Forex Metrics And Chart May 2018

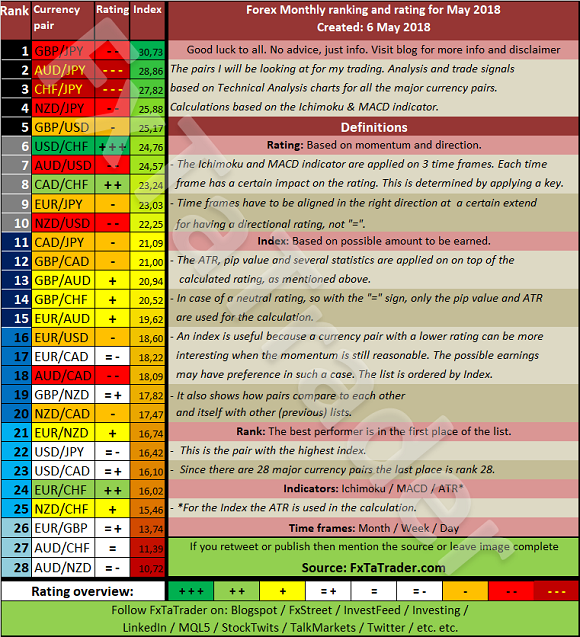

The Top 10 of the Ranking and Rating list for the coming month shows the following stronger currencies being well represented for going long: the JPY(5X) followed by the USD(4X). The weaker currencies are the CHF(4X) followed by the AUD(2X) and the NZD(2X).

By diversifying a nice combination can be traded in the coming month like e.g.:

- USD/CHF with the AUD/JPY

- NZD/USD with the GBP/JPY

Ranking and Rating list

Analysis based on TA charts for all the major currency pairs. Every month the Forex ranking rating list will be prepared around the change of the month. All the relevant Time Frames will be analyzed and the ATR and Pip value will be set.

For analyzing the best pairs to trade looking from a longer-term perspective the last 12 months Currency Classification can be used in support.

This classification was updated on 1 May 2018 and is provided here for reference purposes:

Strong: EUR, GBP. The preferred range is from 7 to 8.

Neutral: JPY, CAD, CHF. The preferred range is from 4 to 6.

Weak: USD, AUD, NZD. The preferred range is 1 to 3.

When comparing the 12 months Currency Classification with the pairs mentioned in the Ranking List above some would then become less interesting. On the other hand, these pairs are at the top of the list partly also because of their volatility. It seems best to take positions for a short period then and take advantage of the high price movements.

With the FxTaTrader Strategy, these pairs are not traded because these would be trades in the 4 Hour chart or in a lower Time Frame. Nevertheless, they may offer good chances for the short term trader.

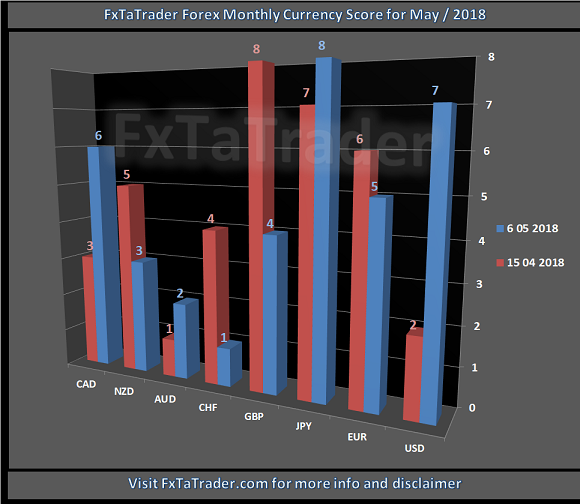

Currency Score Chart

The Currency Score analysis is one of the parameters used for the Ranking and Rating list which is published also in this article. The Currency Score is my analysis on the 8 major currencies based on the technical analysis charts using the MACD and Ichimoku indicator on 4 Time Frames: the monthly, weekly, daily and 4 hours. The result of the technical analysis is the screenshot here below.

When comparing the 12 months Currency Classification with the recent Currency Score, as provided in the image above, we can determine the deviations. In the article "Forex Strength and Comparison" this is analyzed in more detail.

Chart of the Month

The Chart for this month is the CHF/JPY Weekly chart and the set-up is a Short Entry.

The Daily chart is added for clarity. Price is clearly in a downtrend and gaining momentum.

Price broke a few months ago through an important support level, see the yellow horizontal line, which is now a resistance at 112,50. It may pull back to that support like it did already before but as long as it does not break through this level it offers a good opportunity to go short. This should take place at the level of the Tenkan-Sen.

- For a good entry, by preference:

- The PSAR should be positive/negative in the Weekly chart, depending on the set-up. It should also be favorable for trades in the Daily chart in the direction of the set-up. It means that even if it is contrary at the moment the PSAR should show that trades in the direction of the set-up are making a better profit.

- The pullback has still to take place and price should be gaining momentum after the pullback before entering positions.

- The candlesticks should show a good pattern that confirms the entry. This could be e.g. one of the reversal Candlesticks patterns or a continuation pattern. Check e.g. the following links for more information: Bulkowski's Top 10 Reversal Candlesticks ,Wikipedia Candlestick pattern or Investopedia Candlestick .

- The target should be, depending on the current set-up going long or short, below/above the latest high/low. This may be or become a resistance/support level and closing below/above that level is for that reason a good target.

- In case of a stronger pullback with price going far below/above the yellow horizontal support line with the MACD not recovering the set-up is no more valid. A stop-loss should be placed below/above a recent top/bottom. These are levels where Resistance or Support may reside too.

- The MACD should show in the right direction strength in the MACD minus Signal, these are the Green and Red bars. In case of an uptrend, the green bars should be larger. In case of a downtrend, the red bars should become larger. The MACD should stay above/below the MACD Signal line and the zero line.

- This is a pair that fits best in Point 1 of the Comparison Table Guide. For more information read my other Monthly article called the "Forex Strength and Comparison" and the pages Explanation Articles.

- The JPY is a Strong currency and the CHF a Weak currency. The Currency Score Difference is 7.

The set-up mentioned remains valid as long as the pair remains in the Top 10 of the coming Monthly Ranking and Rating lists and continues to comply with the point of the Comparison Table Guide mentioned above.

Disclosure: Besides this article, I also use the Forex "Strength and Comparison" which is also available once a month on my blog. In that article, we look in more detail at the ...

more