EUR/USD Technical Analysis: Has EUR/USD Bottomed Out?

Image Source: Pexels

Coinciding with the beginning of this week's trading, forex currency traders noticed an upward rebound in the price of the euro currency pair against the US dollar.

This happened with gains to the resistance level of 1.0688, rebounding from its lowest level in five years. The gains of the euro came against the rest of the other major currencies. This is following comments from European Central Bank President Christine Lagarde, who reported that the bank plans to exit negative territory this year.

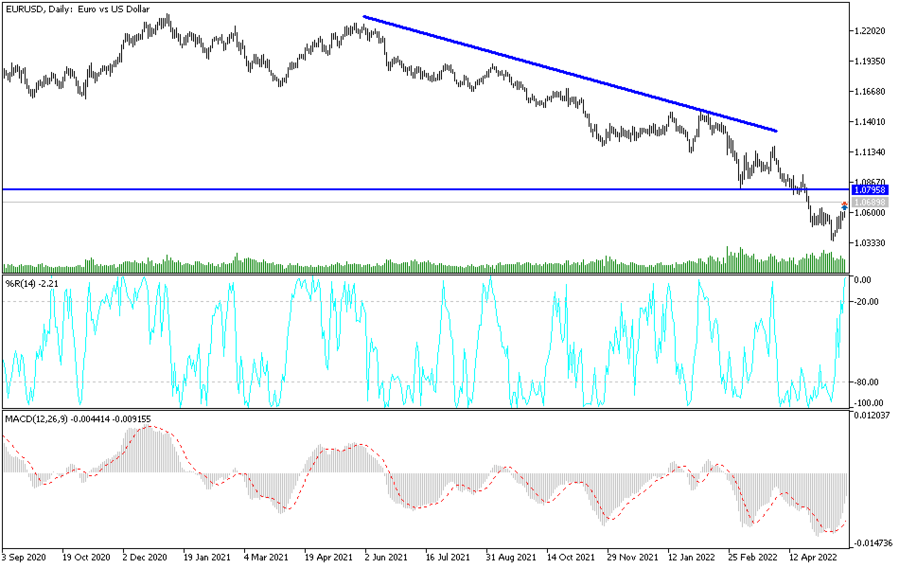

The progress is more visible against the US dollar. The US currency has appreciated against the euro in the past 12 months, with the exchange rate dropping from 1.22 last May to 1.04 two weeks ago. But has the ECB's message changed the rules of the game? Has the EUR/USD bottomed out, or should investors fade this rally?

Overall, the falling wedge pattern indicates more upside. The US dollar's strong gains came with the impetus from the US Federal Reserve's shift to hawkishness. The Fed has raised rates aggressively and plans to continue tightening financial conditions. However, it would be very good if everything was already priced.

Lagarde hinted in her remarks that the European Central Bank is planning to exit the negative rate zone. The European Central Bank has kept the deposit facility rate below zero for many years. It also implemented quantitative easing programs designed to weather European economies during economic downturns.

However, the ECB's mandate involves price stability. With inflation running well around the ECB's target, it is extremely dangerous to ignore it despite the war in Ukraine and the obstacles it poses to European economies.

In yesterday's comments, Christine Lagarde committed to a 25 basis point rate hike in July, followed by another similar hike in September. But perhaps most importantly, she did not commit to anything after September. Accordingly, the euro rose based on the ECB's message. Until September, traders will have plenty of time to interpret the future guidance that the central bank will provide during the summer.

After the euro gains, it may attempt to recover further if the US dollar continues to strengthen and the RMB remains on a firmer footing, although many analysts are concerned about the Eurozone economic figures due out this week.

The European currency, the euro, benefited in recent trading from falling US bond yields, a falling US dollar, a sharp rebound by the renminbi, and a growing chorus of hawkish European Central Bank (ECB) policy makers whose remarks raised Eurozone bond yields significantly.

Governing Council members are increasingly unanimous in their suggestion that the European Central Bank may start raising the negative deposit rate for the first time since 2011 in the near future and possibly as early as July to help curb inflation in the Eurozone.

President Christine Lagarde reportedly repeated that message on Dutch TV over the weekend as she echoed the sentiments she expressed on May 11 at the Bank of Slovenia conference in yet another supportive outcome for Eurozone government bond yields.

Commenting on this, Jordan Rochester, an analyst at Nomura Bank says, “Over the past week, softer US survey data sent the dollar lower, and the 50 basis point suspension from the European Central Bank node pushed the EUR/USD higher.”

This week, it is the turn of the European growth opinion polls to move the price action, with the German Ifo index, the PMI and consumer confidence surveys for May. The analyst suggests that Nomura clients continue to bet that the EUR/USD will fall again.

Recent comments from European Central Bank officials have prompted financial markets to fully raise the interest rate in July from the bank and are also betting with increasing confidence that it will likely follow up with a series of additional interest rate steps before the end of the year. This comes on the back of lower US bond yields and a weak US currency, which has been very supportive of the euro in recent trading.

According to the technical analysis of the pair: I still expect that the recent rebound gains for the EUR/USD may be temporary. We see that Lagarde confirmed earlier statements to ease selling operations on the euro, especially since the Russian-Ukrainian war is still in progress and the future of energy in Europe is becoming more uncertain.

I expect to see better selling of the EUR/USD pair from the 1.0690 and 1.0775 resistance levels, respectively.

On the downside, the 1.0500 support level remains the most important for bears to launch in the path of the stronger and clearer channel on the daily chart below. The euro will interact today with the readings of the industrial and services purchasing managers' index for the economies of the Eurozone and Lagarde's statements, and the dollar will be affected by new statements from Jerome Powell.

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more