For The Bank Of Canada, It Is All About Closing The Output Gap, Not The Recent Surge In Consumer Prices

At today’s decision, the Governing Council judged that the recovery still needs extraordinary support from monetary policy.

We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. Based on our current projection, this happens sometime in the second half of 2022.... Bank of Canada, July 14th.

Photo by Hermes Rivera on Unsplash

Why Inflation is Not on the Horizon

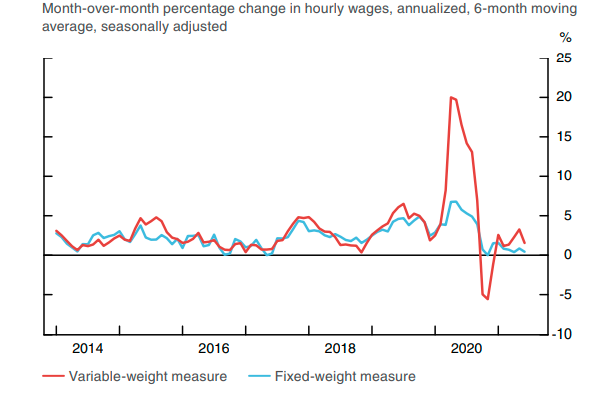

The most significant chart in its July Monetary Policy Report (MPR) is the analysis of wage inflation. The financial press headlines dwell on the shortage of workers in selective industries, citing the need to raise wages to attract workers and the implications for future inflation. Figure 1 charts the percentage change in hourly wages, from two perspectives. Note that the most volatile wages change (red line) is principally found in the low-paying occupations, the ones most affected by the shutdowns in response to the pandemic. Labour market surveys have consistently documented that job dissatisfaction is widespread among both low and high-wage individuals. This level of worker dissatisfaction is apparent throughout the industrialized world. (The Next Disruptions is Hybrid Work ). The quit ratios are among the highest level in over a decade. Workers seek alternative jobs, or alternative occupations or leave the job market permanently. These dynamic shifts will continue for some time. Rightly so, the Bank focuses on the wage measures that are less influenced by such composition effects and are more stable (blue line). Using that metric, wage increases are barely 1% and do not pose any threat to ignite sustained price increases

Figure 1: Average Wage Changes, 2014-2021(June)

Source: Bank of Canada

The Output Gap Remains Large

The output gap the difference between potential economic performance and actual performance will be the biggest influence on future monetary policy decisions. Granted, this measure is not precise especially since the measure of potential is implied rather than observed. Nonetheless, considerable excess capacity dominates the economy. The Bank estimates that the output gap was between -3.0 and -2.0 % in the second quarter. Another way to view the output gap is to consider how far we are from pre-pandemic levels of employment. The employment rate remains 1.7 percentage points below where it was in February 2020. This translates into approximately 550,000 people who would have to be hired just to reach the pre-pandemic employment rate. In addition, the total amount of hours worked in June was 4 % below the pre-pandemic level. Thousands of workers are not working full-time, not by choice, especially in lower-wage occupations. Long-term unemployment is at the highest level since that data series began. The labor market suffers from considerable underutilization, another sign of how large is the output gap.

The Bank offers its forecast that the output gap will be closed sometime is 2022 at which time it is expected to raise its policy rate. Too many observers have anchored onto this narrative. The pandemic is not over and new threats appear from coronavirus variants; the economy is not opening fully and evenly among all sectors; thousands of workers are re-assessing jobs and careers, and the economy continues to underperform at many levels. Predicting the next rate hike is really a mug's game.