China Won’t Bail Out Global Markets This Time Around

I believe there are three important drivers to markets right now. Two long-term and one short-term. These are:

- China is actively trying to restructure its economy and end its incessant leveraging.

- A growing issuance of treasury paper, driven by a widening budget deficit and quantitative tightening, is sucking up global liquidity and creating a “crowding out” effect in other markets.

- Consensus long dollar / long US vs. RoW positioning and sentiment has set the stage for an interim bout of EM outperformance; before another reversal and devastating final sell-off.

We’ve written many times over the last few years about why China is THE most important macro variable this cycle. The reason is in the chart below.

China (orange line) has accounted for the majority of credit creation this cycle. They’ve been the global workhorse by leveraging credit driven demand. As a result, China accounts for over 50% of global GDP growth since the financial crisis.

China is now dead set on ending its super-sized leveraging cycle and transitioning to a more sustainable consumer-driven economy. We know this because President Xi Jingping has told us so as he did here in late 2016.

If we don’t structurally transform the economy and instead just stimulate it to generate short-term growth, then we’re taking our future… If we continue to hesitate and wait, we will not only lose this precious window of opportunity, but we will deplete the resources we’ve built up since the start of the reform era.

Xi finished the above statement by saying the country had until the end of 2020 to make this transition.

Xi’s moves to finally tackle the debt are also clearly showing up in the data. We’ve been writing about it all year, here, here, here, here, here, here, and here.

This is a very big deal that is still largely being ignored by the market. Investors appear to be operating off of the old assumption that Xi and team will stimulate at any moment. But this won’t be the case. It’s very unlikely we’ll see a reversal in policy until the end of 2019, at the earliest. This will give them time to juice the Chinese economy going into the centennial anniversary for the Chinese Communist Party.

Until this happens, we’re going to see a bumpy road ahead for global markets.

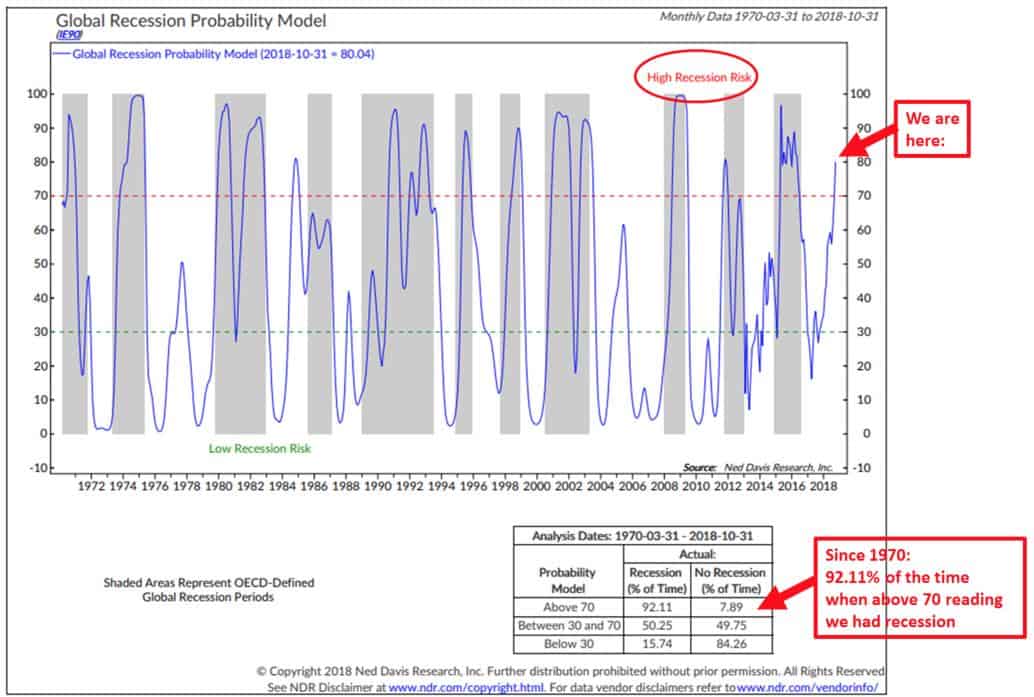

Ned Davis’ Global Recession Probability Model is signaling an 80% probability of a global downturn. As noted on the chart, since 1970 we’ve seen a recession 92.11% of the time there’s been a reading above 70 (chart via CMG Wealth & NDR).

(Click on image to enlarge)

Morgan Stanley’s global Financial Conditions Index is rising and now sits at its highest levels since 2015.

And the Global Manufacturing PMI recently turned negative for the first time since the end of 2015.

Meanwhile, we have strong growth in the US — though it’s likely peaked for the cycle — and near record high equity valuations, combined with rising interest rates.

2019 is going to be an interesting year for markets…

Disclaimer: All statements are solely opinions and are for educational purposes only.