China Data To Weigh On Aussie Dollar

China’s GDP data to be released next week may disappoint, short AUD/USD?

China trade data shows that global growth to be more challenging this year

After steaming ahead, Chinese exports unexpectedly tumbled in December, declining 4.4% from a year ago. December’s drop was followed by a nine-month run in which exports seemed to shrug off the US tariffs that the Trump administration threatened to put in place. Exports surged as companies front-loaded orders to beat the punitive levies. As such, November exports grew 5.4%.

Crumpling exports, if sustained, would sap a key source of growth and employment for a weakening Chinese economy and underscore Beijing’s eagerness to reach a deal with the Trump administration on ending their tariff battle. More than half of Chinese products sold to the US are under punitive tariffs, and the months of wrangling with the US have weighed on investors’ sentiments and private companies’ investments.

China’s imports, which have been weakening, fell 7.6% in December, according to Monday’s trade data which showed global demand flagging more than expected and that will exert more downward pressure this year on the slowing Chinese economy.

US government shutdown act as a cap to US dollar as jobs data to weigh on later

The partial government shutdown could cause the longest stretch of continuous job growth recorded in the US to come to an end this month.

US employers, including private businesses and government agencies, have added jobs every month since October 2010, a streak of 99 months. That is the longest run on record dating back to 1939 and would come to an end, if hundreds of thousands of government workers furloughed by the partial shutdown are dropped from federal payrolls.

Our Picks

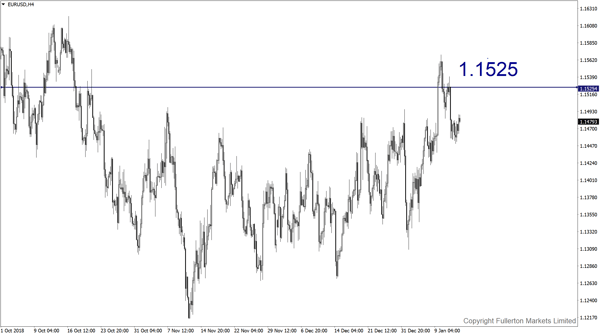

EUR/USD: This pair may rise towards 1.1525 this week amid the US government shutdown.

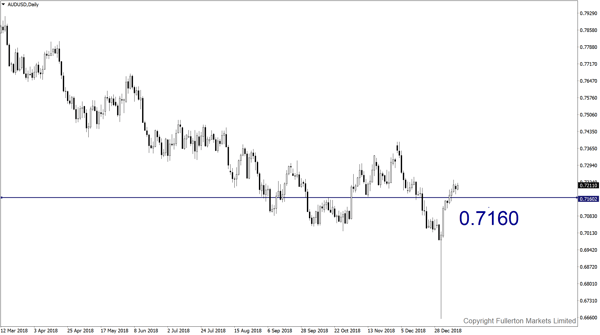

AUD/USD:

This pair may fall towards 0.7160 this week as China’s growth outlook darkens.

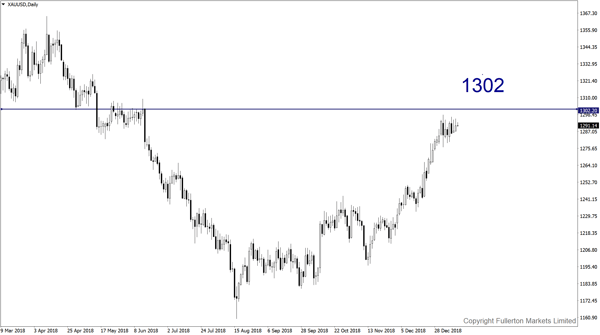

XAU/USD:

This pair may rise towards 1302 this week.

Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more