EUR/USD Price Stable As ECB Leaves Key Interest Rates Unchanged

On Thursday, the ECB kept key rates and forward guidance unchanged, but lowered its estimate, saying that the balance of risks shifted to a downward trend.

The expectations of an increase in the ECB rate were postponed to mid-2020 three weeks ago. In addition, EUR/USD has lost more than 200 pips in the last two weeks.

However, the Euro fell after the ECB release. Moreover, the ECB’s decision to downgrade the risk assessment could have triggered expectations for changes in the forward guidance at the next meeting on March 7.

EUR/USD Technical Analysis

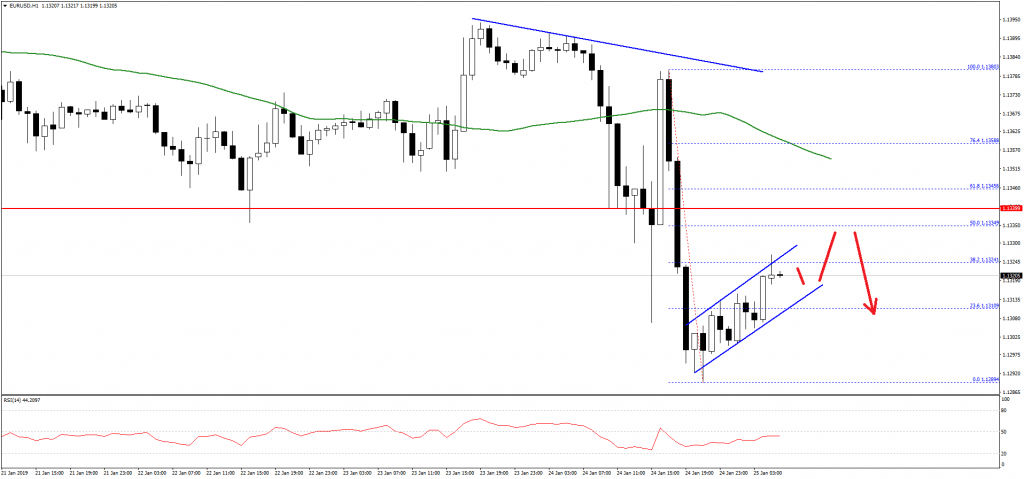

The Euro faced an increase in selling pressure recently and it broke the 1.1360 support level against the US Dollar. The EUR/USD pair even broke the 1.1320 support area and settled below the 50 hourly simple moving average.

The pair traded as low as 1.1289 and it is currently correcting higher. It moved above the 23.6% Fib retracement level of the last decline from the 1.1380 high to 1.1289 low. However, there are many hurdles on the upside near the 1.1330 and 1.1340 levels.

The main resistance is at 1.1340 (the previous support) and the 50% Fib retracement level of the last decline from the 1.1380 high to 1.1289 low. Therefore, if the pair corrects higher towards 1.1340, it is likely to face sellers.

On the downside, an initial support is at 1.1310, below which the price could trade towards the 1.1280 level in the near term.