China’s Global Slump Draws Closer

By the time things got really bad, China’s economy had already been slowing for a long time. The currency spun out of control in August 2015, and then by November, the Chinese central bank was in desperation mode. The PBOC had begun to peg SHIBOR because despite so much monetary “stimulus” in rate cuts and lower RRR banks were hoarding RMB liquidity.

Late 2015 was not a fun time in China. The idea of economic rebalancing had been introduced years before largely to try and suggest the permanent industrial/manufacturing slowdown was a choice. It wasn’t. In the middle of 2014, the service/consumer economy started weakening, too.

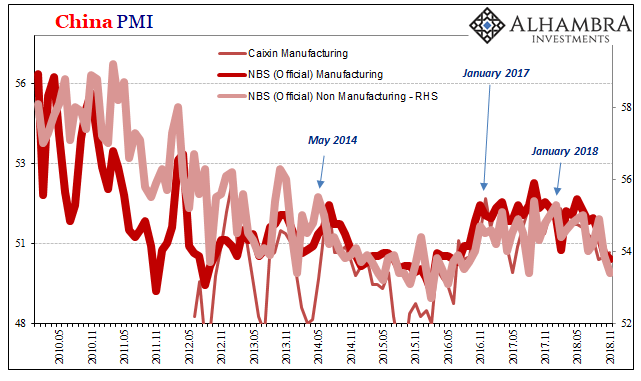

According to China’s National Bureau of Statistics (NBS), the country’s official Non-manufacturing Purchasing Managers Index stood at 55.5 in May 2014. That wasn’t all that robust, to begin with, a number more like 58 would have been consistent with what China was supposed to produce in every economic sector.

By those darkening days toward the end of 2015, however, rather than jump to rescue the Chinese economy (and therefore the global economy) the Non-manufacturing PMI had dropped to 53.1. And it wasn’t an outlier, either, a low level consistent with so many other alarming statistics indicating an immense, uniform global drag.

The NBS reported last week that the same service sector PMI in November 2018 fell to 53.4, or nearly the same as three Novembers before. It was the lowest level since before Reflation #3 really got going in later 2016. China’s economy isn’t crashing, but it is certainly staring into the face of another downturn, the rolling over part of the process nearly complete.

The Manufacturing PMI was right at 50.0 in November, also the lowest in several years. Sitting on the so-called divide between growth and contraction, it’s never so neat and clean, the direction is likewise perfectly clear.

This is not fallout from the trade wars being waged primarily with the United States. By the count and track of the PMI’s, China’s economic problems began long before anyone mentioned the words retaliatory tariff. Both Chinese sentiment indications peaked all the way back in January 2017 at around the same low levels as the last cycle in 2014.

The cycle merely repeats where China now joins the rest of the world under a confoundingly low growth ceiling. Nowhere is this more evident than in that country’s industrial base, which despite so much targeted rhetoric remains the economy’s central axis.

Industrial revenues (and profits) largely determine the overall track of China GDP (nominal rather than the overly managed real GDP numbers). The NBS also reported last week that activity in the sector continued to slow in October 2018 (one month further in arrears than the PMI data).

Accumulated revenue growth, that is the increase in revenue during the January to October period over the same months in 2017, was just 9.3% in the latest month. That’s the weakest rate since December 2016. Profit growth was 13.6% on an accumulated basis, edging closer to single digits.

Chinese industry never recovered from 2014-16, that last burst of “rising dollar” eurodollar disruption that closed off any chance for global recovery. Even during the “best” parts in early 2017, it was never all that good, especially for private industry.

This more than anything explains the Chinese predicament. The economy was walloped by an enormous deflationary wave and was never able to regain its footing. Not for lack of trying, of course, as authorities threw everything they could at the problem. Immense fiscal “stimulus” in 2016 was aided by more creative monetary measures (Hong Kong) attempting to both stabilize China money internal as well as external (CNY).

Nothing worked because globally synchronized growth was itself nothing more than a fairy tale, a companion narrative to rebalancing. China’s economy, like the global economy, got a little better in 2017 than 2016 but like everything in Economics nowadays it was a meaningless change. There was nowhere near enough momentum for actual recovery to materialize.

As that realization set in especially later in 2017, despite the inflation hysteria in the “booming” economies of the United States and Europe, the whole damn system began to roll over anyway. There is just way too much risk for at best low-grade upturns.

Downturns don’t happen suddenly all at once, they are always a process. China’s economic turn the one before began in the earliest months of 2014 and it wasn’t until 2016 that it experienced the worst.

The same process is merely being repeated. The latest data on China proves that much, and at the same time indicates it is still pretty early on in it. CNY jumped last night on more speculation that the trade wars might abate. Maybe, it won’t matter either way. Trade wars haven’t helped, of course, but in the end, there are much much bigger problems.

Disclaimer: All data and information provided on this site is strictly the author’s opinion and does not constitute any financial, legal or other type of advice. GradMoney, nor Jennifer N. ...

more