EUR/USD: Surge Above 1.20? Not So Fast, Lagarde May Lower The Euro

Bond buyers have buoyed bulls – but bears are coming from the old and continent. Wednesday’s highly-anticipated ten-year Treasury auction resulted in satisfactory demand and helped pushed yields on the global benchmark closer to 1.50% – a level that keeps investors content. The previous rise to 1.60% scared markets and boosted the greenback.

Weak US inflation figures also contributed to cooling down the dollar. The Core Consumer Price Index missed with 1.3% YoY in February, showing that at least for now, inflation remains subdued.

Will prices pick up later in the year and force the Federal Reserve to raise rates? Base-effects will likely cause a temporary increase in CPI in the spring, but investors are more focused not on 2020’s lower inflation but on 2021’s potential for overheating. The House passed the Senate’s version of the $1.9 trillion covid relief bill, moving to it President Joe Biden’s desk. Once he signs it on Friday, Uncle Sam will unleash funds that may lift not only the local but also the global economy.

For both the Fed and the White House, policy depends on people getting back to work. Thursday’s weekly jobless claims will provide some hints.

ECB decision – yields in focus

The European Central Bank has had little time to rest on the laurels of a lower exchange rate, and now, higher yields for eurozone countries are causing sleepless nights. While the Fed sees higher returns as reflecting better growth prospects in the US, the old continent continues struggling. The ECB’s new forecasts will likely be only marginally better.

If economic expansion is sluggish – in line with the EU’s snail’s pace vaccination campaign – will the bank act to lower bond yields? Officials have offered relatively stark words, but weekly bond-buying figures have been showing a surprising decline in purchases.

ECB President Christine Lagarde has the power to push returns on debt lower – either by front-loading buys, or even expanding the bank’s current “envelope” of €1.850 trillion. Will she inject new money into the ailing economies? That could boost the euro, but the slow-moving institution is unlikely to act with speed. All in all, there is room for disappointment.

All in all, the upbeat market mood and optimism about the ECB are unlikely to extend into another rally.

EUR/USD Technical Analysis

(Click on image to enlarge)

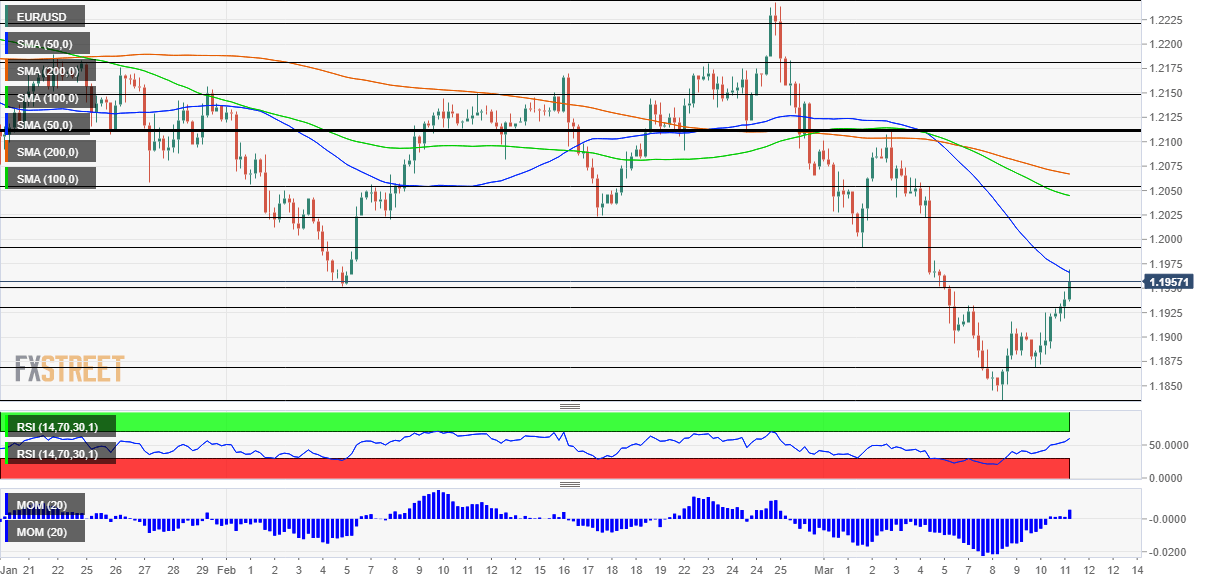

Euro/dollar has advanced to the 50 Simple Moving Average on the four-hour chart but has been rejected at the time of writing. Momentum has turned to the upside, but the currency pair is trading below the 100 and 200 SMAs.

All in all, the picture is improving but bulls are not out of the woods.

Some resistance awaits at the 50 SMA at around 1.1965. Last week’s swing low around 1.1990 defends the psychologically significant 1.20 level. Further above, 1.2025 and 1.2050 are eyed.

Some support awaits at 1.1950, followed by 1.1925, which capped EUR/USD last week. It is followed by 1.1870 and 1.1836 – the 2021 bottom.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more