EUR/USD Technical Analysis: Ahead Of The German IFO - Monday, May 25

The single European currency may be prone to disappointment in the coming days over the recent European response to COVID-19, which comes as investors learn of many of the new geopolitical risks.

The Euro price dropped against most other major currencies at the end of last week’s trading amid deteriorating investor sentiment, as tensions between the United States and China escalated, and China decided not to set a target for economic growth for 2020 due to the coronavirus pandemic. Accordingly, the EUR/USD pair fell below 1.0900, with losses reaching the 1.0885 support.

The pressure on markets increased after China moved to strengthen its control over Hong Kong with new security laws. Therefore, US President Donald Trump warned that Washington would respond with "great force" if Beijing followed its plans. Critics say the controversial law will effectively end wide-ranging freedoms, including the right to peaceful assembly and freedom of expression, as enjoyed by Hong Kong under the "one country, two systems" mechanism.

On the other hand, the minutes of the April 29-30 meeting showed that the European Central Bank is ready to implement more stimulus at the coming June meeting, if it sees that the current efforts were less than required. Members recognized that the extent of the coronavirus pandemic was unpredictable, and that the current crisis was significantly different from previous crises.

In light of high uncertainties surrounding the economic outlook and inflation, the Board of Directors stressed its willingness to adjust its monetary policy stance as necessary, as well as to ensure that the transfer works across the Eurozone.

The Euro rose 0.69% against the dollar last week, but failed to overcome major technical hurdles. The recent Euro gains were helped by optimism and enhanced sentiment across broader financial markets, but the previous momentum came from a French-German proposal to allow the European Commission to borrow 500 billion Euros (447 billion pounds), so that it could provide grants to the members of the Eurozone that are most affected by the virus, who otherwise, may struggle to cover the unprecedented cost of national economic closings without adding so much debt to GDP ratios that they may risk a destabilizing rebellion in the bond markets.

The Euro has a negative relationship with bond yields that have declined in response to the announcement, although the performance of those yields and the currency in the coming days will depend on investor response to a competing proposal from the “economic” northern members, who, last week, objected to the idea of granting loans to southern members who have long been marked as "extravagant."

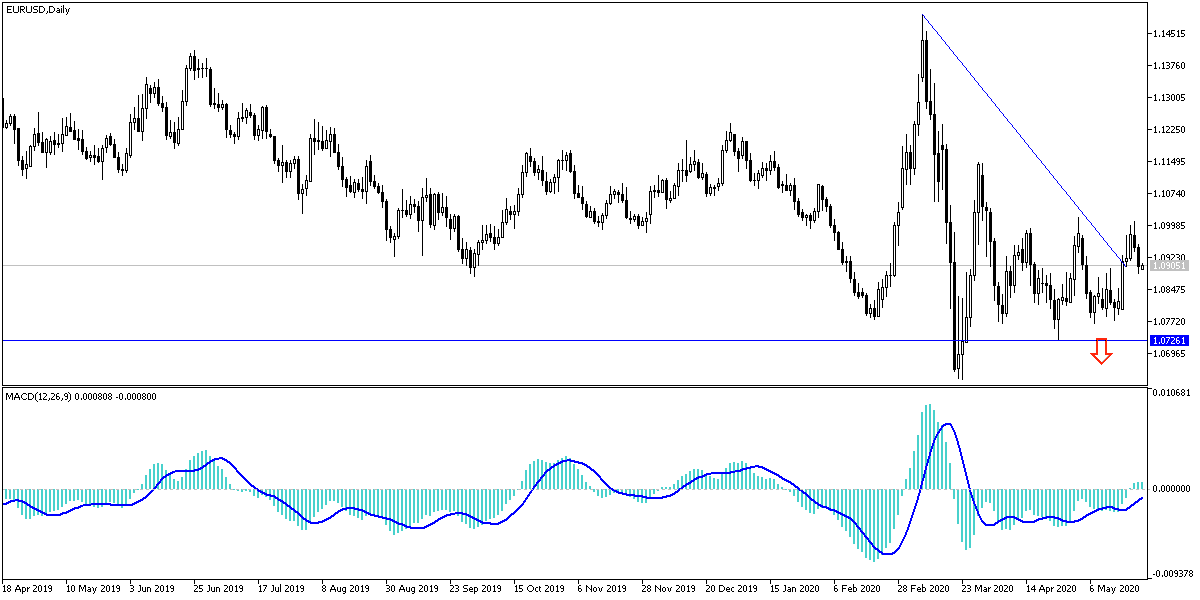

According to technical analysis: On the daily chart, the EUR/USD is still facing strong obstacles in the upward correction, especially with failure to overcome the 1.1000 psychological resistance. The current stability below 1.09 support will support the move towards 1.0800 psychological support at the earliest, especially with the continued deterioration in markets and investors morals, which is very likely, especially with the increasing tensions between the two largest economies in the world towards the spread of the Coronavirus, which is still devastating to the global economy.

As for the economic calendar data today: From the Eurozone, the German IFO business climate indicator will be announced, along with the German GDP growth rate. On the other hand, there is an American holiday.

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals and ...

more