EUR/USD: Euro Seizes On German Strength To Push Higher, Ignores US Politics

- EUR/USD is rising after German Manufacturing PMI smashed estimates.

- The chances of a generous US stimulus package are diminishing as the elections are close.

- Friday’s four-hour chart is painting a bullish picture for the currency pair.

Is it China? President Donald Trump blamed China for coronavirus, but for the euro, the world’s second-largest economy is serving as a factor in the recent rise. China is recovering from COVID-19 and demand may be boosting the German industry.

Markit’s preliminary German Manufacturing Purchasing Managers’ Index has jumped to 58 points – far above estimates and reflecting robust growth. That contrasts with misses in the country’s services sector and downbeat figures from France.

The upbeat figure has helped the euro recover from other depressing developments. Covid continues raging in the old continent, with record numbers of cases in several countries. Curfews are gradually becoming the norm in many cities, following the lead from Paris.

On Thursday, EUR/USD declined as hopes for a fiscal stimulus package faded away. While House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin reported progress, time is running out to pass a multi-trillion package before November 3, election day. While Congress could still approve it during the “lame-duck” session – the period following the vote and before newly elected officials settle in – uncertainty rises after the all-important event.

There are only 11 days to go until that day, yet nearly 50 million Americans have already cast their ballots – around 35% of the total vote count in 2016. Under these circumstances, could the final debate have an influence?

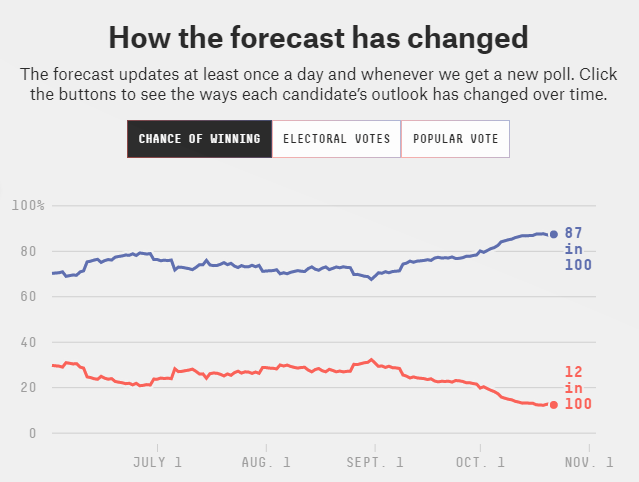

President Donald Trump and challenger Joe Biden clashed in a televised debate that was far more civilized than the previous one. The incumbent´s performance was more solid, potentially leading to an additional tightening in the polls. Biden leads Trump by around 8-9% in national polls and has an 87% chance of winning according to FiveThirtyEight. Post-debate polls are due early next week.

Source: FiveThirtyEight

The US dollar has room to rise amid concerns about a contested election and lower chances for additional funds from the government.

More:

- 2020 US Elections: Handicapping the race–polls, registration and the shy Trump voter

- 2020 Elections: Trump is showing signs of a comeback, will the dollar follow?

Markets are banking on a Democratic clean sweep – or “blue wave” – to provide a generous stimulus package. If Republicans hold onto the Senate, the relief would likely be smaller, but it could be somewhere in between if Trump wins re-election and forces his party to go along with more stimulus.

Speculation about politics and is set to increase as the week draws to an end, while Covid-19 will probably play second fiddle.

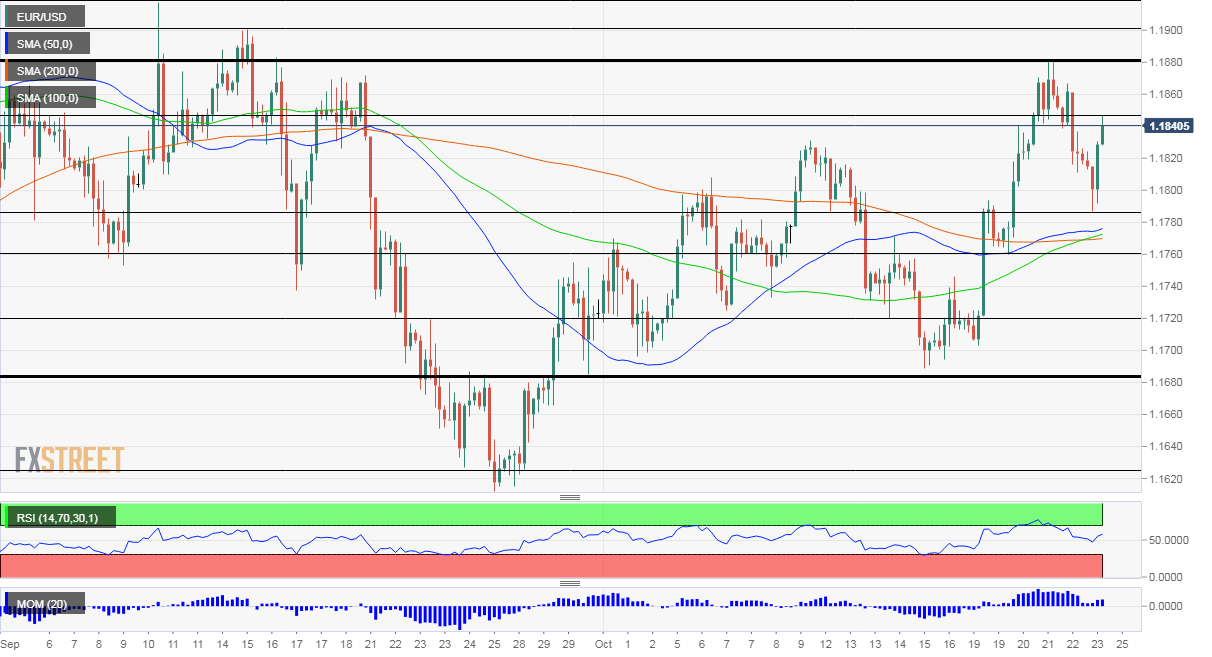

EUR/USD Technical Analysis

Euro/dollar has held above the 50, 100, and 200 Simple Moving Averages during its recent dip, and momentum remains upbeat. All in all, bulls are in control.

Resistance awaits at the daily high of 1.1845, followed by 1.1880, October’s peak. The next levels above are 1.19 and 1.1920.

Support awaits at 1.785, the daily low, followed by 1.1760, a stepping stone on the way up. Further down, 1.1720 and 1.1685 await EUR/USD.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more