EUR/USD Waiting For The Next Hammer To Fall

- EUR/USD has been attempting to stabilize around the lowest since 2017.

- Economic divergence, coronavirus headlines and the FOMC Meeting Minutes await traders.

- Wednesday’s four-hour chart is pointing to oversold conditions.

The “Macron Gap” has been breached – and that implies further falls for EUR/USD, even if it suffers from oversold conditions. Back in April 2017, the world’s most popular currency pair leaped above the 1.0770 – 1.0820 zone over the weekend in which Emmanuel Macron won the first round of the French presidential elections before assuming office later that year.

The economic divergence between the struggling eurozone and the upbeat US economy remains the main downside driver for euro/dollar. The latest disappointing figure came from ZEW’s business survey, which showed that Economic Sentiment slipped to 8.7 points, significantly worse than expected. In the US, the Empire State Manufacturing Index beat estimates with 12.9.

The coronavirus outbreak is also weighing on the common currency as Germany relies heavily on exports to China. Beijing has reported that its refineries processed 25% less oil in early 2020 than the average in the second half of 2019. Several factories remain at low utilization or shut down, causing Apple to cut its forecasts.

On the other hand, the pace of new infections has decelerated and authorities in the second-largest economy remain optimistic about a swift return to rapid growth. Nevertheless, while global stock markets have stabilized, the euro remains under pressure.

Apart from fresh developments related to the respiratory disease, markets are awaiting the Federal Open Markets Committee (FOMC) Meeting Minutes for its January meeting. The Fed left rates unchanged and made only subtle changes to its accompanying statement. Robert Kaplan, President of the Dallas branch of the Federal Reserve, has said that he supports leaving rates unchanged for longer. Bond markets have other plans for rates – foreseeing a reduction later this year.

Investors will look for any hints about changes in policy – related to the coronavirus or other factors.

Kaplan and his Neel Kashkari, his colleague from the Minnesota Fed, will speak later. The US also publishes Building Permits and Housing Starts, which are set to show ongoing expansion in the construction sector.

Overall, concerns about European growth, coronavirus headlines and the Fed’s minutes are eyed.

EUR/USD Technical Analysis

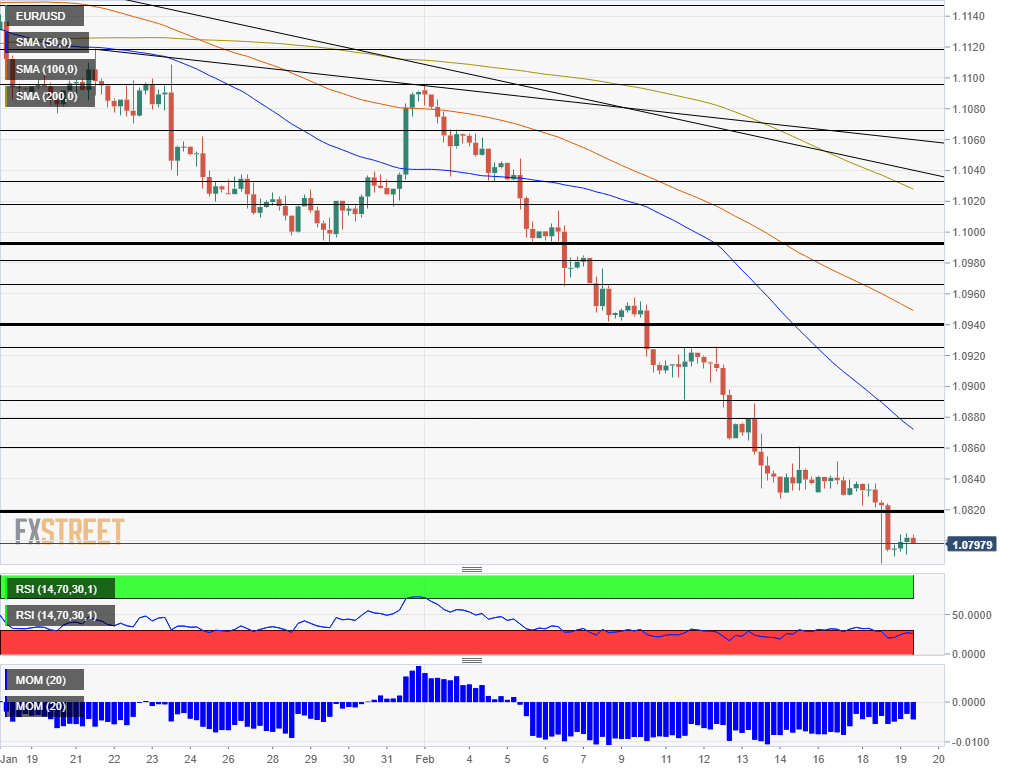

(Click on image to enlarge)

Euro/dollar is oversold according to the Relative Strength Index on the four-hour chart, which is just below 30 – implying a recovery. However, as recent days have shown, all upticks proved to be “dead-cat bounces” – limited and shortlived, followed by further falls.

Momentum remains to the downside and the currency pair trades below the 50, 100, and 200 Simple Moving Averages.

Support awaits at the new low of 1.0785 recorded on Tuesday, followed by 1.0770 and 1.0720 – levels seen in April 2017.

Resistance is at 1.0820, the top of the Macron Gap, and then at 1.0860, a swing high seen on Friday. The 2019 trough of 1.0880 and 1.0905 are next.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk appetite and ...

more