ECB Keeps Policy Unchanged, Renews Pledge For Faster Bond Buying

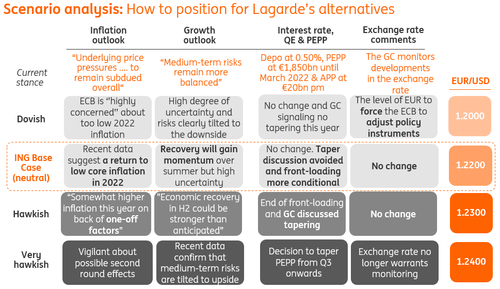

As previewed this morning, after lots of noise, the ECB ended up keeping its key policy unchanged and continues to see PEPP purchases "to continue at significantly higher pace" for at least the current quarter, meaning that the ECB's Dovish policies remain in place for summer with bond-buying to continue at a "significantly higher" pace in 3Q and ahead of the Sep strategy review.

The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25%, and -0.50% respectively. The Governing Council will continue to conduct net asset purchases under the pandemic emergency purchase program with a total envelope of EU1.85t until at least the end of March 2022.

The key sentence: “Based on a joint assessment of financing conditions and the inflation outlook, the Governing Council expects net purchases under the PEPP over the coming quarter to continue to be conducted at a significantly higher pace than during the first months of the year,” the European Central Bank says in a statement. The word "coming" is the only change to the April statement, replacing "current."

Additionally, bond-buying under the older APP program will continue at a monthly pace of EU20b for as long as necessary

Next up: ECB President Christine Lagarde speaks at 2:30 p.m. in Frankfurt when ECB watchers should expect a cautious message and emphasis on avoiding a tightening of financial conditions at a presser. Inflation forecasts may be notable.

As a reminder for those curious how to trade today's announcement, ING summarized it best:

Here is the full statement from today's meeting

At today’s meeting, the Governing Council decided to confirm its very accommodative monetary policy stance:

The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.50% respectively. The Governing Council expects the key ECB interest rates to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics.

The Governing Council will continue to conduct net asset purchases under the pandemic emergency purchase programme (PEPP) with a total envelope of €1,850 billion until at least the end of March 2022 and, in any case, until it judges that the coronavirus crisis phase is over. Based on a joint assessment of financing conditions and the inflation outlook, the Governing Council expects net purchases under the PEPP over the coming quarter to continue to be conducted at a significantly higher pace than during the first months of the year.

The Governing Council will purchase flexibly according to market conditions and with a view to preventing a tightening of financing conditions that is inconsistent with countering the downward impact of the pandemic on the projected path of inflation. In addition, the flexibility of purchases over time, across asset classes and among jurisdictions will continue to support the smooth transmission of monetary policy. If favourable financing conditions can be maintained with asset purchase flows that do not exhaust the envelope over the net purchase horizon of the PEPP, the envelope need not be used in full. Equally, the envelope can be recalibrated if required to maintain favourable financing conditions to help counter the negative pandemic shock to the path of inflation.

The Governing Council will continue to reinvest the principal payments from maturing securities purchased under the PEPP until at least the end of 2023. In any case, the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance.

Net purchases under the asset purchase programme (APP) will continue at a monthly pace of €20 billion. The Governing Council continues to expect monthly net asset purchases under the APP to run for as long as necessary to reinforce the accommodative impact of its policy rates, and to end shortly before it starts raising the key ECB interest rates.

The Governing Council also intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation.

Finally, the Governing Council will continue to provide ample liquidity through its refinancing operations. The funding obtained through the third series of targeted longer-term refinancing operations (TLTRO III) plays a crucial role in supporting bank lending to firms and households.

The Governing Council stands ready to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner, in line with its commitment to symmetry.

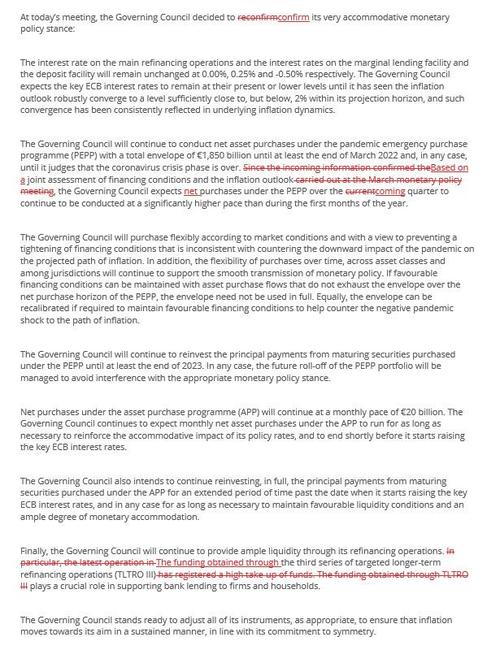

If the above statement seems familiar, it's because it is: as shown in the redline comparison below, there are virtually no changes from the April statement.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more