Continued Progress, Promise With Oryzon's Pipeline

Last week, Oryzon Genomics (MADX: ORY) reported financial results and provided a corporate update following the end of the first quarter 2017. The company made a number of advancements during the first quarter, including successfully completing a Phase 1/2a clinical trial with ORY-1001 in acute leukemia. Preliminary data was presented at the American Society of Hematology (ASH) meeting in December 2016. With the final data now analyzed, Oryzon has passed off future development of ORY-1001 to commercial partner, Roche.

Oryzon also presented preliminary Phase 1 data from ORY-2001 at the 13th International Conference on Alzheimer's and Parkinson's Disease. The positive safety and pharmacologic data, along with confirmed proof-of-concept, positions Oryzon to move into Phase 2 studies later this year. Finally, pre-IND work on ORY-3001 continues, with the goal to file later in 2017.

Oryzon also raised €18 million in cash during the first quarter through a private placement with U.S. and European investors. As a result, the company exited the quarter with $29.8 million in cash and marketable securities. The solid cash position is sufficient to fund Oryzon for the foreseeable future. Below is a detailed update on the pipeline for investors.

Quick Review of the Financials

On May 9, 2017, Oryzon reported financial results for the first quarter 2017. Total collaborative revenue for the quarter was $0.02 million. Revenue is derived from collaborative research work with Roche on ORY-1001, deferred recognition of a previous upfront payment from Roche for ORY-1001 in 2014, and non-dilutive research grants that support work on ORY-2001.

Research grants have been a nice source of cash for the company. In December 2016, Oryzon announced a new grant in the form of a loan from the Ministry of Economy and Competitiveness, Government of Spain and FEDER Funds from the European Union and included under the RETOS Collaboration 2016 program. Oryzon will receive approximately $0.8 million through multiyear disbursements for further development of its epigenetic inhibitors against inflammatory indications.

In April 2017, the company announced another grant from the Alzheimer's Drug Discovery Foundation (ADDF) of $0.3 million. The grant will help fund the clinical development of a companion market for the treatment of AD with Oryzon's dual LSD1/MAO-B inhibitor, ORY-2001. ADDF is also a shareholder in Oryzon, owning just under 1% of the common stock.

Net loss for the quarter totaled $1.4 million, driven by $1.6 million in R&D and $1.0 million in general and administrative costs. Oryzon continues to invest in its therapeutic pipeline, having recently reported positive data on the multiple ascending dose part of the ORY-2001 Phase 1 study and nominated ORY-3001 for IND-enabling studies in non-oncological conditions. Nevertheless, the solid cash position of $29.2 million, recently strengthened by the €18.2 million private placement, is sufficient to fund operations well into 2018. The private placement took place at €3.20 per share; this is roughly where the shares are trading today (€3.30).

Pipeline Update - RG6016 (formerly ORY-1001)

Roche is now solely responsible for the development of ORY-1001 (now called RG6016). I think Oryzon did a fantastic job in stewarding development of ORY-1001, the company's potent and highly selective LSD1 inhibitor, from preclinical studies through the Phase 1/2a program. The Phase 1/2a data presented at the ASH demonstrate excellent safety and tolerability, along with initial signs of therapeutic effect in acute leukemia.

For example, in vivo blast differentiation (including differentiation syndrome) occurred in four of six (67%) subjects with MLL fusion gene. Falling bone marrow blasts was observed in one subject following subsequent cycles. Blast cells cleared from blood in another subject that achieved stable disease. In subjects with M6/AML, all achieved stable disease (n=4). Results in other subjects (n=4) with MLL were mixed, with one achieving differentiation and another showing only residual skin disease, whereas one saw progressive disease and another was unevaluable (withdrew).

(Click on image to enlarge)

- See my full update >> Phase 1 Data At ASH In AL Looks Good For Oryzon

Beyond AML, Roche believes that RG6016 has utility in solid tumors. In January 2017, Oryzon announced that Roche commenced patient dosing in a Phase 1 study in patients with SCLC. The Phase 1, open-label, multicenter study is designed to assess the safety and tolerability of RG6016 in participants with relapsed extensive disease SCLC. This dose escalation and expansion study plans to determine the maximum tolerated dose and/or optimal biological dose as a recommended Phase 2 dose for RG6016, based on the safety, tolerability, pharmacokinetic and pharmacodynamic profiles observed after oral administration of the drug. Target enrollment is 70 subjects and will take place in the U.S., Canada, Denmark, France, and Spain. Roche has sole responsibility for this program.

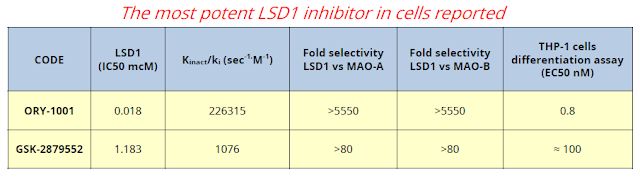

For reference, GlaxoSmithKline progressed a similar LSD1 inhibitor into Phase 1 clinical studies last year. Despite being several months behind in development, RG6016 looks far more potent and offers superior pk to Glaxo's GSK2879552.

(Click on image to enlarge)

The fact that ORY-1001 is now being called RG6016 is a clear sign that progress has been made over the past year. Roche is now in charge of future clinical development, which currently entails two clinical trials, one in leukemia and another in small cell lung cancer (SCLC). Oryzon has the potential to earn in excess of $500 million in development and commercial milestone, along with tiered royalties up to the mid-teens on sales. RG6016 targets potential indications with sales in the billions of dollars; and, with Roche now in full control of the clinical development program, it will be exciting to see where they take the drug in the coming years.

Pipeline Update - ORY-2001

Oryzon’s second drug candidate is ORY-2001, a potent and selective, orally available, small molecule inhibitor of LSD1-monoamine oxidase-B (MAO-B). LSD1 is a key component of the LSD1-REST- CoREST-HDAC1/2 repressor complex involved mainly in controlling developmental programs and modulating neuronal morphology in the CNS. This mechanism is believed to be an important marker of disease status and progression in many neurodegenerative diseases. Preclinical data suggest that ORY-2001 improves cognition, with positive implications for diseases such as Alzheimer’s, Parkinson's, and Huntington’s disease.

Oryzon recently completed a Phase 1 study for ORY-2001 in April 2017. The randomized, double-blind, placebo-controlled single and multiple ascending dose program was designed to investigate the safety and pk/pd of oral ORY-2001 in healthy subjects as well as an elderly population. Preliminary top-line data were presented at the 13th International Conference on Alzheimer's and Parkinson's Disease in Vienna, Austria on March 31, 2017.

Results show that orally administered ORY-2001 is well tolerated and does not provoke clinically significant changes in laboratory tests, vital signs, ECGs, physical findings, or relevant adverse events. The trial was originally designed to dose five cohorts in the multiple ascending dose phase; however, as the maximum tolerated dose (MTD) was not reached, management expanded the study to include an additional cohort of volunteers to be administered at a higher dose, as well as an additional cohort to determine the level of the drug in cerebrospinal fluid and to confirm that ORY-2001 passes the human blood-brain barrier. It's a nice expansion of the study and positions Oryzon to file the IND/CTA for Phase 2 studies during the second half of 2017 and move into treatment of patients with Alzheimer's disease.

(Click on image to enlarge)

Oryzon owns full rights to the drug; thus, the Phase 2 study could represent a significant valuation inflection for the company if successful. Alzheimer’s disease is obviously an enormous market, with approximately 5.4 million Americans affected today. The number is expected to rise to 7.1 million in the U.S. by 2025 according to Alz.org. Alzheimer Europe estimates 8.7 million Europeans are affected by Alzheimer’s disease. Another 10 to 12 million people in Asia are also suspected to suffer from Alzheimer’s. Little success has been accomplished with respect to new Alzheimer’s treatments over the past decade. An epigenomic approach to Alzheimer’s, as well as Huntington’s disease and Parkinson’s disease, represents a novel and exciting new approach to these difficult to treat diseases.

(Click on image to enlarge)

The potential for ORY-2001 even extends to other diseases such as Multiple Sclerosis (MS) and Experimental Autoimmune Encephalomyelitis (EAE). In September 2016, Oryzon presented preclinical mouse data at ECTRIMS in London that showed treatment with ORY-2001 inhibited the development of EAE and reduced disease incidence and severity measured by daily clinical scores compared to control mice. In fact, 30% of ORY-2001 treated mice almost completely recovered after 40 days; and, the protective effect of ORY-2001 was maintained for a long period of time after cessation of treatment.

(Click on image to enlarge)

Additional preclinical data on ORY-2001 in MS came at ACTRIMS-2017 in Orlando, Florida in February 2017. The new data build upon what was presented at ECTRIMS last September in London. A poster entitled "ORY-2001 Reduces Lymphocyte Egress and Demyelination in Experimental Autoimmune Encephalomyelitis and Highlights the Epigenetic Axis in Multiple Sclerosis" showed that ORY-2001 provides an effective and long lasting protection in terms of survival and mobility in a mouse model of induced autoimmune encephalomyelitis, even at the lowest dose of 0.05 mg/kg tested.

Histopathological analysis showed a strong reduction of infiltration of inflammatory cells and demyelination plaques in the lumbar region of the spinal cord and its total disappearance in the cervical region in animals treated with 0.5 mg/kg of ORY-2001 compared to vehicle-treated animals. In addition, treatment with ORY-2001 resulted in a significant increase in the number of immune cells retained in the spleen and lymph nodes of treated animals, suggesting a reduced egress of lymphocytes from immune tissues.

ORY-2001 also caused a reduction in the levels of various pro-inflammatory cytokines such as IL-6 and IL-1beta and of chemokines such as IP-10 and MCP-1, which are involved in the recruitment of the inflammatory and encephalitogenic cells known as Th1 into the spinal cord leading to the destruction of motor neurons. Importantly, the company observed no negative hematological or lymphocytic effects, or gastrointestinal toxicity, which are some of the various adverse effects common in these approved drugs.

Nevertheless, it is worth mentioning that several experimental histone deacetylases inhibitors have been linked to beneficial memory effects in various Alzheimer's and other dementia models. For example, work by Hait NC, et al., 2014 shows that Novartis AG's Gilenya® (fingolimod) used at high doses improves memory in mouse models. This is consistent with Oryzon’s data showing that ORY-2001 enhances memory in Alzheimer's and produces a potent and lasting protection in the EAE-MS model and hints at epigenetic mechanisms underlying different phenomena in the brain, including memory function and neuroinflammatory pathways.

Pipeline Update - ORY-3001

In July 2016, Oryzon announced that it had designated its next drug, ORY-3001, for preclinical development. ORY-3001 is a first-in-class specific Lysine Specific Demethylase 1 (LSD1) inhibitor for the treatment of, yet undisclosed, non-oncological orphan disease. ORY-3001 is a potent and selective compound with good pharmacological properties, orally bioavailable, with optimal pk, safety, and selectivity profile. After successful completion of regulatory toxicology studies, the company expects to file the IND/CTA in 2017 and move ORY-3001 into clinical Phase 1/2a studies later this year.

(Click on image to enlarge)

Conclusion

Oryzon is focused on developing epigenetic-based therapies and personalized drugs from its proprietary platform technology. Over the past several months, management has made significant progress moving the pipeline forward. Roche has taken over the development of ORY-1001 - now called RG6016. RG6016 is progressing in two clinical trials for acute leukemia and small cell lung cancer. Oryzon has the potential to earn over $500 million in milestones plus mid-teens royalties on commercial sales of RG6016 at Roche.

The second compound is ORY-2001, under early-stage clinical investigation for the treatment of Alzheimer's disease and other CNS indications. Preclinical data show encouraging effect in mouse models of both AD and MS/EAE. The Phase 1 data at the 13th International Conference on Alzheimer's and Parkinson's Disease in Vienna, Austria confirm the drugs safety and pk effect. A third compound, ORY-3001, is nearing clinical studies. Management has stated this candidate will target a non-oncologic orphan indication.

The company currently trades on the Madrid Stock Exchange (MADX: ORY) with a market capitalization of approximately €107 million ($117 million). The shares are up nicely over the past six months, driven by a nice response to the Phase 1/2a clinical data on RG6016 presented at ASH in December 2016. Positive data on ORY-2001 and the initial clinical work on ORY-3001 are nice pending catalysts for later in 2017 (see below).

(Click on image to enlarge)

Peer-valuation analysis suggests Oryzon should be worth $250 million in value based on a Phase 2 asset in oncology and Phase 1 asset in neurodegenerative diseases. This would essentially be a doubling of the shares. I have yet to factor in any value for ORY-3001, which represents further upside to the story in 2017.

Disclosure:Please see important information about BioNap and our financial relationship with companies mentioned above our more