China Shows How To Fight A 21st Century Trade War

Trade wars made the Great Depression great. When countries needed to cooperate, they imposed tariffs. This reduced trade and increased unemployment in each country.

Tariffs are the traditional tool of trade wars. A tariff is a tax one country imposes on another country’s products.

Proponents say tariffs give the country time to develop a capability or to protect a critical industry. Examples includes tariffs on imported steel, a critical industry for national defense.

They might serve that purpose, but other countries often retaliate with their own tariffs. Unless governments break the cycle of tariff and retaliation, a global recession or depression starts.

However, China showed there could be a better way to fight a trade war.

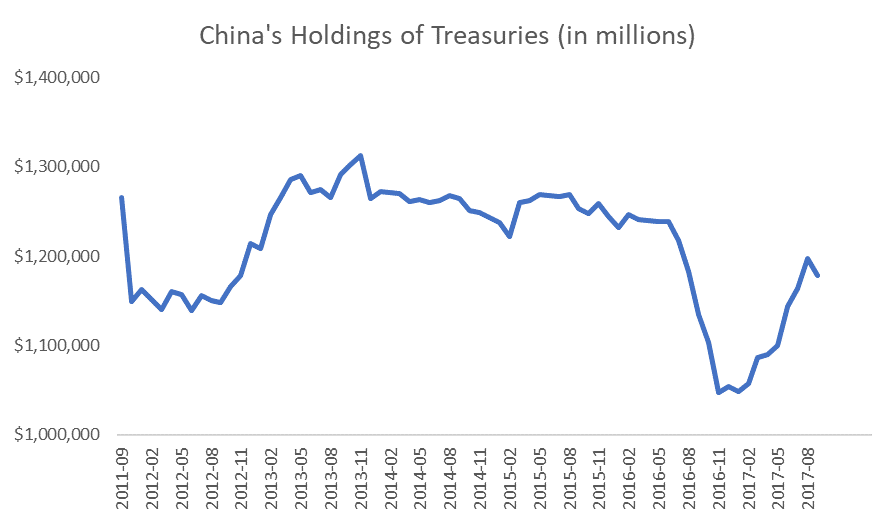

After accumulating $1.2 trillion in Treasury bonds, Bloomberg reported that an unnamed Chinese official hinted the country may stop buying U.S. Treasuries. China is the largest holder of U.S. Treasuries and almost holds as much as all the nations in the European Union combined.

(Source: U.S. Treasury)

Stocks opened lower on the rumor. China holds 7.95% of the Treasury’s outstanding debt. If the country pulled back from buying U.S. debt, the U.S. would face an economic slowdown.

This threat comes as the U.S. needs to sell more Treasuries.

Tax reform is designed to increase the deficit. To finance the deficit, the Treasury Department auctions off bonds. If there is a large buyer absent from auctions, prices fall because there is less demand.

In the bond market, lower prices mean higher interest rates. Combined with the Federal Reserve’s interest rate increases, China’s action could be the trigger for the next recession.

In the current political environment, it seems safe to say the U.S. would retaliate in some way. Then, in a matter of months, a full-blown trade war would be underway.

China’s threat might just be a way to signal that it has more power than we realize. In fact, it’s possible few investors realize China could singlehandedly tank the stock market and make mortgages more expensive, which would hurt the real estate market.

But if China stops buying Treasuries, global chaos is a certainty.

I'm confused, why were tariffs the sole reason that the great depression was great? Can you please elaborate? The link you included had nothing to do with tariffs, but rather was a clip from the Rodney Dangerfield movie "Back to School." And while I enjoyed the humorous blast from the past, I don't see how that is relevant.

While tariffs may have contributed, I would argue that the great depression was far more a direct result of the stock market crashing, following by the bank failures.

I don't believe China will cease buying treasuries, although big buyers will likely cut buying as they see and expect more rate hikes and watch for signs of inflation. It is not increasing oil prices that alone are a concern for inflation watchers. There is increasing demand which is a stronger signal about potential broad based inflation on the horizon.

I agree with you as usual, Moon.