Finance Job Vacancies In London Collapse

As if European banks did not have enough on their plates, with diving profitability in a prolonged period of zero or negative interest rates, along with rising NPLs, the virus pandemic has accelerated the plunge into the abyss, which as of recent, has resulted in a collapse in finance job vacancies and industrywide job cuts.

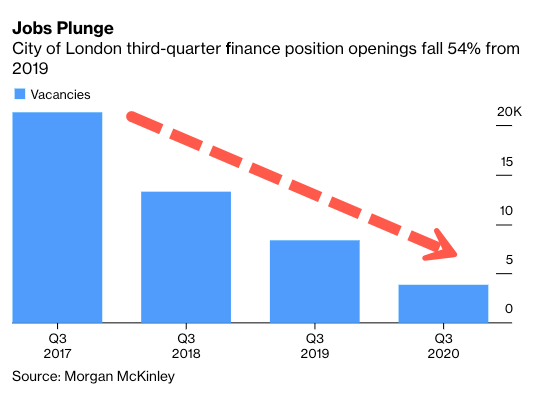

Bloomberg, citing a new report via recruitment firm Morgan McKinley, said job vacancies in London's finance industry were more than halved in the third quarter compared with 2019. The report said coronavirus, Brexit, and bank profits discouraged many of the top banks situated in the financial district to hire in the third quarter - as many also reduced their workforce.

Morgan McKinley showed only 3,800 finance position openings were offered in the three months through September, a sharp drop of 4,500 openings from 8,300 compared with the quarter last year, representing a 54% decline.

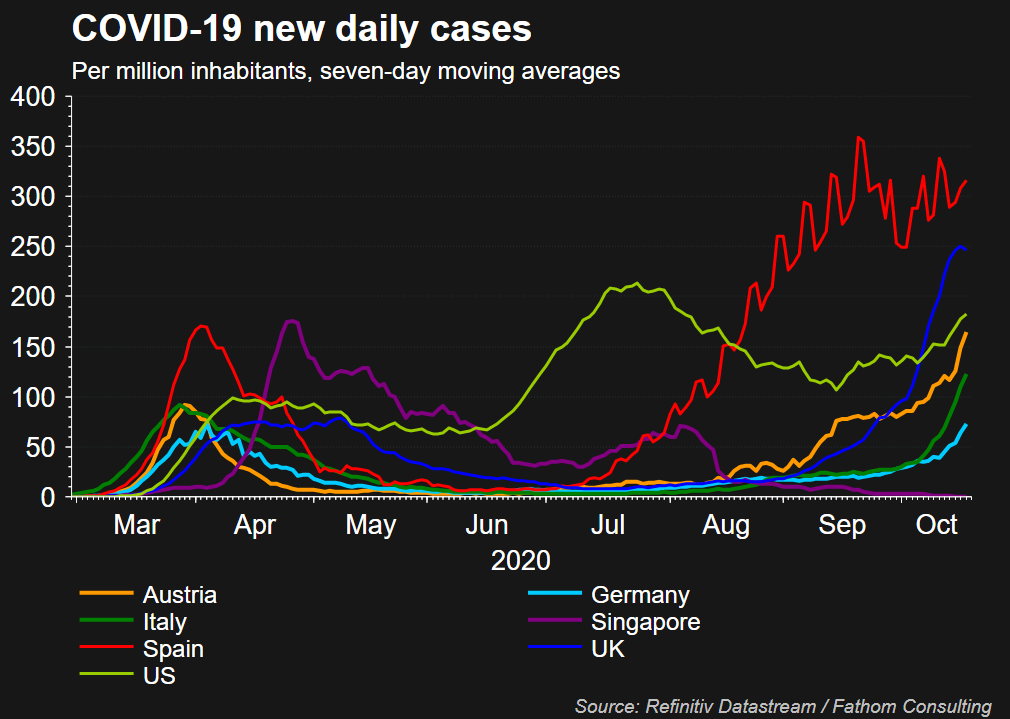

Hakan Enver, managing director at Morgan McKinley U.K., said, "businesses and job seekers were struggling with the impact of the pandemic and worried about what a second wave will mean."

"But we also can't forget about Brexit. There are concerns for the long-term recovery and the free flow of capital and equivalence for U.K. financial services that need to be clarified," Enver said.

The plunge in London third-quarter finance position openings comes as big banks such as Citi, Wells Fargo, HSBC, and Deutsche Bank reduce their workforce to the tune of 64,000 this year. The number of job cuts could be on pace to surpass 78,000 bank jobs lost last year and could soon hone in on the 94,100 cuts seen in 2015.

The coronavirus pandemic has halved the FTSE U.K. bank equity since the start of the pandemic.

Andrea Enria, chair of the ECB's supervisory board, recently told the German business daily Handelsblatt that a second wave of the virus pandemic could spark another surge of bad loans.

Rating agency S&P has remained vocal about the European bank debacle, warning corporate default rates would more than double over the next nine months to 8.5% from 3.8%.

Europe's financial system is hanging on by a thread. Another round of the pandemic could doom the continent's banking industry; nevertheless, bankers at Barclays, Deutsche Bank, and SocGen will be unhappy this year as their bonuses are set to slump because of the virus-induced downturn.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more