Christmas Comes Early For BMW And Daimler

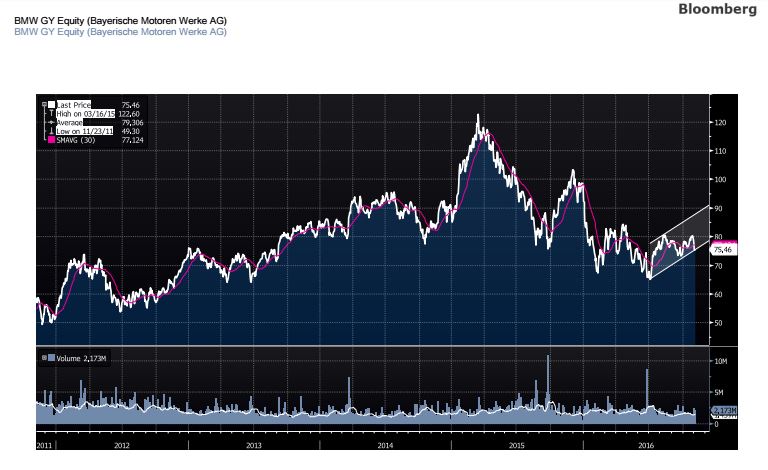

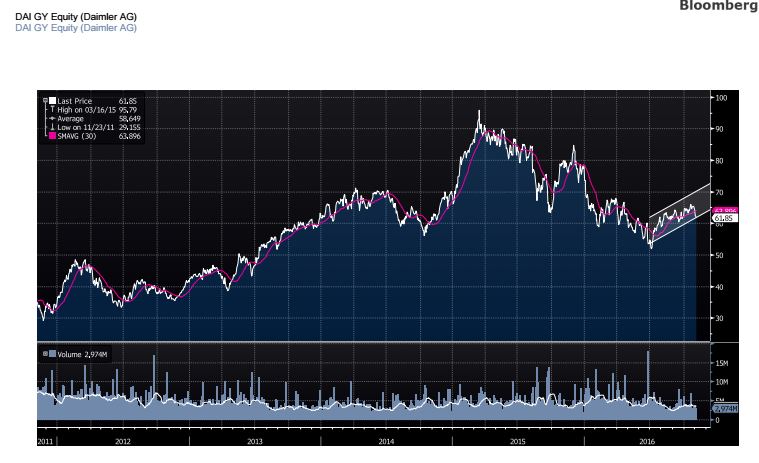

Historically, BMW (BMWYY) and DAI (DDAIF) have been pro-cyclically moving with the DAX Index business cycles. Last year, both stocks have been closer to the 52-week high. They were also on the uptrend which was preceded by two valleys (52-week lows). Currently, stock prices are near slumping near a bottom of the 52-week high/low, which is a periodic movement. However, such low prices signal an upward trajectory. Nonetheless, if each stock were to reach a new low, that would not be surprising, since any peak is preceded by three valleys. The 30-day simple moving average over 5 years has been leading the business cycle and is significantly close to the stock price. This is a good indicator especially since both firms are pro-cyclical with the DAX.

5 Year Chart with Simple Moving Average (30 days)

BMW

DAI

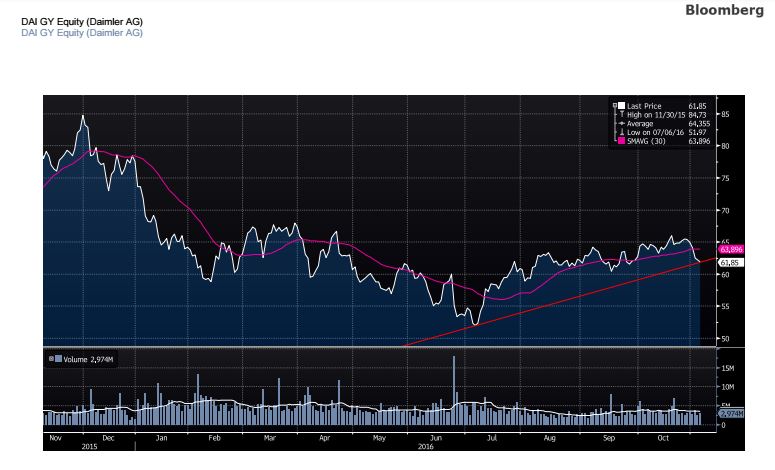

According to the one-year chart, the price is in the middle, and it is likely that they will gain momentum and achieve a new high by December 2016 as manufacturers try to get rid of old stock. This will increase revenue whereby, increasing EPS.

1 Year Chart with Simple Moving Average (30 days)

BMW

DAI

BMW has been consistently meeting analyst expectations on EPS since 2012. Whereas, DAI has beat expectations for the most part, with the exception of last year (2015). EPS expectations for the fiscal year ending 12/2016 are realistic, achievable and projected to meet expectations at the least. Generally, Q2 has had highest EPS, which also signals a positive movement.

Quarterly EPS figures

BMW – expected EPS €9.97 (12/2016)

DAI – expected EPS €8.20 (12/2016)

Considering that DAI has a lower debt-to-asset ratio (DAI 38.3%; BMW 50.6%) as well as a better asset turnover ratio (DAI 0.7; BMW 0.5), they are more price stable; especially, since DAI have a commercial vehicle revenue stream (26.53% of their total revenue) that is not present in the BMW business model. Moreover, DAI has a smaller price fluctuation gap between 52-week high/low. Furthermore, DAIs Return on Investment is higher than BMW, indicating a higher operating efficiency. All in all, DAI is a more stable investment option in the long run.

Despite austerity measures of the German economy, cutbacks in consumption, government spending and ultimately Real GDP, exports are anticipated to increase, thus having a positive impact on BMW and DAI, who mainly export vehicles to the rest of the world. Moreover, as interest rates are stable at around zero, this will likely induce spending and consumption.

All Sources: Bloomberg Terminal

Disclosure: None.

Nice article @[Abdullah Jouejati](user:32712), looks like your prediction was correct and $BMWYY went up.

https://www.bloomberg.com/quote/BMW:GR

$DAI has also increased from 61.85 (11/2016) to 68.72 (02/2017). Here we can see that the growth is more stable.

Since this article was published, $BMW has witnessed an increase in stock price from 75.46 (11/2016) to 83.90 (02/2014).