Chart Of The Day: Contrarian On China

COTD Bullet Points:

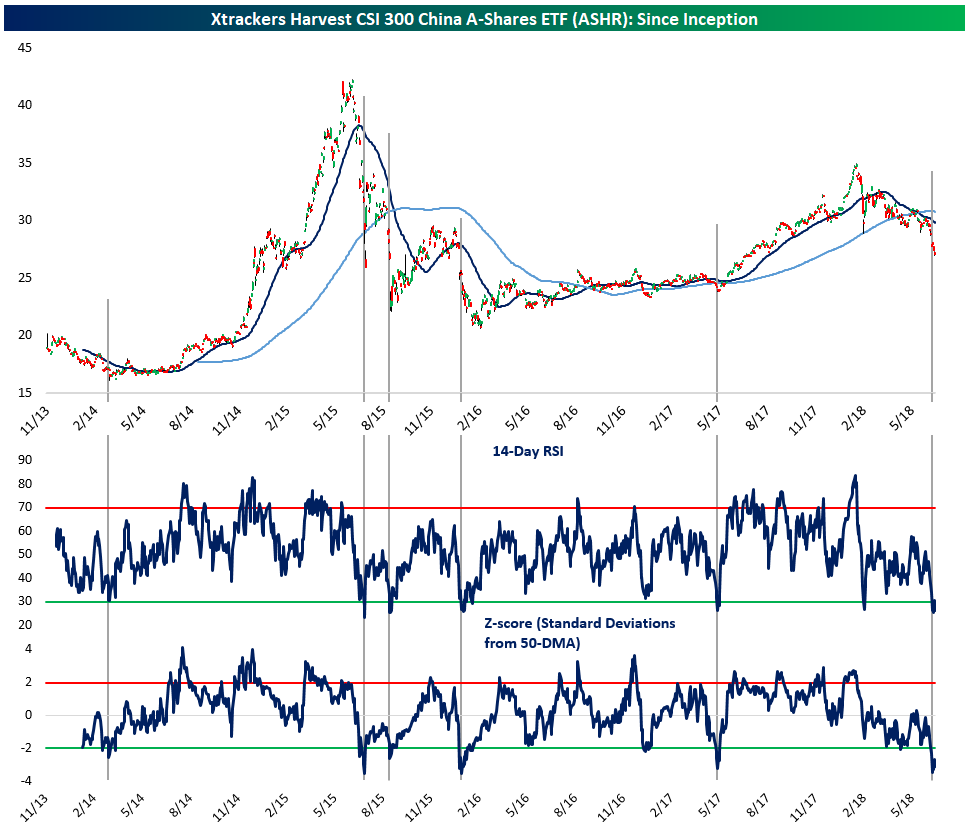

- Amidst trade war concerns, the onshore China equity ETF ASHR is dramatically oversold.

- 5 of 6 previous instances for this kind of price action have been excellent entry opportunities in the ETF.

- While not compelling alone, the contrarian nature of owning Chinese equities and possible government support for the market also make the trade compelling.

Chart of the Day:

The ASHR ETF (which tracks large-cap onshore Chinese stocks) has gotten badly oversold. While further declines may be pending, in 5 of 6 instances where both 14 Day RSI and Z-score (standard deviations from 50-DMA) reached oversold territory, the ETF saw a significant gain on at least a tactical basis. The only exception was Q1 of 2016. While this is hardly a sure thing, it’s contrarian (goes against prevailing view that China will suffer most from tariff hikes by the US) and would benefit from Chinese policy support for their domestic equity market amidst poor price action.

Comments

Please wait...

Comment posted successfully.

No Thumbs up yet!