EUR/USD Weekly Forecast: ECB, COVID-19 To Halt Recovery Below 1.1350

Image Source: Unsplash

- The EUR/USD pair suffered heavy losses for the second week in a row.

- EUR/USD cannot erase its losses due to policy divergence between the ECB and the Fed.

- The European common currency was hurt by concerns over widespread lockdowns.

The EUR/USD weekly forecast points out further losses as the Fed and ECB policies remain divergent, giving more room to the bears. Meanwhile, widespread lockdowns in the region may also be a cause of worry for the euro.

The EUR/USD exchange rate started the week under strong downward pressure and fell to 1.1263 on Wednesday, its lowest level since July 2020, as the dollar strengthened amid inflation concerns.

During the second half of the week, US Treasury yields began to decline, driving the pair to 1.1400 on Thursday. Christine Lagarde, the president of the European Central Bank (ECB), commented about the economic outlook before the weekend that led to the couple’s defeat.

The EUR/USD exchange rate updated the lows below 1.1300 in 2021 before stabilizing at that level as Austria announced a nationwide lockdown due to rising coronavirus infections. For two weeks in a row, the pair lost over 1%.

The EUR/USD pair hit a new 16-month low during Wednesday’s Asian session due to the steady strength of the dollar. In October, the Eurozone’s consumer price index (CPI) was 4.1%. However, the imprint was largely ignored by investors since it fell within preliminary estimates and market expectations. In the afternoon, the yield on 10-year US Treasuries fell below 1.6%, triggering a moderate recovery in the EUR/USD currency pair.

The ECB’s decision to keep buying bonds is an indication that a rate hike isn’t imminent, according to ECB member Isabelle Schnabel. Furthermore, Schnabel added that the rise in inflation is a positive development.

Finally, Lagarde crossed the borders again on Friday, arguing that tightening policies ahead of schedule would not make sense if inflationary pressures were likely to ease. According to Lagarde, stricter policies would only increase deterrent effects on the economy.

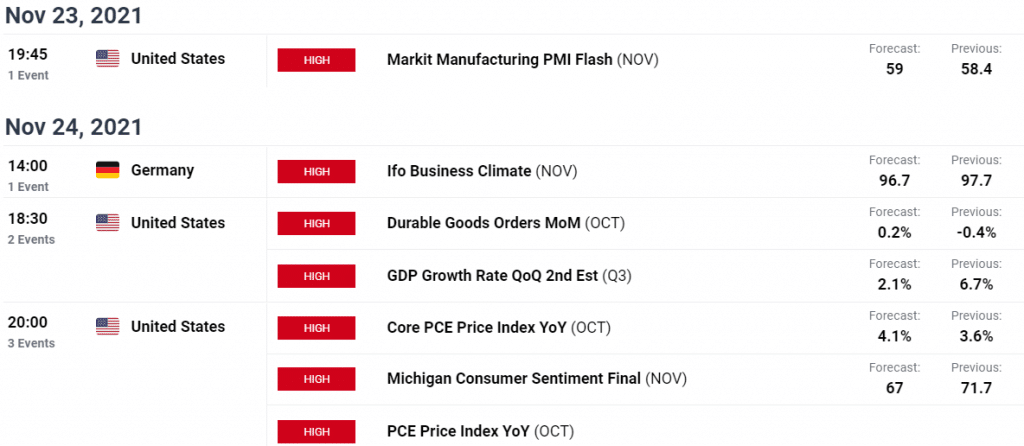

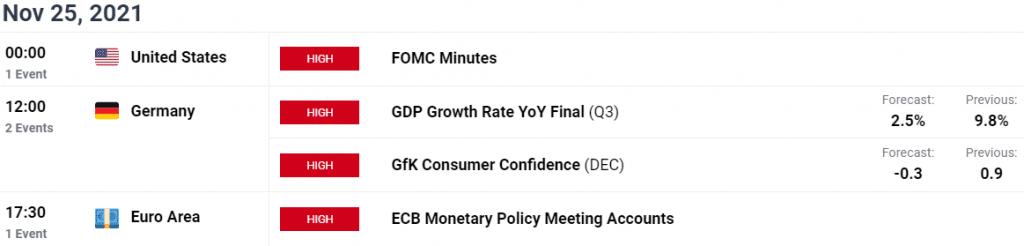

Key Data/Events for EUR/USD

PMIs for the Eurozone and Germany will be released by IHS Markit on Tuesday. If the euro area’s economy remains healthy, investors could raise the ECB rate further in 2022, which will help the single currency to find demand put pressure on the euro.

The US economic summary will release three key data sets on Wednesday: durable goods orders for October, the first estimate of GDP for the third quarter, and the personal consumption price index (PCE). Inflation data from the PCE price index will be of particular interest to market participants. The US Dollar Index and US Treasuries rose earlier this month due to a stronger-than-expected CPI. If annual PCE continues to rise, a similar market reaction will ensue.

According to the ECB’s report on Thursday’s monetary policy meeting, the outlook for economic policy is unlikely to be improved. We are also examining the German Gross Domestic Product data for the third quarter. Market activity should remain sluggish for the rest of the week due to the Thanksgiving holiday in the US.

EUR/USD Weekly Technical Forecast: More Losses to Come

The EUR/USD price is slightly off the weekly lows, but it remains far below the key moving averages. The price attempted twice to build a recovery momentum, but failed around the mid-1.1300 area.

The volume is also supporting the downside. The pair may be likely to test the yearly lows at 1.1250 ahead of 1.1200. Any bullish attempt will remain capped by the 1.1350 zone.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more