China’s Trade Outlook Is Souring And Its Economy Is Weakening

“So far, the US has imposed tariffs on more than $360bn of Chinese goods, and China has retaliated with tariffs on more than $110bn of US products. Washington delivered three rounds of tariffs last year, and a fourth one in September. The latest round targeted Chinese imports, from meat to musical instruments, with a 15% duty. Beijing has hit back with tariffs ranging from 5% to 25% on US goods. Its latest tariff strike included a 5% levy on US crude oil, the first time fuel has been hit in the trade battle.” (BBC News, September 2019)

There is considerable confusion around with respect to the impact the trade war is having on China’s actual trade situation.

As one of the following charts illustrates, China’s overall surplus in foreign trade has declined from about $600 billion (US) to $400 billion over the past three years.

Some of the 50% decline in the trade surplus may be due to the reality that the global economy has started to slow, but clearly the trade war with the US has also played a significant part.

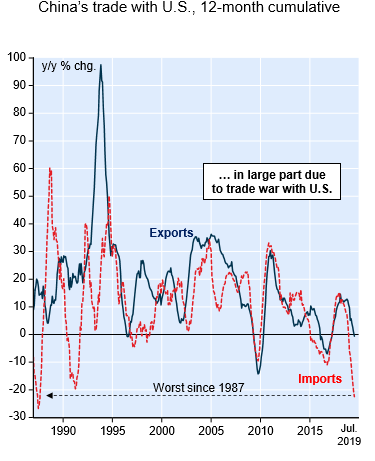

In straight bilateral terms, the trade war with the US is clearly having a huge effect on China’s economy. As the chart illustrates, China’s imports from the US and its exports to that country have fallen sharply.

Up until around 2012, China’s imports and exports to the US were both growing in the 20% annual range. This year imports from the US have plunged about 20%, while exports to the US rose 3.3% over the year as of July. Nonetheless, China’s exports to that country have largely stagnated at around US$2.5 trillion level.

The Chinese economy, the second-largest in the world, is growing at a slower pace amid its escalating trade war with the US.

The US-China trade relationship is thought to support about 2.6 million jobs in the US across a range of industries, including many jobs that Chinese companies have created directly in America.

The escalating trade war between the U.S. and China is rippling through the global economy, hurting confidence among U.S. small businesses, crimping trade among industrial giants in Asia and hitting export-oriented factories in Europe.

Indeed, what has started as a tariff battle between the two countries has spilled over into a technology and currency skirmish as well.

The latest published data indicates that China’s economy only grew at a 6.2% annual rate in the second quarter from a year ago, its slowest growth rate in at least 27 years.

Beijing has recently taken a series of measures to offset the negative effects of its tariff battle with the US. Monetary policy has eased in China and the country introduced some new fiscal measures including tax cuts to boost the economy.

As well, Beijing has supported the depreciation of the yuan, which is clearly helping China’s exports not just to the U.S. but to other countries as well.

When the yuan recently weakened below the important threshold of 7 per U.S. dollar, the Trump Administration labeled China a currency manipulator.