Chinese Credit Impulse Is Slowing... And That Is Bad News For Global Economy

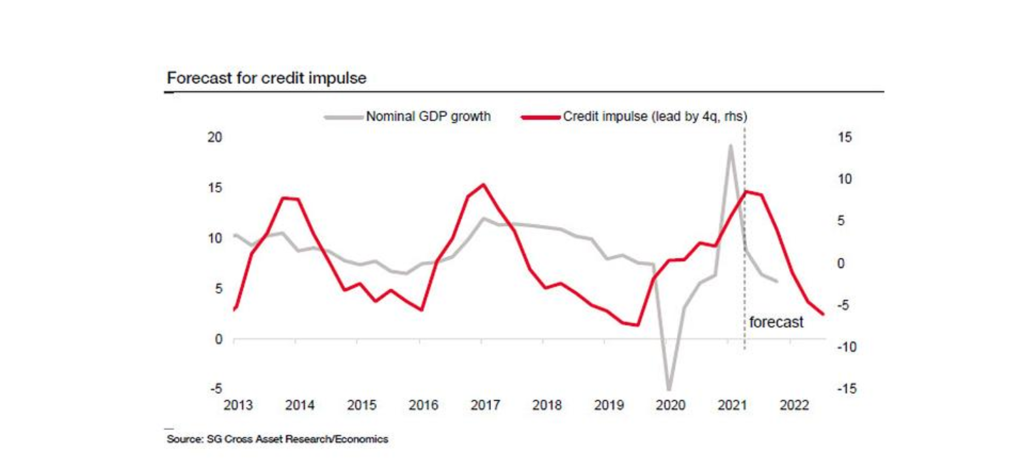

Soc Gen says that China’s credit, and indeed fiscal impulse, is peaking and about to turn down. Even if the PBoC does not embark on an aggressive tightening cycle, “the combination of a smaller fiscal deficit, these targeted deleveraging programmes, and potentially more credit events will likely already be enough to exert material downward pressure on credit growth in 2021”. Given all the factors above, SocGen expects the credit impulse to start moving dramatically lower at the turn of the year, from over +8% to around -7% end-2021, about as low as that seen in late 2018 when global stock markets suffered a major wobble. his projection assumes that credit growth will decelerate slightly slower than during the 2017-18 deleveraging campaign, from 13.5% y/y currently to barely above 10% y/y end-2021. Then, as nominal GDP growth is expected to rebound strongly in YoY terms, partly thanks to base effects, the credit impulse will likely see a steeper decline than credit growth next year. According to Macro strategy …In the year through Q2, China only managed to get 9.2 cents of growth for each additional yuan of debt, and in the year through December 2019, before the crisis, 27.6 cents. This meant that 72.4 cents of the credit was just going into servicing and sustaining imbalances, and therefore, with only 27.6 cents of that credit going into growth, any slowdown in credit growth would have a much more material impact on economic growth – (the residual that is not going into servicing imbalances) – than historically.

and Promptly after this data, JP Morgan just closed its bullish position on Base Metals

As per CNBC

- JPMorgan has turned “neutral” on base metals, which include copper, aluminum, nickel, and zinc, and now forecasts that copper will deteriorate from an average of $7,700 per ton in the first quarter of 2021 down to around $6,500 per ton average in the fourth quarter.

- “Our analysis shows that a slowing in Chinese credit over the course of 2021 will turn into a drag on base metals prices that will likely outweigh continued recovery in the rest of the world,” JPMorgan commodities analysts said in a quarterly outlook report.

Conclusion

Chinese credit impulse historically has been positively correlated with Base metal prices and any slowdown in that data will negatively effect the Base metals and support the general slowdown in the Chinese Economy.