China Launches QE To Jumpstart Economy

One month ago, the South China Morning Post reported that China’s top economic policymakers have been "engaged in heated debate over whether the country’s central bank should directly buy special bonds issued by the finance ministry to help the government’s economic support measures."

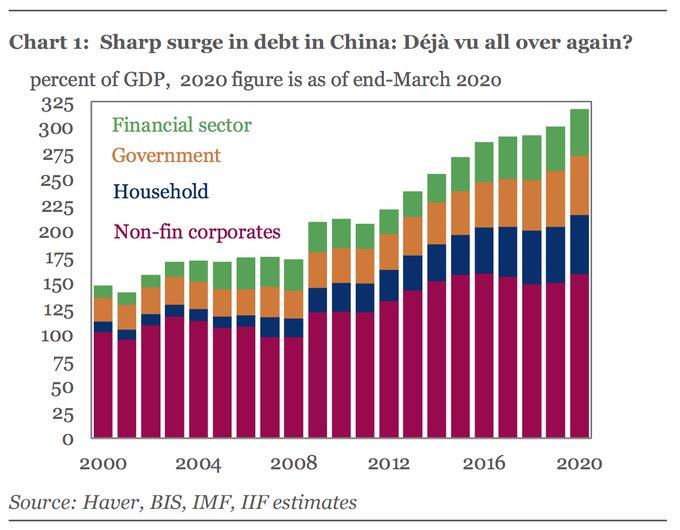

That "heated debate" appears to have ended with fans of money printing winning, because overnight the PBOC announced a new "credit loan program" which essentially amounts to another form of QE-lite (with Chinese characteristics of the Fed's Main Street Lending Program and the Paycheck Protection Program Liquidity Facility), and which will "temporarily" purchase loans made to small businesses from some local banks; it represents Beijing's latest attempt to boost the supply of credit to the real economy without a wholesale rate cut amid fears China's record debt load (some 317% according to the IIF) can no longer sustain shotgun easing.

(Click on image to enlarge)

The central bank's plan will use 400 billion yuan ($56 billion) from its re-lending quota to buy 40% of un-collateralized loans to small and medium-sized firms from qualified local banks, with maturities of at least six months made between Mar. 1 and Dec. 31, 2020.

The newly announced program has elements of both PPP and QE.

First, the PBOC and CBIRC jointly stated that SME loans that are scheduled to mature this year are allowed to be extended through March 31, 2021, as long as borrowers promise to keep employment stable (think of it as a quasi PPP). To incentivize participation, the central bank will use RMB 40bn of its re-lending quota to subsidize banks with 1% of the loan principal. The PBOC stated that around RMB 7 trillion ($1 trillion) of SME loans are eligible for this loan extension program.

In addition, the PBOC announced that it will set up a special purchase vehicle (SPV) and use RMB 400bn of its re-lending quota to purchase SME loans from qualified local banks (similar to what the Fed is doing with PPP-loans issued by participating banks). The funding is available to local banks for one year and the PBOC estimates that this program can increase SME lending by about RMB 1tn.

The purpose of the latest PBOC program is to help free up local banks’ balance sheet and allow them to increase lending to SMEs. As noted above, it shares similarity with the efforts by other central banks around the world to help small businesses and employment during the coronacrisis (e.g., the Main Street Lending Program and the Paycheck Protection Program Liquidity Facility by the Federal Reserve in the US). Similar to the Fed, the PBOC does not take credit risk of the purchased loans and the goal is to provide more liquidity for lending to SMEs. In addition, the type of SME loans targeted here is also relatively narrow in scope: only inclusive loans to small and micro-sized firms are eligible (around RMB 11tn total outstanding) vs. all loans to small and medium-sized firms (RMB 50-60tn total outstanding).

Speaking to Bloomberg, Australia and New Zealand Banking Group economist Xing Zhaopeng said the program "reflects policymakers’ top priority to support SMEs amid the aftershock of Covid-19,” while not willing to expand its balance sheet to flood the market, said "We expect the PBOC will not end the program as it described in the statement. In fact, this starts the QE process to lend cheap funds directly to the real economy."

And confirming that this is precisely QE, the central banks was quick to say it isn't. Speaking at a briefing, PBOC Deputy Governor Pan Gongsheng said the new monetary tools of the central bank are different from QE by "nature and scale", which is what central bankers usually say when they have no qualified arguments.

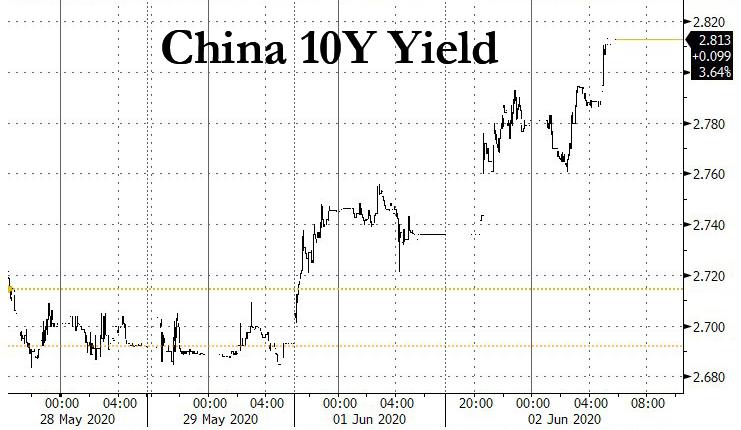

In response, Government bond yields and China interest rate swap (IRS) rates sold off amid market concerns that PBOC will focus even more on targeted lending than broad-based easing, which the market had been expecting to be announced after the conclusion of last month's Congress. The 10-year government bond yield rose 5bp and 5-year IRS rate increased 8bp in the morning of June 2.

(Click on image to enlarge)

Ultimately, the central bank is trying to bring down borrowing costs across the economy to stimulate lackluster demand (as described in "As China PMI Disappoints, Another Major Problem Emerges") and help China rebound from the economic collapse recorded in the first quarter caused by the pandemic. By taking loans to small businesses on to its balance sheet, the PBOC may help lower lenders’ capital requirements and thereby lower the cost of further lending.

As for China's newly launched QE being temporary, Bloomberg's David Qu was quick to pour cold water over that particular optimistic assumption: "We think the quota may expand further in the future, depending on how the economy is recovering from the impact of the coronavirus. The effectiveness of the policy move remains an important consideration - banks may still face constraints in regulatory requirements (such as capital adequacy) and risk-aversion sentiment."

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more