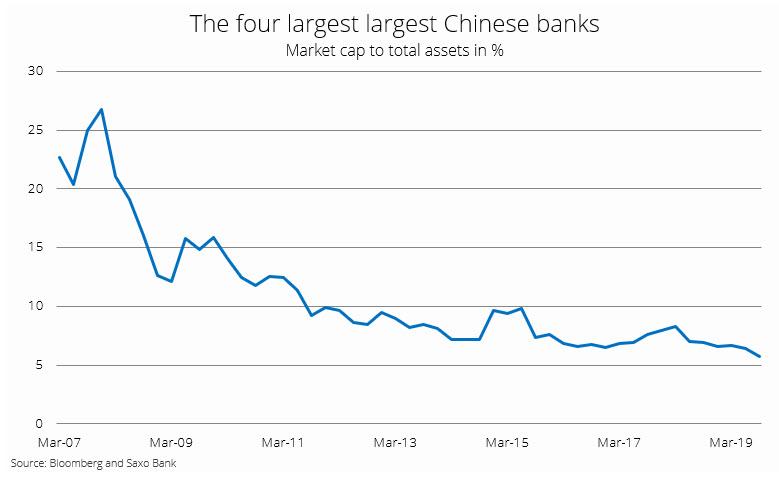

However, while the slowdown in China's economy has been widely telegraphed for years, a more ominous development is taking place in China's financial system, which at roughly $40 trillion is not only nearly double the size of that of the US, but is the world's biggest. It is here, that one find not only an escalating loss of faith by the market but confirmation that China's all-important credit channel is increasingly clogged up, if not outright broken.

Following the Q3 earnings releases from Chinese banks, Saxo Bank's Peter Garnry has updated his market cap to total assets ratio for the four largest commercial banks in China. What he found is that the ratio hit a new all-time low of 5.8% in Q3 as total assets grew an annualized 8% in Q3 while market cap of the four banks declined.

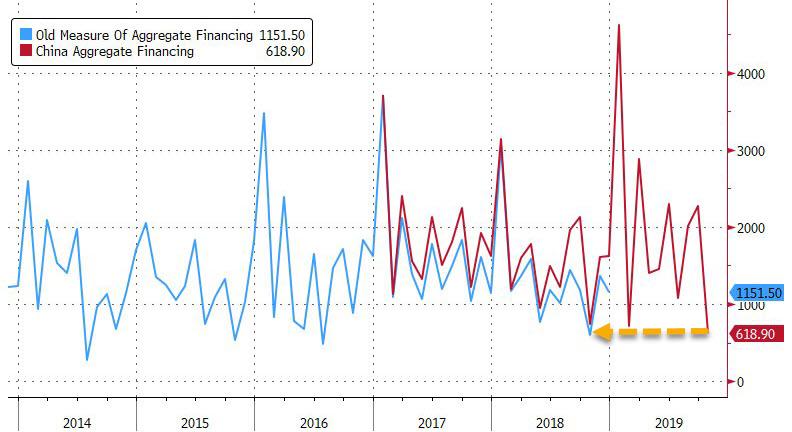

This means that Chinese investors - who happen to know best what is truly going on behind the scenes - are not valuing these new assets as high quality, and the most likely dynamic in China right now is that the current credit expansion is just offsetting the surge in bad loans, whose real amount Beijing is naturally keeping under wraps. The net effect is zero credit transmission to the real economy in China constraining economic growth, which in a time of collapsing total social credit...

... and virtually non-existent credit impulse...

... simply means that the country that in 2008 pulled the world out of a global depression, will not be able to do so again.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more