EUR/USD May Come Under Pressure As Post-Brexit Talks Currently Likely To Fail

EUR/USD PRICE, NEWS AND ANALYSIS:

Talks between the EU and UK are seemingly going nowhere and both sides are now saying that this Sunday remains the crunch day as to whether post-Brexit trade talks will continue or not. Both parties are now saying that a no-deal seems the more likely outcome, leaving Sterling, and to a certain extent the Euro, at risk of further weakness. This EUR and GBP weakness will likely boost the US dollar basket (DXY) as investors return to the haven USD, underpinning a currently weak greenback.

.The latest ECB meeting produced little new or unexpected news with the central bank increasing its bond-buying program by a further EUR500 billion and extending it out to March 2022, all in line with market expectations. ECB President Lagarde continues to keep monetary policy as loose as possible as Europe struggles with an increase in Covid-19 cases and stagnating growth. While Eurozone government yields have been uber-low or negative for some time now, the yield on the Spanish 10-year turned negative Thursday for the first, while Greek 10-years now offer a record low of just 57 basis points of yield.

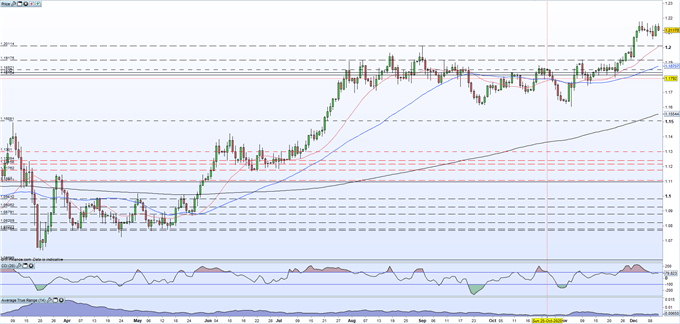

The daily EURUSD chart shows the pair stagnating near recent highs but with little enthusiasm to push further ahead. All three simple moving averages are positive, underpinning the recent move higher, while the CCI indicator shows that the pair are no longer in overbought territory. The outcome of Brexit talks and next week’s FOMC meeting will drive EUR/USD price action into the end of December and beyond.

EUR/USD DAILY PRICE CHART (MARCH – DECEMBER 11, 2020)

EUR/USDBEARISHData provided by IG

| CHANGE IN | LONGS | SHORTS | OI |

| DAILY | 4% | -2% | -1% |

| WEEKLY | 1% | -8% | -5% |

IG Retail trader data show 31.18% of traders are net-long with the ratio of traders short to long at 2.21 to 1. We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

Disclosure: See the full disclosure for DailyFX here.