EUR/USD Ready To Break 1.22, Yet The Fed, Brexit, Stimulus And Virus Loom

- EUR/USD has been grinding higher after the ECB decision and amid multiple negotiations.

- The final Fed decision of the year and coronavirus headlines stand out.

- Mid-December’s daily chart is showing the pair has more room to rise.

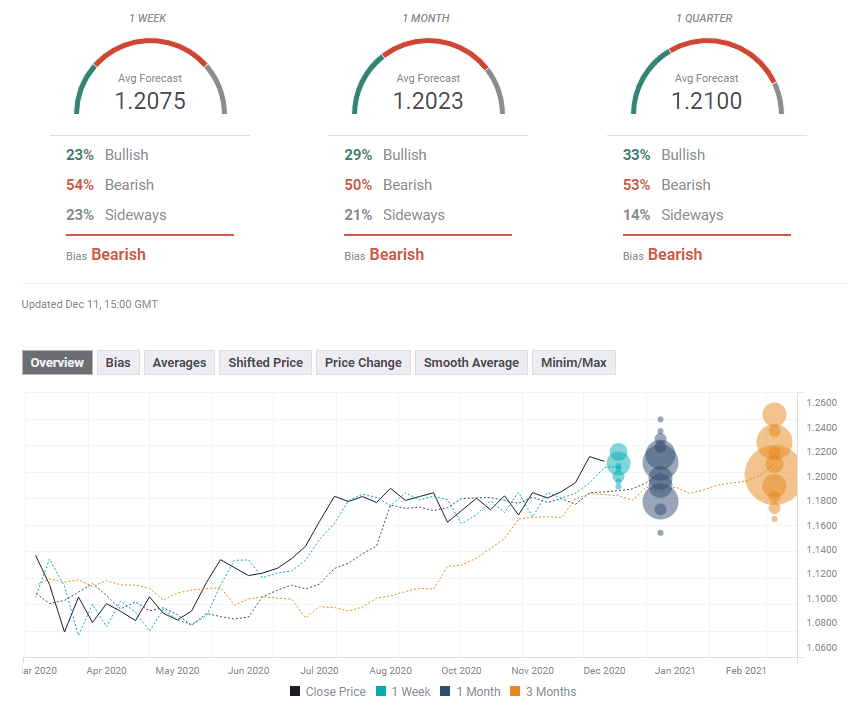

- The FX Poll is pointing to falls on all timeframes.

There is no good without bad – the ECB has given its shot in the arm and the vaccine is coming, yet virus numbers continue rising and both Brexit and US stimulus talks are stuck. The Federal Reserve’s decision competes with politics in the last full trading week of a turbulent 2020.

This week in EUR/USD: Between hope and fear

The European Central Bank delivered its pledge to add stimulus via expanding its bond-buying scheme by €500 billion and through March 2022. Moreover, the Frankfurt-based institution left its language on the exchange rate unchanged, only saying it is “monitoring” it. While the ECB looks unfavorably at the rise of the euro – which depresses inflation and weak exports’ attractiveness – it seems unwilling to act.

ECB President Christine Lagarde allowed the euro to rise, yet it was not enough to trigger new highs as other developments weighed on the currency pair.

The focus in the US was around fiscal stimulus. After the weak Nonfarm Payrolls figures seemed to push politicians to action, cheering markets, doubts about a deal crept in later on. Mitch McConnell, the Senate Majority Leader, is reluctant to support a relief package worth close to $1 trillion. The sluggish talks in Washington weighed on sentiment and contributed to curbing EUR/USD’s advance.

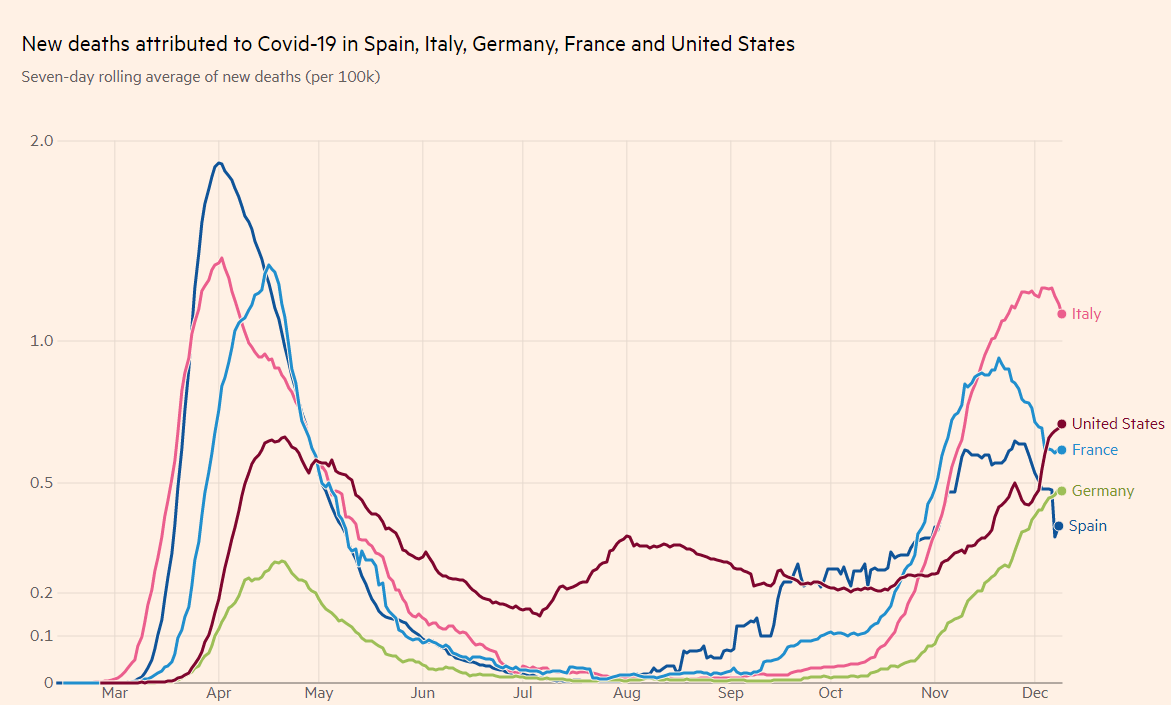

Additional support from Uncle Sam is of higher urgency also due to new records in daily coronavirus cases, deaths and hospitalizations – with the latter’s seven-day moving average topping 100,000.

German COVID-19 infections remained stubbornly high and prompted preparations for additional restrictions. France, which had enjoyed a downturn in infections, saw the rapid improvement halt and consequently considers halting the reopening process.

Source: FT

On the positive side, the UK began administering the Pfizer/BioNTech vaccine without major incidents. The US Food and Drug Administration (FDA) also authorized the jabs’ emergency usage, providing hope.

Brexit negotiations had an outsized effect on the euro, which echoed some of the pound’s movements. Several “make or break” moments triggered action. At the time of writing, talks are being stretched to the wire. Both the EU and the UK are talking up the prospects of a no-deal Brexit ahead of yet another target to conclude talks– December 13. However, the expiration of the transition period on December 31 is the only hard deadline.

Data played second-fiddle to the ECB decision and political development but is still noteworthy. German industrial output jumped by 3.2% in October, beating expectations. The ZEW Economic Sentiment survey for December also exceeded an estimated 55 points, showing that investors see through the current hardship.

US jobless claims disappointed with a jump to 853,000 in the week ending December 4 after dropping beforehand. The virus is taking its toll, but more data is needed to confirm the downturn.

Eurozone events: Coronavirus, Brexit and PMIs

How soon will eurozone countries begin immunizing their citizens? Resistance to vaccination is more prevalent in continental Europe than in the US or the UK, which is why the European Medicines Agency is taking a more cautious approach. Nevertheless, success in other countries could help bring forward the EMA’s decision from late in December to potentially before Christmas.

The continent is preparing for the Christmas holidays with fear that travel and family mixing would contribute to the disease’s spread. Governments are torn between enabling the economies to breathe – which would be euro-positive – to halting infections, which would help the recovery. Decisions in Germany and France are of importance to the common currency.

Brexit deal or no deal? An accord is in the interest of both sides and markets are pricing in higher chances of an accord. While the euro is not sensitive as the pound to details about fisheries, major announcements are likely to rock the single currency.

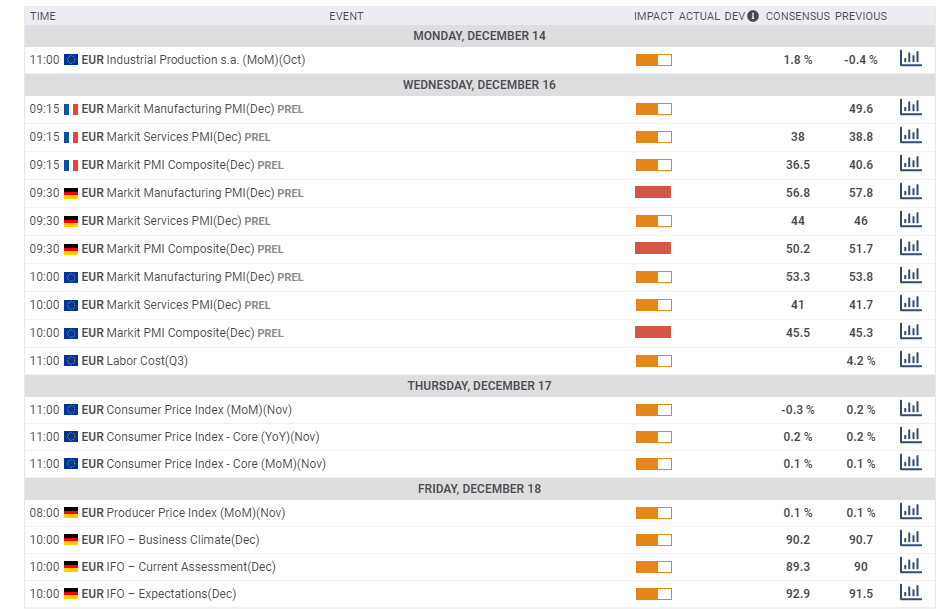

Final Consumer Price Index figures for November will likely confirm subdued inflation levels, vindicating ECB doves. The focus will likely shift to Markit’s forward-looking Purchasing Managers’ Indexes for December, which will likely reflect a contraction in the continent’s services sector. However, the vaccine hopes to provide room for an upside surprise.

Here are the events lined up in the eurozone on the forex calendar:

US events: Fed stands out

The elections temporarily return to investors’ radars as the Electoral College meets on Monday, December 14, to formally elect Joe Biden as President. So far, outgoing President Donald Trump’s efforts to overturn the elections have suffered miserable failures. Still, last-minute efforts and the odd “faithless elector” – a person voting against their state’s popular vote – may cause jitters. A smooth process would help alleviate concerns and weigh on the greenback.

While Biden prepares to take office, stimulus talks continue in the “lame-duck” session. Even a more modest sum than the bipartisan $908 billion deal will likely be cheered given the protracted talks.

Concerns about the virus and shutdowns will likely remain a dominant topic for markets. Record numbers could weigh on market sentiment and boost the safe-haven dollar. On the other hand, markets will be awaiting the FDA’s verdict on Moderna’s covid vaccine due on Thursday. The regulator will likely give its second greenlight, injecting another shot in the arm to markets.

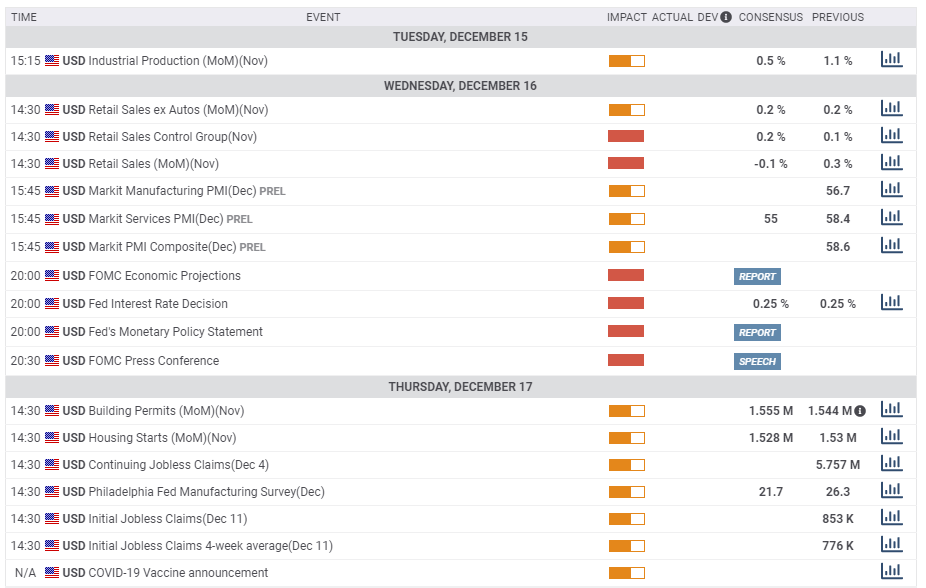

America’s economy heavily depends on consumption, and the updated Retail Sales statistics for November are set to provide a snapshot of how the virus weighed the economy last month. On the other hand, online expenditure hit record highs, raising expectations from the lows.

The week’s main event – and the last significant release for the year – is the Federal Reserve’s decision on Wednesday. The Fed is highly likely to leave its policy unchanged, including the Quantitative Easing program. Markets may be disappointed and the dollar could rise.

While members discussed recalibrating this bond-buying scheme last month, Chairman Jerome Powell characterize the recovery as “very good” in his testimony to Congress. Moreover, Charles Evans, President of the Chicago Fed and a dove, seemed reluctant to add QE at this point.

The Fed will probably repeat its call on elected officials to do more and express concerns about the slowdown in job growth. However, one disappointing month is unlikely to sway the bank to immediate action – especially before the new administration takes hold.

Weekly jobless claims remain of interest and investors would like to see them coming down. However, this Thursday’s release will likely be overshadowed by the Fed and the FDA’s vaccine announcement.

Here are the scheduled events in the US:

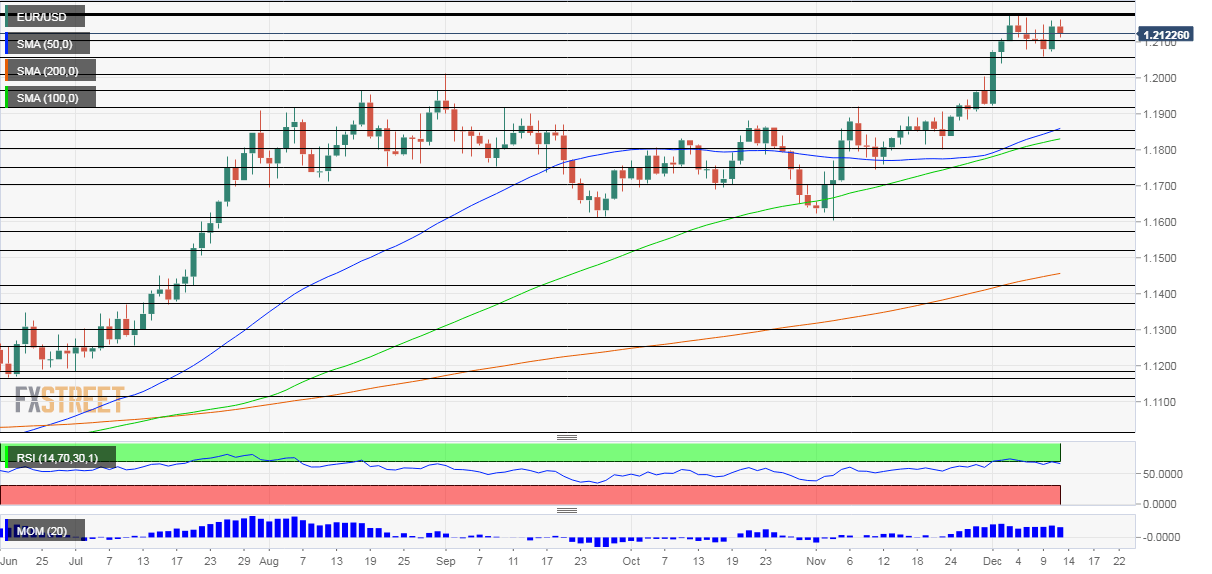

EUR/USD Technical Analysis

Euro/dollar continues benefiting from upside momentum on the daily chart and the Relative Strength Index is just under 70 – outside overbought conditions, but only just. That allows the pair some room to the upside, albeit limited. When the RSI surpassed the 70 level earlier in the month, the rally stalled. Another increase, followed by a pause, is on the cards.

Resistance is at the 2020 peak of 1.2177, followed by the round 1.22 level, which played a role in 2018. Further above, the next levels to watch are 1.2310, 1.2420 and 1.25, all recorded in early 2018.

Some support awaits at 1.21, a round number that played a pivotal role in early December. Is followed by 1.2055, a swing low around the same time. Further down, the previous 2020 high of 1.2010 switches to support and it is followed by 1.1960.

EUR/USD Sentiment

Optimism about the vaccine, ECB support – and perhaps a surprising Brexit deal – may push the pair to new highs. Still, a reluctant Federal Reserve and worrying virus figures may trigger a pullback.

The FXStreet Poll is showing that investors are bearish on all timeframes, pricing a more significant fall in the medium term than at any other horizon. Average targets are little moved from those seen in the previous week, in line with volatility.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more