EUR/USD Weekly Forecast: Bears To Target 1.17 Amid Stronger Dollar

EUR/USD Forecast Highlights

- EUR/USD remains under selling pressure.

- Fed’s dovish tone couldn’t help bulls in EUR/USD.

- A further decline towards the 1.17 region can be expected.

On Friday, the EUR/USD forecast felt inclined to decline all day. The dynamics of EUR/USD were influenced by macroeconomic reports from the Eurozone. According to final data from the European statistical agency Eurostat, the consumer price index rose 0.3% in June. As a result, annual inflation in June slowed to 1.9% from 2% a month earlier.

The indicators coincided with the forecasts of experts. The core consumer price index (excluding food and energy) was 0.3% m/m and 0.9% y/y, in line with market expectations. Despite all the efforts of Jerome Powell, who voiced dovish rhetoric in Congress, the greenback stayed afloat and showed character, strengthening its position throughout the market on Friday.

The immediate reason for the southern impulse of the EUR/USD was the release of retail sales data in the United States. The published figures came out in the green zone, significantly exceeding the forecasted values. Thus, the total volume of retail trade in June increased by 0.6% m/m, while experts had predicted its decline by 0.4%. Excluding car sales, the indicator showed a stronger result, rising by 1.3% (against the growth forecast of only 0.4%).

There are more and more assumptions in the market that the Fed will decide to tighten the monetary policy parameters earlier than previously announced. Abstracting from intraday price fluctuations, it can be noted that the main support for the dollar is provided by the hawkish expectations of investors.

This is especially evident in the EUR/USD pair. The non-correlation of the positions of the ECB and the FRS is becoming more and more pronounced, and it is this fact that serves (and will serve in the future) as the main anchor for the EUR/USD pair.

What’s Next to Watch in EUR/USD?

We have two important events which can trigger higher volatility in the EUR/USD. They are ECB refinancing rate and monetary policy statement followed by the ECB press conference. Additionally, we have US unemployment claims figures which can also impact the market.

EUR/USD Technical Forecast: More Fall to Come?

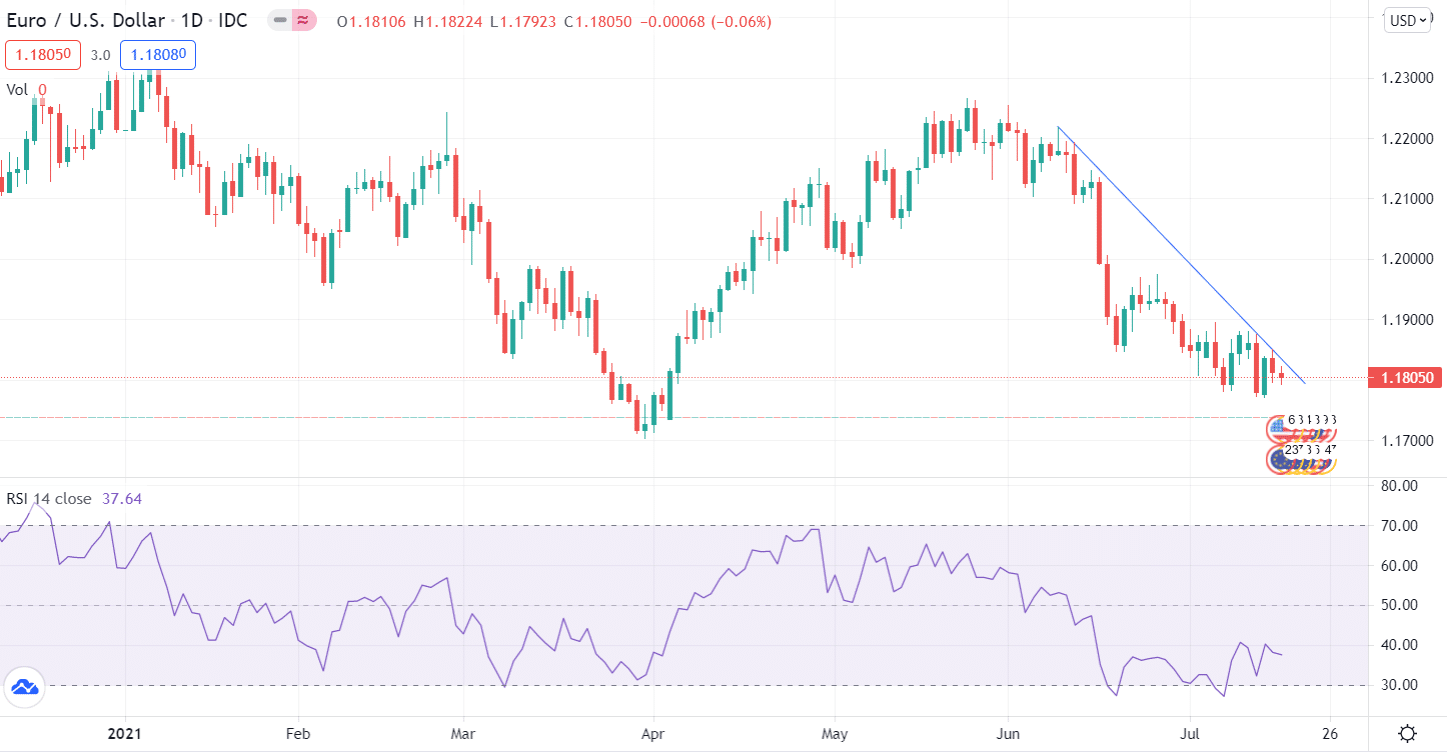

The EUR/USD has stabilized near the level of 1.18. The relative strength indicator has corrected to the neutral zone. The bullish potential is limited by the downtrend line, which indicates the weakening of the European currency.

Thus, the EUR/USD forecast for the week of July 19-23, 2021, is expected to depreciate towards the lows of the year. The breakdown of the level of 1.17 will open the way to the psychological level of 1.15.

EUR/USD Daily Chart Forecast

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more