EUR/USD Price At Risk Of Decline Below 1.034 Amid Fed/ECB Divergence

The EUR/USD price remains positive as the pair soars above the 1.0400 mark with a 0.22% gain at 1.0433 at the time of writing. However, the upside potential seems limited as the Fed-ECB policy divergence and poor risk sentiment limit the gains.

Considering the policies undertaken by the European Central Bank (ECB), among others, to raise interest rates three times this year to quell inflation, this also aligns their views with the increasing sense of urgency among policymakers.

ECB’s Interest Rate Plan

The Governing Council will raise interest rates by a quarter-point in July, September and December, in increments of 0.25%, with a target of 0.50% by the end of the year. In addition, the main refinancing operation rate will be raised in September and December, bringing it to 0.5% from its current 0% level.

Meanwhile, the European economy is expected to continue to expand this year despite increasing challenges due to the war crisis in Ukraine. Therefore, growth of 2.8% and 2.3% in 2022 and 2023 is sufficient to consider — a decrease of 0.1%, respectively.

In addition to the inflation forecast being raised to 6.7% and 2.6% for this year and next, consumer price growth is still seen slowing to 1.9%, below the ECB’s target, in 2024.

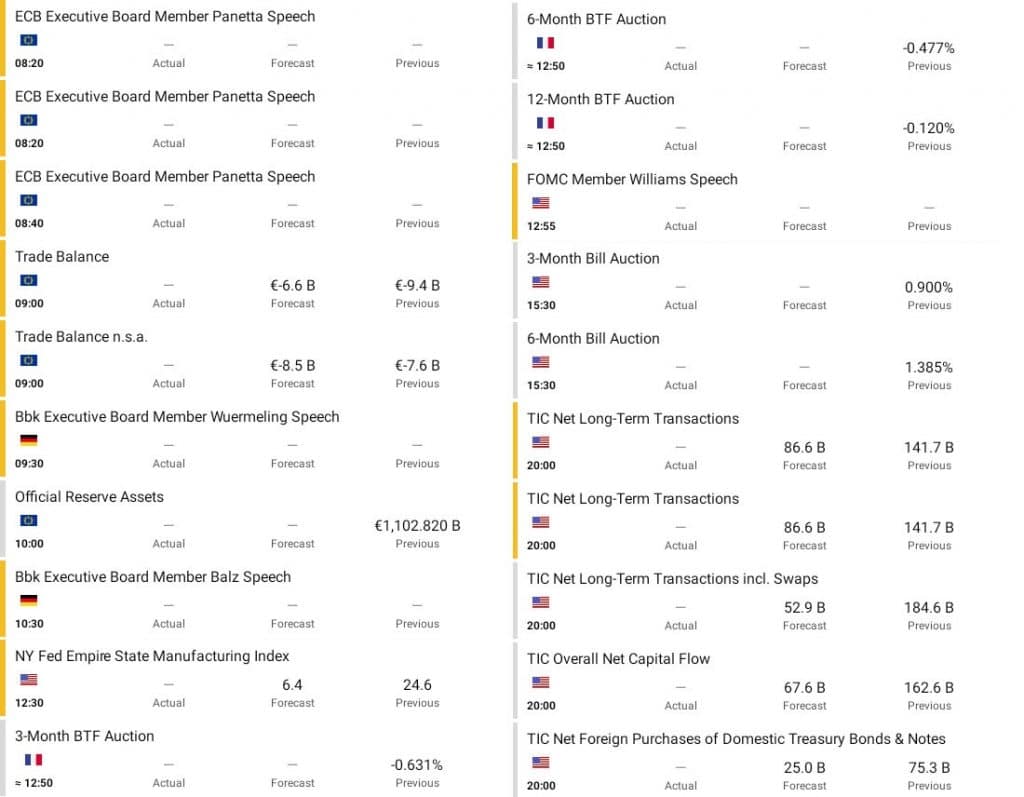

EUR/USD Key Events To Watch

Several events are important and fundamentally influential for the ECB and the FED this Monday. First, today, the President of the Federal Reserve Bank of New York, John Williams, participated in moderated discussions before the Mortgage Bankers Association Secondary Markets and Capital Markets Conference and Expo. The speech will be held at 0855 EST, which is 1255 GMT.

Later in succession from the ECB were ECB Executive Board Members Fabio Panetta and Philip R. Lane participating in a panel discussion at the ‘Towards a digital euro’ event at the National College of Ireland at 0840 GMT and Vice President of the European Systemic Risk Council (ESRB), Governor Riksbank (Swedish Central Bank), Stefan Ingves was questioned by the European Parliament’s Committee on Economic and Monetary Affairs at 1345 GMT.

So the moments mentioned above can affect the volatility of market prices for a moment. For the security of your investment, it is necessary to manage risk in the area of these hours for the EUR/USD pair.

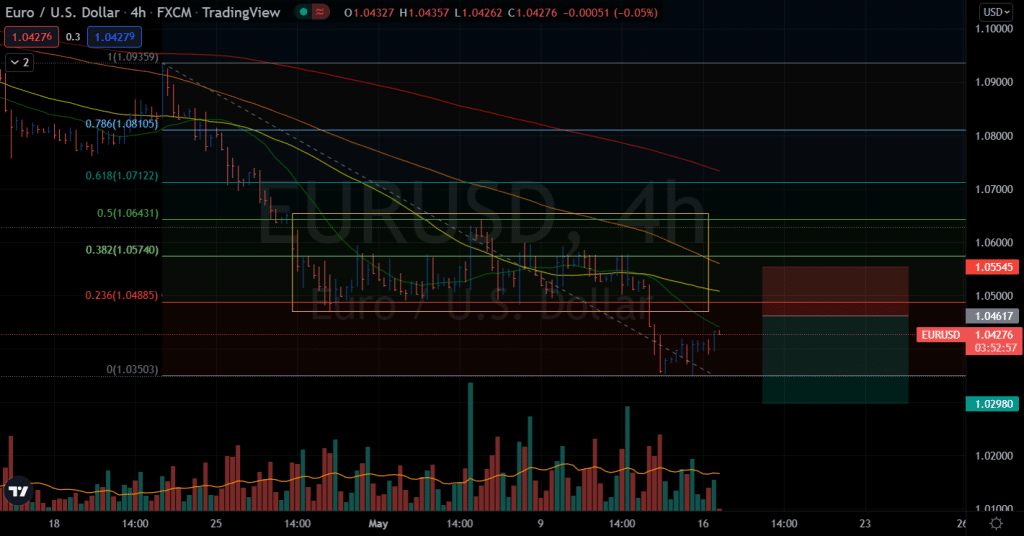

EUR/USD Price Technical Analysis: Gains Capped By 1.0470

Technically, the opening price of EUR/USD today is 1.04081. There was no significant movement with conditions throughout the Asian session on Monday. There was no significant movement. Tend to show sideways conditions. Although USD pressure against EUR is still quite high, institutions have taken no decision to increase opportunities for price movements. However, the European session saw some positive traction as the pair gained around 35 pips.

The lowest price in the Asian session was at 1.04025 and the highest at 1.04171. After the moment of significant movement that occurred last Thursday of 174 pips, the price retracement condition should be at least 60 pips. Is there a chance for the price retracement on Monday when the European session to the American session can break through the 38.2% barrier, or is there a rejection in that area and then continue the bearish trend?

While we expected the EUR to weaken, we believe that the ‘opportunity for a break of the key support at 1.0470 is not high’. However, the EUR broke the key support and fell to a low of 1.0352. A deep oversold decline has scope for a downside, below 1.0340 first before stabilization can be expected (next support is at 1.0300). Resistance is at 1.0430, followed by 1.0460.

We expect a reaction of a break of 1.0470 as the EUR fell to a low of 1.0352. A break of the 2017 low near 1.0340 could trigger a further sharp decline. The next support levels are at 1.0300 and 1.0200. Overall, only a break of 1.0490 (the ‘strong resistance’ level was at 1.0605 yesterday) would suggest that the EUR’s current decline has stabilized.

The opportunities that you can take this Monday are as follows:

EUR/USD Price Trade Idea

But if you have broken through the 38.2% fibo retracement area after retesting that area, which is around 1.0421 price. Then, exit to take profit at the 61.8% fibo retracement at the price of 1.0462 and to limit the loss, it is set at the price of 1.0385.

Selling can increase the level of profit by following the main trend. It can be prepared in the 1.04790 price area with an exit target at last week’s lowest price.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more