Don't Be So Negative

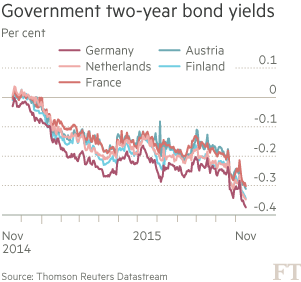

Germany just sold two-year government bonds at a -0.38% yield.

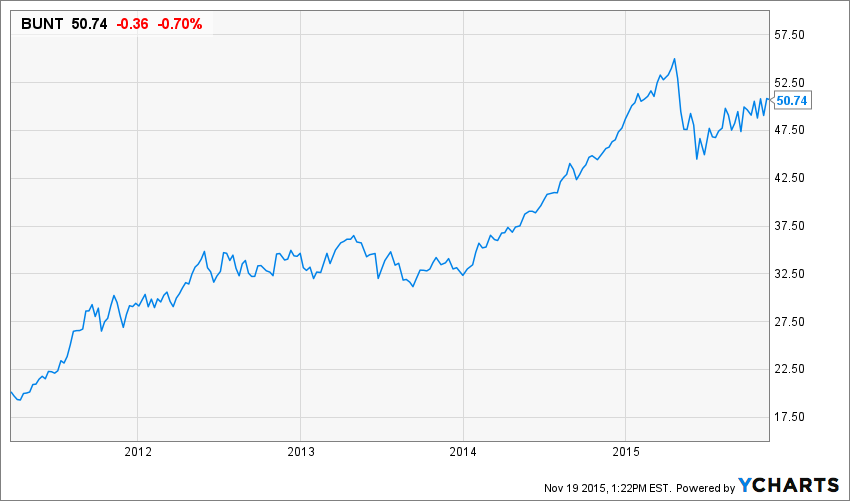

This might sound crazy and one might be tempted to short such bonds directly or via the DB 3x German Bund Futures ETN (NYSEARCA:BUNT).

That being said, Germans are thought to be good credit risks and may be worth the negative yield. If these bonds are attractive to you, I have an even better deal to offer.

I am of German extract and am a mighty good credit risk myself. I have never failed to pay back a debt (which is easy as I have rarely owed one). So, here is my offer to the German bond buying public: I would like to offer a deal that is twice as good: I will charge you a half-priced -0.19% yield on a German(ish) bond. If you would like to offer me float in convenient increments, I will pay you this attractive yield, which will save you $1.9 million on every billion that you invest in my Germanish bond over the similar German bond. This is twice as good an idea as lending at -0.38%.

Disclosure: more