EUR/NZD: Bearish Market Patterns Signaling The Move Lower

On Feb. 12, 2021, EUR/NZD was showing bearish market patterns which signaled to traders that there was a high probability the pair could make a move lower. The pair has been trending and moving lower since the March 2020 peak high, and we always advise to trade with the trend, not against it.

The charts below clearly illustrate the various bearish market patterns that signaled to traders to get in the market as EUR/NZD would continue on its bearish trend lower.

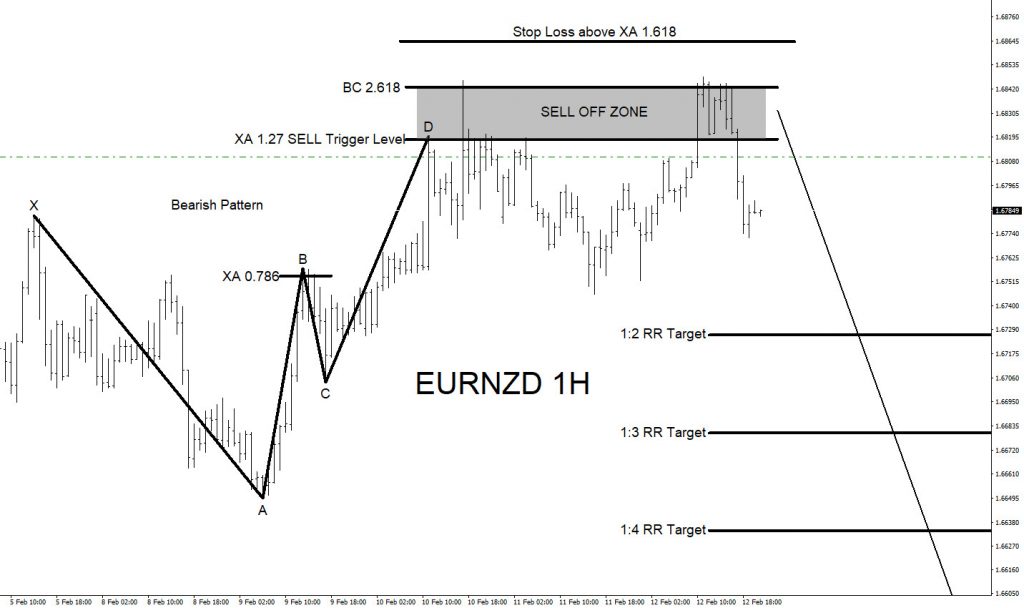

EUR/NZD One-Hour Chart For Feb. 12, 2021 (Pattern 1)

The first bearish market pattern formed, signaling to traders that the pair would move lower from the XA 1.27% – BC 2.618% Fib. retracement levels. Only a move above the XA 1.618% would invalidate the market pattern. Targets were based on the XA 1.27% sell trigger level and the XA 1.618% invalidation level.

EUR/NZD One-Hour Chart For Feb. 12, 2021 (Pattern 2)

The second bearish market pattern then formed, signaling to traders that the pair would move lower from the XA 0.886% – BC 2.618% Fib. retracement levels. Only a move above the XA 2.618% would invalidate the market pattern. Targets were based on the XA 0.886% sell trigger level and the BC 2.618% invalidation level.

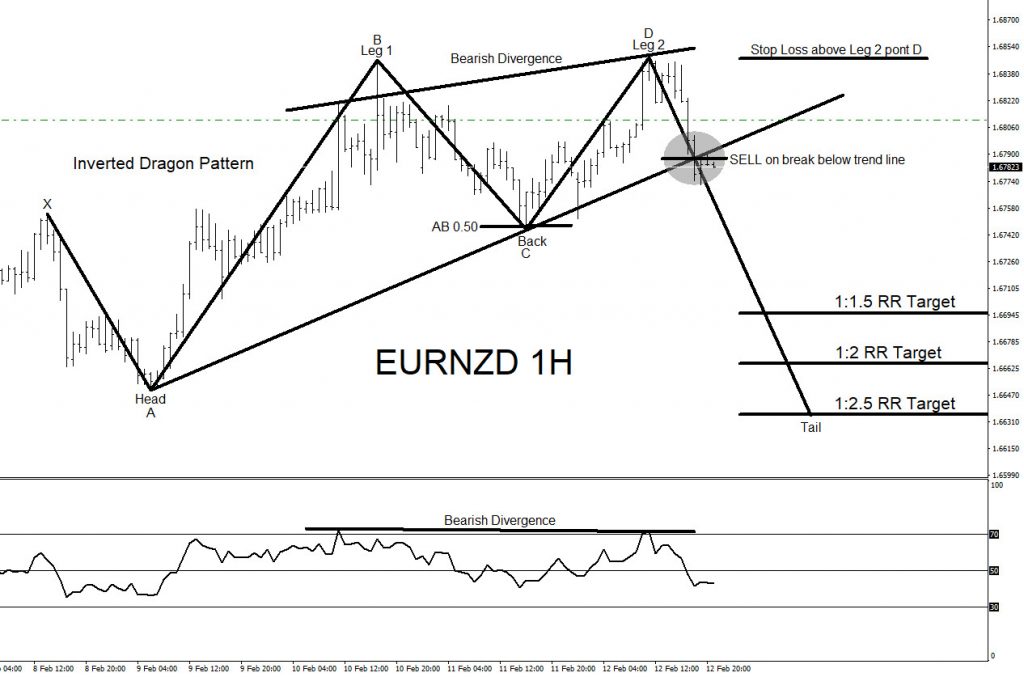

EUR/NZD One-Hour Chart For Feb. 12, 2021 (Pattern 3)

The third bearish market pattern formed after, signaling to traders that the pair would move lower from the break of the A to C trend line. Only a move above the point D would invalidate the market pattern. Targets were based on the sell trend line break and the point D invalidation level.

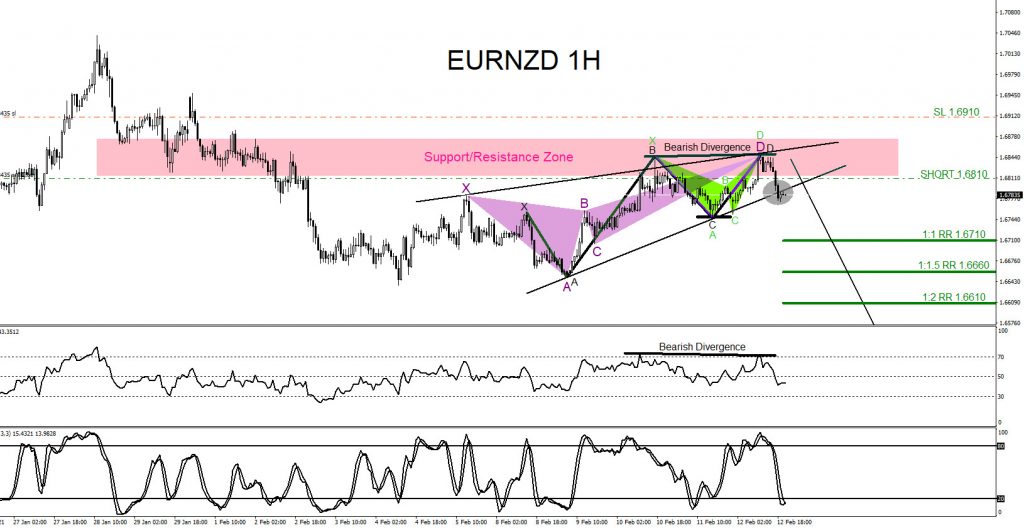

EUR/NZD One-Hour Chart For Feb. 12, 2021 (Support/Resistance Zone & Bearish Divergence)

A bearish wedge breakout pattern formed, and bearish market patterns 1 (purple) & 2 (green) triggered sell signals in the support/resistance zone. Also, a bearish divergence formed in the same support/resistance zone, signaling to traders that the zone was a good selling area.

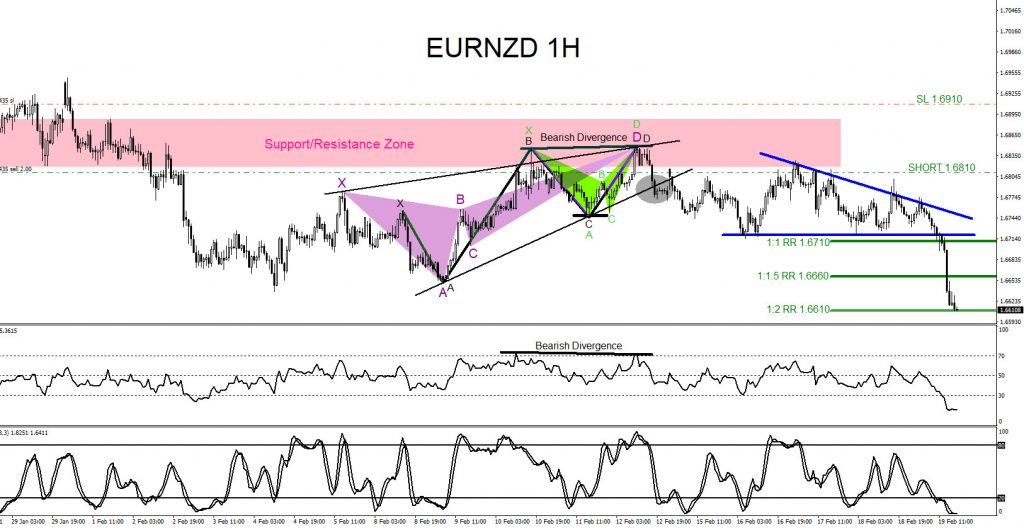

EUR/NZD One-Hour Chart For Feb. 19, 2021 (Pattern 4)

A bearish descending triangle pattern 4 (blue) formed and the price broke below the triangle, signaling to traders once again that more sellers were entering the market. EUR/NZD eventually moved lower and hit my 1:2 RR target at 1.6610 from the 1.6810 sell entry for a +200 pip move.

Like any strategy, there will be times when the approach fails, so proper money/risk management should always be used on every trade.

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more