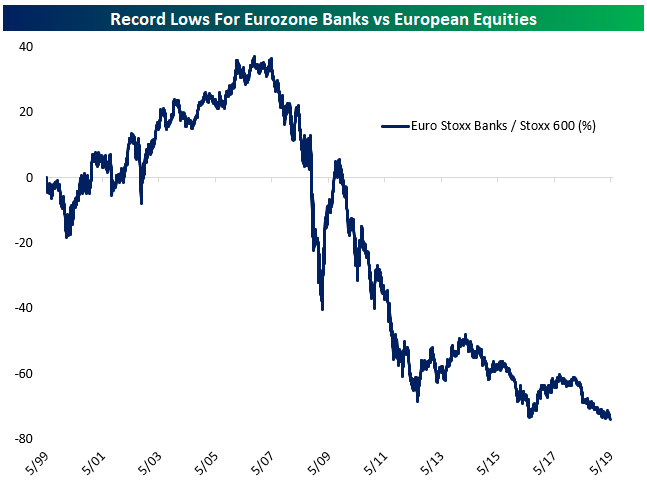

Eurozone Banks Make New Lows Versus The Market

Today Eurozone banks are lagging the market, but that’s nothing new. During the mid-2000s banks were the key drivers of European equity market performance, outperforming by almost 40% from mid-1999 through mid-2007. Since, it’s been a seemingly never-ending series of disasters: the global financial crisis, the Eurozone crisis, non-performing loan build-ups, recapitalization, negative interest rates, and more. As a result, Eurozone banks have underperformed the broadest measure of European stock prices by 77% since the 1990s came to a close. How much lower can this ratio go? Buying Eurozone banks here would certainly qualify as “buying low”.

Start a two-week free trial to Bespoke Institutional to read more on international equity markets and the global ...

more