China Exports Jump By Most Ever As Global Economy Redlines

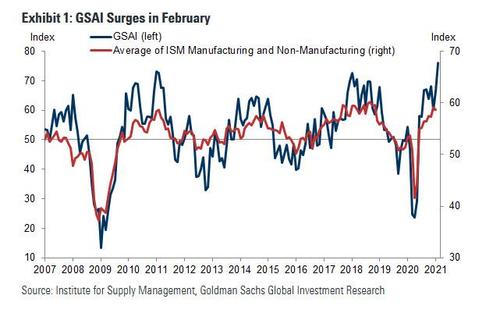

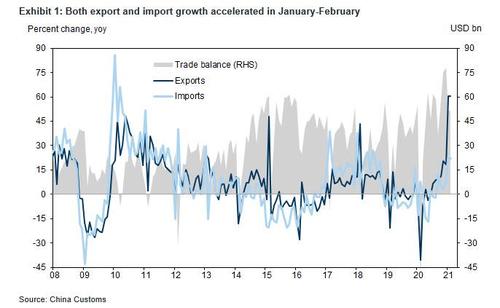

China's exports surged by a record 60.6%Y/Y in January-February, and smashing expectations of 40%, in part due to the one-year anniversary of China's shutdown last February when covid first emerged, but also thanks to the soaring global economy which at least in the US, grew at the fastest pace on record in February according to Goldman's GSAI index.

The reason why Jan and Feb are lumped together is that the first two months are normally volatile for China’s economic activity because of the week-long Lunar New Year holiday, which fell in February this year. The figures are even more distorted this time around because of the comparison with 2020, when factories and businesses were shut to contain the coronavirus outbreak in the early part of the year. Exports plunged 17.4% in the first two months of last year.

Here are the details from China's General Administration of Customs:

-

Exports jumped 60.6% in dollar terms from a year earlier, more than 50% higher than the median estimate of 40% median, with February exports alone more than doubled from last year. The implied sequential growth, which compares to an 18.1% increase Y/Y in December, accelerated to +4.5% mom in January-February vs. +0.7% in December (RMB-denominated exports surged +50.1% yoy in January-February vs. +10.9% yoy in December.)

-

Imports also grew more than expected by 22.2% yoy in January-February. In sequential terms, exports growth accelerated to +4.5% mom sa non-annualized in January-February (vs. +0.7% in December). Imports expanded by 9.8% mom sa non-annualized in January-February vs. +2.1% in December. (RMB-denominated Imports surged +14.5% yoy in January-February vs. -0.2% yoy in December.)

-

China's trade surplus was US$103bn in January-February, roughly double the Bloomberg consensus of $59BN, and up from $78.2BN in December.

By major export destination, exports to the US surged 87.3% yoy in January-February (vs. +34.5% yoy in December) and growth of exports to EU accelerated to +62.6% yoy from +4.3% yoy in December. In contrast, exports to Japan and Korea rose +47.7% yoy and 49.0% yoy, respectively. Exports to ASEAN rose 53% yoy and exports to Vietnam rose most significantly by 78.2% yoy among ASEAN economies.

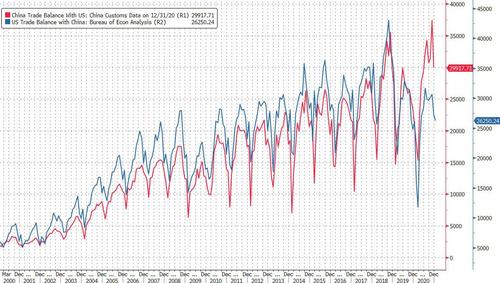

As a reminder, we recently showed that in a surprising regime change, over the past year there has been a sharp reversal in the long-running discrepancy between US and Chinese trade data, where China's trade balance with the US reported by Beijing ha collapsed and is now far below the complimentary US data set. We await the latest US trade data to see if these two series will eventually converge.

The customs agency said the strong trade data reflects improving demand in major trading partners like the U.S. and Europe, a domestic recovery that’s fueling import growth, and base effects from last year’s slump, but the reality is a little different.

By major export category, "working from home"-related exports and Covid-19 related personal protection products remained strong in January-February. In other words, China continues to directly benefit from a massive export burst as a result of the pandemic it itself spread around the world. Even the notoriously pro-China Bloomberg admits that "the data shows exports continued to benefit from soaring global demand for medical equipment and work-from-home devices, which has helped to underpin China’s V-shaped recovery from the pandemic since the second half of the year." Almost as if China stood to benefit from unleashing a global plague...

Growth of exports in automatic data processing machines surged 80% yoy in January-February (vs. 54.5% yoy in December), though growth of exports in electronic integrated circuits moderated slightly to 30.8% yoy in January-February from 39.4% yoy in December. Exports of textile & fabric goods rose 60.8% yoy (vs. +11.7% yoy in December) and exports of plastic articles grew 82.5% yoy (vs. 90.2% yoy in December). Other major drivers to the export strength include furniture and lightnings. Exports of furniture grew 81.7% yoy and lightnings surged 122.1% yoy in January-February.

Exports also benefited from a shorter-than-usual vacation for migrant workers during this year’s Lunar New Year break and the early resumption of factory production. Travel restrictions imposed early in the year prevented many workers from making their annual trip home during the holiday.

“Excluding distortions from base effects, trade growth was still quite solid,” Nomura Holdings Inc. economists led by Ting Lu wrote in a note. While export growth will likely slow after March as base effects ease, fresh stimulus measures in developed nations, especially in the U.S., “may bolster external demand for Chinese products and partly offset the downward pressure,” they said.

On the import side, higher oil and metal prices drove major commodity imports higher in value terms in January and February. The decline in crude oil imports narrowed to -19.6% yoy from -43.2% yoy in December and iron ore imports rose 60.9% yoy, vs. +32.0% yoy in December. Imports of integrated circuits also accelerated to +34.3% yoy in January-February from +26.5% yoy. In volume terms, crude oil imports rose 4.1% yoy, vs. -15.4% yoy in December. Iron ore imports rose 2.8% yoy, reversing from -4.5% yoy in December.

A breakdown of commodity imports shows large increases in purchases of steel and natural gas in the two-month period and a plunge in coal.

In short, as Goldman summarizes, "Export growth accelerated in January-February as Covid-driven demand remained strong amid resurgence of infections globally, while total import value rose sharply on higher commodity prices, resulting in narrower monthly trade surplus."

The data comes two days after the closely watched National People’s Congress kicked off in Beijing, with the government setting out its economic agenda for coming years. Authorities are targeting growth of more than 6% this year (roughly in line with where the US will be), a disappointing and "conservative" goal compared with the 8.4% expansion that economists predict. The government also signaled more restrained monetary and fiscal policy after last year’s pandemic stimulus.

“We expect Beijing to carry out its policy normalization in coming months, although a sharp shift in policies appears unlikely,” Nomura’s economists said.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more