Downside Risk For CAD Ahead Of BoC Meeting

The Bank of Canada meets tomorrow, and we expect no change in the monetary stance (in line with consensus). However, we suspect markets have too aggressively priced out BoC easing and the balance of risks for CAD appears tilted to the downside.

Rate expectations ignored bad data

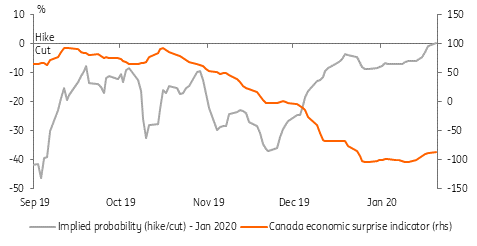

The Bank of Canada will announce monetary policy tomorrow and markets are widely expecting no changes in the policy rate. Investor sentiment around the prospect of BoC easing has shifted significantly in the past few months. The figure below shows the historical OIS-implied probability of a rate change at this January meeting: markets have sharply scaled down their easing expectations, starting from mid-November.

While this dynamic is in line with an improvement in the external backdrop (US-China trade talks and, eventually, the “Phase One” deal), markets have substantially ignored - if we only look at the OIS pricing - developments in the domestic dataflow. In December the economic surprise indicator actually touched its lowest levels since 2009.

Easing expectations dropped, despite grim data

(Click on image to enlarge)

Source: Bloomberg, ING

MPR projections may be revised down

The slump in employment seen in the November jobs report – although partly recovered in December - was not the only stain on the Canadian economic outlook recently. GDP rose at a modest 1.3% in 3Q19 and fell in October, retail sales dropped, and housing activity slowed (building permits fell for six of the past ten months).

We suspect that a downward revision to the GDP forecasts published in the MPR tomorrow may be on the cards. With any significant change in the monetary policy stance unlikely for now, those projections have the potential to determine most of the market reaction.

CAD faces downside risk

Looking at the implication for CAD, the market’s strong repricing of rate cut expectations puts the bar for a hawkish surprise very high. The BoC has made the strong economic backdrop the basis of its reluctance to follow the global easing trend and investors' unwillingness to embed poor data into their rate expectations leads us to believe there is a mispricing of rate cut probabilities (only 22% for a 1H move) in the next few months.

In turn, we believe the balance of risks for the loonie is tilted to the downside ahead of tomorrow’s rate announcement and that a downward revision in the Bank’s GDP forecasts may prompt markets to bring forward their cut expectations. We continue to have a constructive view on CAD in the longer term and a one-off cut in the next few months would not dent such an advantage. However, our view on the BoC makes us believe USD/CAD will struggle to consistently trade below 1.30 in the near term, also on the back of an uninspiring oil outlook.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more