Forex Forecast And Cryptocurrency Forecast For November 30 - December 4

First, a review of last week’s events:

EUR/USD

Making a forecast for the past week, most experts (65%) preferred the European currency. Graphical analysis, 90% of trend indicators and 75% of oscillators on D1 also sided with the bulls. And this forecast turned out to be almost correct. “Almost”, because it was expected that, having broken through the resistance of 1.1900, the EUR/USD pair will reach the zone 1.2000-1.2100. However, it managed to rise only to the height of 1.1960 at the very end of the working week. Perhaps this is due to the weekend in the United States - Thanksgiving on Thursday November 26th and Black Friday on the 27th.

The pair is pushed to growth by the improvement of the epidemiological situation in the European region. For example, France has already passed the peak of the second wave of the pandemic, and on November 28, a phased weakening of the existing restrictions begins. But there are also numerous global factors that make this pair's movement difficult to predict. The number of applications for unemployment benefits in the US last week was as much as 778 thousand - the worst figure in five weeks. This indicates a worsening economic situation. That being said, Republicans and Democrats still have no way to agree on the amount of additional stimulus payments under the QE program. And incumbent President Donald Trump does not want to cooperate with the opposite camp at all.

As for the timing of the appearance of the vaccine against COVID-19 and how vaccination will affect the recovery of the economies of the Old and New Worlds, there is no clarity, only guesses. The assessments of experts are diametrically different about the decision of the US President-elect Joe Biden to appoint the former head of the Fed Janet Yellen to the post of Treasury Secretary, Markets hoped that some guidelines would be suggested by the minutes of the meeting of the US Federal Reserve Committee on Open Markets. But there was not much clarity in it either, only an indecisive discussion of the asset purchase program. We quote: “Most of the participants believed that the Committee should update the forecast of actions over time and apply results-oriented guidance of a qualitative nature”. Well, and then everything is in the same style.

So far, the only indisputable thing is that the dollar index dropped from the March highs by more than 10% as a result of the Fed's monetary policy, reaching a two-year low, and the EUR/USD pair returned to the values of mid-August 2020. These facts are beyond doubt;

GBP/USD

The result, which, due to general uncertainty, including negotiations on Brexit, was shown by this pair, can be called zero. Three weeks of November marked the Pivot Point at 1.3300. But if this line performed the function of resistance for the first two weeks, then it turned into support. The pair spent the entire five-day period in a lateral trend in a fairly narrow range of 1.3300-1.3400, and finished the trading session at its lower border;

USD/JPY

The yen has made its unconditional contribution to the fall in the DXY dollar index. Its strengthening and the entry of the USD/JPY pair into the downward channel started at the end of March this year, in parallel with the spread of the coronavirus epidemic around the world. And in search of a safe haven currency, investors once again turned to the Japanese currency.

The pair not only kept within this channel last week, but also narrowed its trading range to 100 points in its upper half. As for the final indicators, they turned out to be even less - having started the five-day week at 103.80, it ended it at 104.05, showing an increase of only 25 points;

Cryptocurrencies

This time we will skip the introduction, like crime news, and immediately move on to the most important thing. Bitcoin being overbought is something we've written about on numerous occasions, something that has long been warned about by indicators including the RSI and Crypto Fear & Greed Index. Everything indicated that the market urgently needs a correction. And so it happened: the BTC/USD pair fell down, and now traders and investors are concerned about only two very important issues. 1) If this is a correction, at what level will it end? And 2) Is this a correction, and will the disaster that occurred with bitcoin in December 2017 happen again? Recall that then, getting close to $20,000, the pair turned sharply and found itself in the $3.125 region a year later, shrinking more than 6 times.

The current rally of the main cryptocurrency started in the first decade of September from the $10,000 area and was stopped on November 25 in the area of $19,500. This was followed by a collapse, and the local weekly low was fixed the next day at $16.280. After a slight rebound, BTC was quoted in the $17,000 zone on the evening of Friday 27 November.

At its peak on November 25, the total capitalization of the crypto market was $582 billion, but on Friday fell to $500 billion, losing 14%. This movement is fully correlated with the BTC/USD quotes. Much more interesting is that the Crypto Fear & Greed Index is still at 86 as it was seven days ago, and continues to indicate that the pair is strongly overbought. So, it is entirely possible that bitcoin has not yet completed its journey south.

As for altcoins, a number of them have recently shown more positive dynamics than the reference cryptocurrency. So, if the BTC/USD pair lost about 11% over the past seven days, the ripple (XRP/USD), for example, on the contrary, grew heavier by almost 70%, while ethereum (ETH/USD) ended this period with a zero result. Note that the leading altcoin still has good growth prospects. Business for the leading altcoin took off in the summer, thanks to the growth of the decentralized finance sector (most of these projects were created on the basis of Ethereum). To date, investors have already invested $13 billion in the DeFi-sector, and the number of wallets on which at least 1 ETH is stored has reached a historic high of 1.171 million

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

EUR/USD

We spoke about the fog that has covered financial markets in recent weeks, in the first part of this review. And even the appearance of a vaccine against COVID-19, for all its obvious usefulness, is unclear how it will affect the exchange rate of a particular currency. Indeed, the degree of damage to the economies of different countries by the coronavirus is different, and the speed of their recovery will also differ. Undoubtedly, the policies that the new US administration under the leadership of Joe Biden will carryout will play a huge role, including domestic policy and the end of trade wars with Europe and China. Considering scenarios for next year, Goldman Sachs predicts a 6% drop in the USD weighted rate in 2021, Citibank does not rule out that the dollar index could fall by 20%, and Morgan Stanley expects the EUR/USD pair to grow from the current levels to 1.2500.

Most experts (60%) expect the pair to grow in the coming week as well. 100% trend indicators and 75% of oscillators on both H4 and D1 side with them. The nearest goal is still the same: to overcome the September 01 high and consolidate in the zone of 1.2000-1.2100.

The opposite point of view is supported by the remaining 35% of analysts, graphical analysis and a quarter of oscillators that give signals that the euro is overbought on both timeframes. Support levels are 1.1880, 1.1800, 1.1740 and 1.1685.

Among the macro-events of the week, we can note the publication of data on business activity (ISM) on December 1 and 3, as well as data on the US labor market on December 2 and 4. In addition, we will find out the statistics on the consumer market of the Eurozone on Tuesday, December 1 and Thursday, December 3. Also, the speeches of the head of the ECB Christine Lagarde on November 30 and December 1, as well as the head of the Fed Jerome Powell on December 1, may also influence the formation of short-term trends;

GBP/USD

The general tendency towards the weakening of the dollar affects the forecasts for this pair as well. 75% of analysts predict its growth first to the upper border of the channel 1.3300-1.3400. Perhaps it will be able to break through the resistance of 1.3400 and rise another 80-100 points higher, but only 30% of experts vote for this. Graphical analysis on H4 and 90% of oscillators and trend indicators on D1 also side with the bulls.

Indicators on H4 give a mixed picture. But graphical analysis on D1 showed that, after several days of movement in the 1.3300-1.3400 corridor, the pair may decline to 1.3200, after which it can return to the upper border of this corridor and even reach the September 1 high at 1.3480.

Support levels 1.3175, 1.3100 and 1.3000;

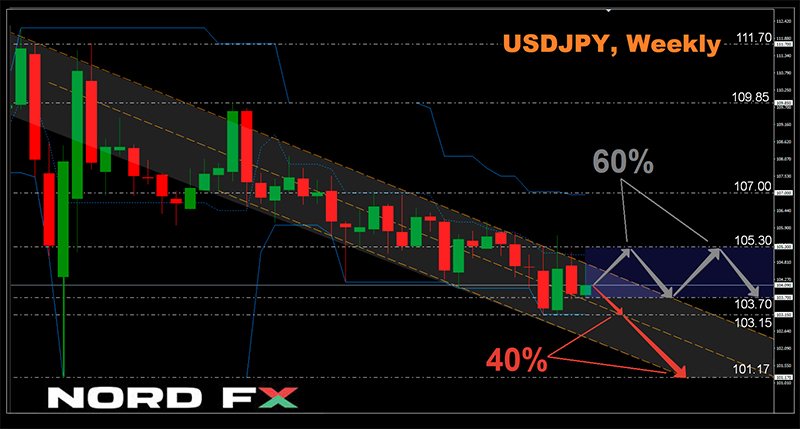

USD/JPY

Albeit minimal, but still the growth of this pair last week made analysts think about its transition from a downward movement to a sideways movement. So, 60% of them assumed that it would move east in the range 103.70-105.30 for some time. Such a scenario is supported by graphical analysis on D1 and only 10% of oscillators giving signals that the pair is oversold. In case of a breakout of the upper border of the channel, the pair will meet resistance at 105.70, then at 106.15.

The remaining 40% of experts, along with graphical analysis on H4, as well as 100% of trend indicators and 90% of oscillators on both timeframes, side with the bears, indicating the direction to the south for the pair. The first support is 103.70. It is followed by the November 9 low at 103.15, which corresponds to the center line of the descending medium-term channel. The ultimate target of the bears is the 2020 low, which the pair reached on March 9, at 101.17;

Cryptocurrencies

If you look at the charts, you can see that the current situation is very similar to what it was in December 2017. At the same time, many experts say that the market is no longer the same, and that the collapse of three years ago is unlikely to repeat. Indeed, there is a growing acceptance of bitcoin by both private depositors and large institutional investors. Indeed, against the background of the coronavirus pandemic, the mass of fiat is growing, which increases the popularity of bitcoin as a protection against inflation. But what if the current fall is caused by the fact that large speculators simply started taking profits ahead of the end of the year? What if the stop orders set near the historic high have already started to work?

According to CoinTelegraph, shortly before the collapse, the All Exchanges Inflow metric showed an increase in BTC placement on exchanges, which clearly indicates the intentions of whales to start selling their crypto assets. But after the whales, looking at the current situation, many retail investors will follow. Moreover, Christmas holidays are not far off, and this is a period of increased need for fiat.

So there are plenty of reasons for the further fall of the BTC/USD pair. But no compelling reasons for new growth are foreseen at least until early 2021. Although, of course, the pair's jerks to the north are quite possible. Some of the major speculators may try to play bullish, or, for example, the Chinese government will deal another blow to its miners, creating a supply shortage in the crypto market. All of this could push the quotes back up.

Looking ahead, it is appropriate to quote the opinion of the analyst Mati Greenspan. He believes that, unlike in 2017, the market is now controlled not by speculators but by corporations and large investors interested in its stability. The entry of large players leads to the fact that volatility will weaken, and this area will become more attractive. In connection with the above, Greenspan, like many other experts (there are now 65% of them), expects a further update of the bitcoin highs already this year.

In the meantime, the market is interested in the level at which the current correction will end. In general, is it a correction or a global trend reversal downward?

In addition to the $17,000 zone, in which there was a consolidation at the end of the last working week, the next strong support may be the November 26 low in the $16,000-16,300 area, which fits within the Fibonacci correction. However, if the pair overcomes this support confidently, then it will return to the $14,700-15,700 zone, where it stayed in the first decade of November and from which the last stage of the upward rally started.

And at the end of the review, one more, already global, forecast from Max Kaiser. This Wall Street veteran believes the supply shock will drive bitcoin to rise to $1 million. “The demand for bitcoin is growing almost exponentially,” he says, “while its supply is mathematically fixed at 900 coins per day. And in 2024, the supply will be halved to 450 BTC per day. This is why I think that institutions that buy bitcoins will do it directly from miners, and people simply won't have the opportunity to buy coins as the price will skyrocket to $1 million per BTC. Meanwhile, Gen Z, who bought a lot of bitcoins when they were under $100, will become the new global power elite. The world order is about to change.”

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is ...

more