Euro Forecast: Reversals Gather Pace In EUR/JPY, EUR/USD

Euro Struggling in December

On balance, the Euro has had a weak December. Thanks to dramatic shifts in key macro themes – the ‘race to the bottom’ among central banks, the US-China trade war, and Brexit vis-à-vis the UK general election – there has been a rush by traders into currencies that have struggled this year under the weight of geopolitical tensions.

Thus far in December, the Euro has only gained ground against three currencies: the Canadian Dollar (EUR/CAD 0.23% month-to-date); the Japanese Yen (EUR/JPY 0.76%); and the US Dollar (EUR/USD 0.93%). Elsewhere, the losses have been steep: the British Pound (EUR/GBP -2.2%) and the New Zealand Dollar (EUR/NZD -1.6%) have been the clear winners.

Eurozone Economic Data Starting to Improve

The Euro’s struggles in December have been removed from improvement in domestic Eurozone economic conditions. The forex economic calendar has been more favorable in recent days around the December ECB meeting. Overall, Eurozone economic data has improved, at least when trying to measure releases relative to expectations. The Citi Economic Surprise Index for the Eurozone, a gauge of economic data momentum, currently sits at 9 today relative to -11.1 one-month ago on November 15 and -36.5 on September 13.

Eurozone Inflation Tracking Brent Oil

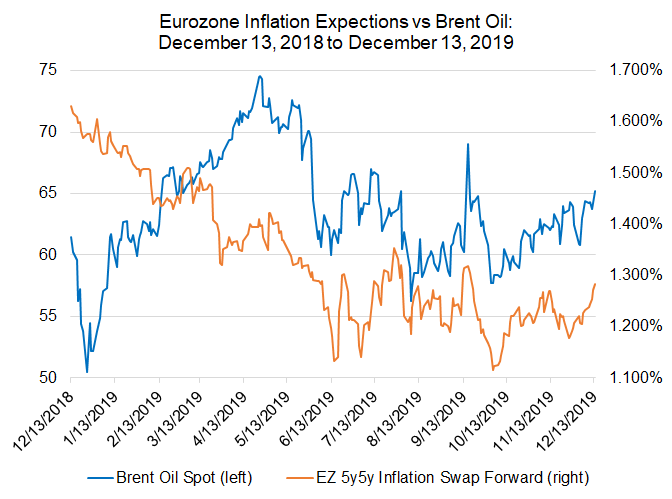

Given the state of Eurozone 5y5y inflation swap forwards – a medium-term market-derived measure of inflation expectations – it’s not a surprise that the ECB under new President Christine Lagarde promised a comprehensive review of policy outcomes. But to this end, the Eurozone is faced with a situation where low growth and inflation expectations are keeping the ECB’s bias pointed towards easing.

Eurozone Inflation Expectations versus Brent Oil Prices: Daily Timeframe (December 2018 to December 2019) (Chart 1)

(Click on image to enlarge)

The relationship between Eurozone 5y5y inflation swap forwards and Brent oil prices has tightened up over the past few weeks. The current 20-day correlation between Eurozone inflation expectations and Brent oil prices has held steady in recent weeks, from -0.34 one week ago to 0.31 today. The strengthening correlation comes at a time when global recession fears are receding.

ECB Review Period Keeps Rate Cuts at Bay

New ECB President Christine Lagarde is using the early months of her tenure to try and clear divisions among ECB Governing Council members. The schism exists as a result of former ECB President Mario Draghi ramming through his easing package at the September ECB meeting. As policymakers search for a new consensus, it seems likely that the ECB will remain on the sidelines for the time being.

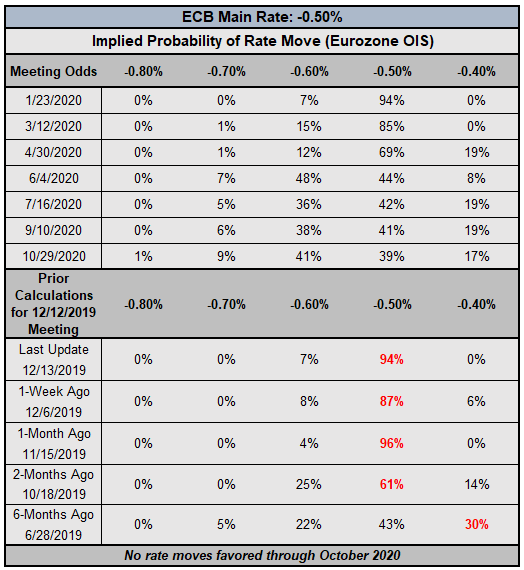

European Central Bank Interest Rate Expectations (December 13, 2019) (Table 1)

According to Eurozone overnight index swaps, traders are convinced that the period of recalibration by new ECB President Lagarde will take several months: there is only a 12% chance of a rate move through April 2020. Accordingly, there are still no rates moves discounted through October 2020; now, there is a 41% chance of 10-bps rate cut in October 2020 as well as a 17% chance of a 10-bps rate hike.

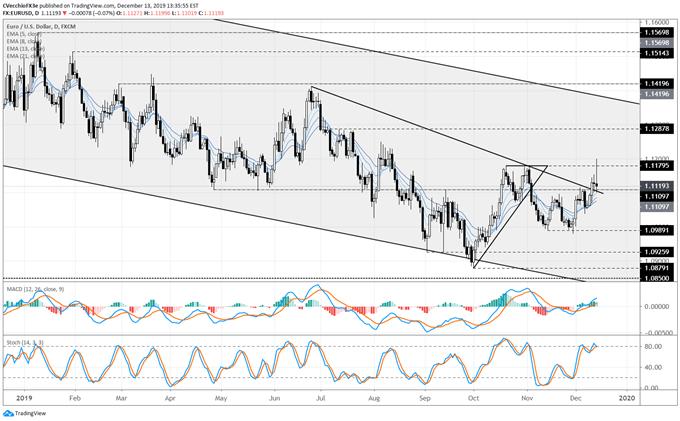

EUR/USD RATE TECHNICAL ANALYSIS: DAILY CHART (OCTOBER 2018 to OCTOBER 2019 INTRADAY) (CHART 2)

(Click on image to enlarge)

In our last EUR/USD rate forecast update, it was noted that “EUR/USD would be looking for a return towards the prior range high near 1.1110. A move above this level would suggest that a meaningful bottom has been found in EUR/USD rates.” Such a move transpired this week, with EUR/USD hitting a high of 1.1200 on December 13 after breaking above the descending trendline from the June, July, and September highs.

Yet not all is sanguine. EUR/USD rates are above the daily 8-, 13-, and 21-EMA envelope, but the daily candle is forming a bearish outside engulfing bar after briefly breaching the October and November swing highs near 1.1180. Daily MACD continues to extend above its median line, while Slow Stochastics are still in overbought territory. For now, the daily 5-EMA is near-term bullish momentum support for EUR/USD rates – a near-term top could be in focus.

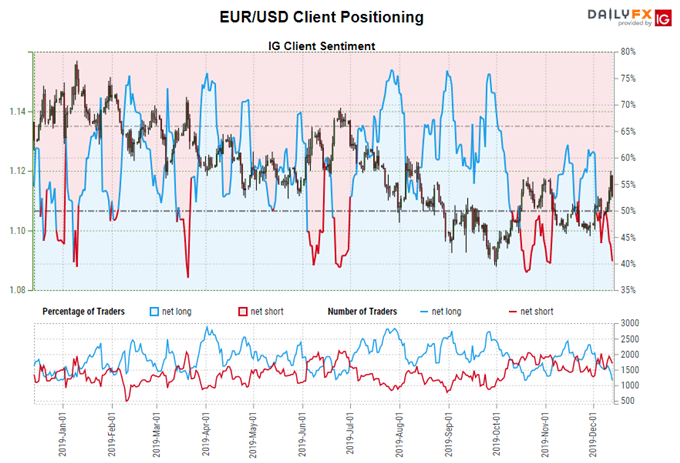

IG Client Sentiment Index: EUR/USD Rate Forecast (December 13, 2019) (Chart 3)

(Click on image to enlarge)

EUR/USD: Retail trader data shows 39.95% of traders are net-long with the ratio of traders short to long at 1.50 to 1. The number of traders net-long is 17.34% lower than yesterday and 22.39% lower from last week, while the number of traders net-short is 3.67% lower than yesterday and 7.07% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

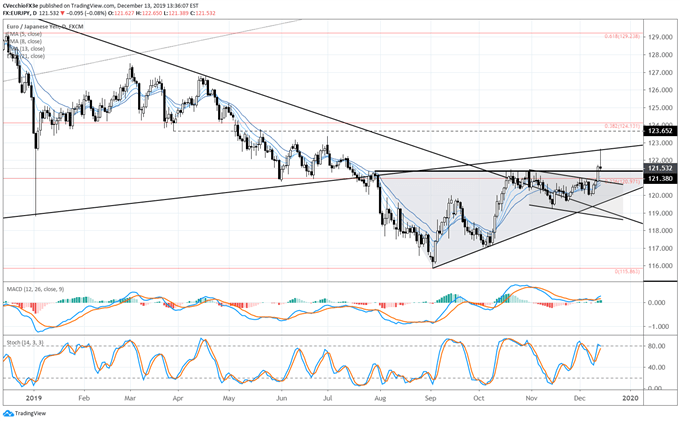

EUR/JPY RATE TECHNICAL ANALYSIS: DAILY CHART (OCTOBER 2018 to OCTOBER 2019 INTRADAY) (CHART 4)

(Click on image to enlarge)

In our last EUR/JPY rate forecast update, it was noted that “running into the descending trendline from the September 2018 and April 2019 highs, EUR/JPY has likewise hit resistance in the form of the 23.6% retracement of the 2018 high/2019 low range at 120.97. The path of least resistance may be higher yet, nonetheless. A turn higher from here would see EUR/JPY rates eye 122.00 by the end of the month.” EUR/JPY hit a high of 122.65 on December 13.

Nevertheless, a top may be forming. A shooting star candle on the daily chart comes as EUR/JPY rates ran into the rising trendline from the 2012, 2016, and early-2019 lows. Daily MACD continues to extend above its median line, while Slow Stochastics are still in overbought territory. Similarly, the daily 5-EMA is near-term bullish momentum support for EUR/JPY rates – a near-term top could be in focus.

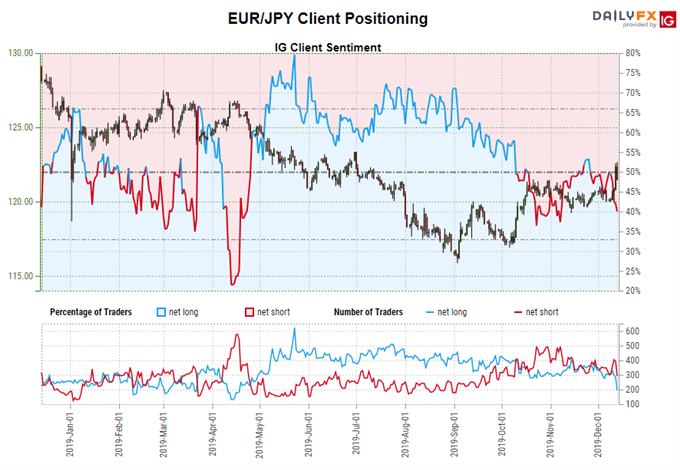

IG Client Sentiment Index: EUR/JPY Rate Forecast (December 13, 2019) (Chart 5)

(Click on image to enlarge)

EUR/JPY: Retail trader data shows 37.32% of traders are net-long with the ratio of traders short to long at 1.68 to 1. The number of traders net-long is 36.11% lower than yesterday and 35.89% lower from last week, while the number of traders net-short is 10.95% lower than yesterday and 9.38% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/JPY prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/JPY-bullish contrarian trading bias.