EUR Price Outlook: Euro Eyes Inflation Data Ahead Of ECB

EURO PRICE OUTLOOK FOCUSED ON INFLATION DATA AS ECB MEETING APPROACHES

- EUR price action will be front and center during Tuesday’s trading session with EU inflation data for December due for release at 10:00 GMT

- The Euro has staged a notable rebound since its October 2019 swing low as Eurozone CPI measures show signs of ticking higher

- Read more on the European Central Bank and how ECB monetary policy can impact the Euro

Expected currency volatility in the Euro is jumping ahead of upcoming Eurozone inflation data, which is set to cross the wires Tuesday, January 07 at 10:00 GMT.

In fact, EUR/USD, EUR/GBP, EUR/JPY, EUR/AUD, EUR/CAD, EUR/NZD and EUR/CHF overnight implied volatility readings were all just clocked above their respective 5-day averages.

This suggests that Euro forex traders will likely pay close attention to Eurozone CPI data on deck seeing that it will likely weigh on monetary policy guidance from the ECB later this month.

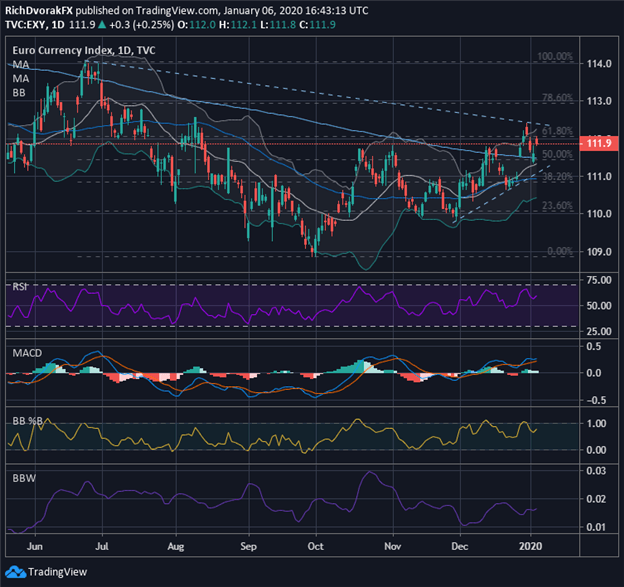

EURO CURRENCY INDEX PRICE CHART: DAILY TIME FRAME (MAY 2019 TO JANUARY 2020)

Chart created by @RichDvorakFX with TradingView

EUR price action has risen roughly 3% on balance since bottoming October last year as measured by performance in the EXY Euro Currency Index – a commonly referenced benchmark of major Euro currency pairs.

One fundamental factor possibly contributing to the recent climb in spot EUR prices could be the rebound in Eurozone inflation indicators since last summer’s lull, which may keep future dovish action from the ECB at bay.

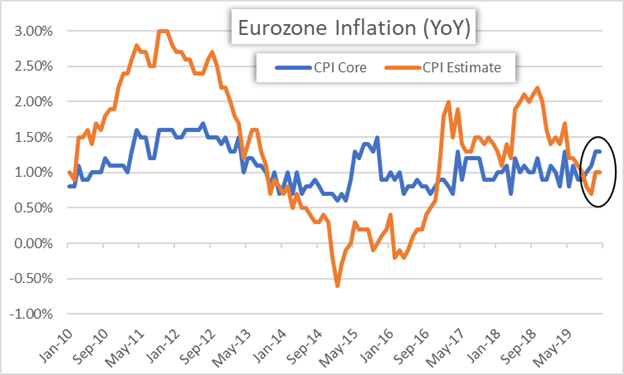

CHART OF EURO-AREA INFLATION (CPI CORE & CPI ESTIMATE)

On that note, the year-over-year core consumer price index for the Eurozone has jumped to 1.30% from a low of 0.80% last May. Similarly, the year-over-year CPI estimate has risen from 0.70% in October to last month’s reading of 1.00%.

That said, further evidence that Euro-area inflation is firming has potential to reiterate this positive tailwind that has helped steer EUR price action higher over recent months.

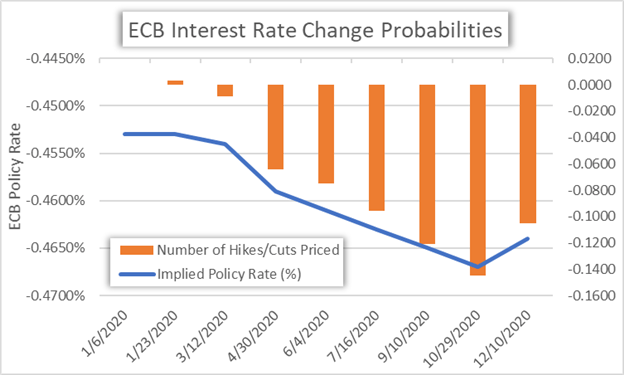

CHART OF ECB INTEREST RATE CHANGE PROBABILITIES

The press statement accompanying the most recent ECB interest rate decision noted how the ECB Governing Council expects to remain accommodative until the central bank sees “the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon.”

Correspondingly, a stronger-than-expected reading on Eurozone inflation figures could cause markets to unwind ECB rate cut expectations. In turn, this would likely be supportive of EUR price action whereas further sluggishness in EU inflation figures could cause the Euro to edge lower.

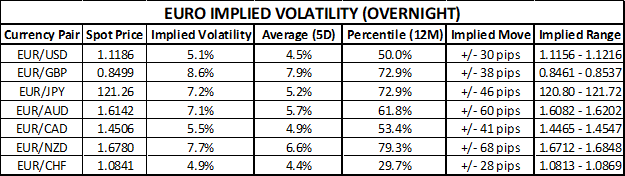

CHART OF EURO IMPLIED VOLATILITY & TRADING RANGES (OVERNIGHT)

EUR/GBP is expected to be the most volatile Euro currency pair during Tuesday’s trading session judging by its overnight implied volatility reading of 8.6%.

EUR/GBP overnight implied volatility of 8.6% compares to its 5-day average reading of 7.9% and ranks in the top 70th percentile of measurements taken over the last 12-months.

Options-implied trading ranges are calculated using 1-standard deviation (i.e. 68% statistical probability price action is contained within the implied trading range over the specified time frame).

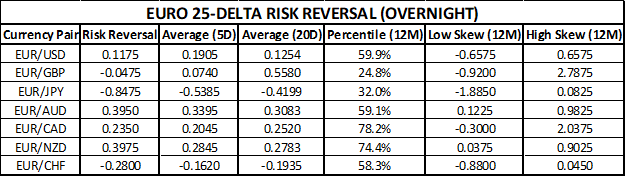

CHART OF EURO RISK REVERSALS (OVERNIGHT)

Euro risk reversals suggest forex options traders have a mixed trading bias toward EUR price action headed into Tuesday’s trading session. The overnight risk reversal for EUR/USD of 0.1175 is lower than its 5-day and 20-day average readings of 0.1905 and 0.1254 respectively, which implies a fading bullish bias.

A risk reversal reading above zero indicates that the demand for call option volatility (upside protection) exceeds that of put option volatility (downside protection). This information can be compared to retail forex trader positioning data detailed in the IG Client Sentiment Report, which reveals that 44.02% of traders are net-long and results in a short-to-long ratio of -1.27 to 1.

Disclosure: Take a look at this insight on how to trade the