Central Bank Watch: BOE & ECB Interest Rate Expectations - Update

Starting to Scale Back Pandemic Measures

In this edition of Central Bank Watch, we’ll cover the two major central banks in Europe: the Bank of England and the European Central Bank. The ECB’s June meeting is in the rearview mirror, while the BOE is due up in two weeks’ time. While the latter has started to scale back its QE program, the former has started to offer hints that it too will soon move in that direction.

BOE Watching Inflation

The BOE meets in two weeks for its June meeting, having just produced a Quarterly Inflation Report at their prior policy meeting, its unlikely that any changes are made to either asset purchases or interest rates. The BOE has already adjusted its bond-buying program so that it will reach its £875 billion target at its intended end date at the end of the year; BOE QE is continuing for now, just at a slower pace.

In the interim period, BOE Chief Economist Andy Haldane remains in the news cycle, continuing to color BOE policy at the margins. At the end of May, the BOE’s chief economist said that “an upside surprise to inflation is among the greatest risks” as it would force policymakers “to tighten policy even more rapidly or on a more significant scale, or possibly both, in a way that would take the legs out of the recovery.” This week, the BOE’s Haldane offered some dovish leanings, suggesting that the UK labor market has “pretty acute” uncertainties.

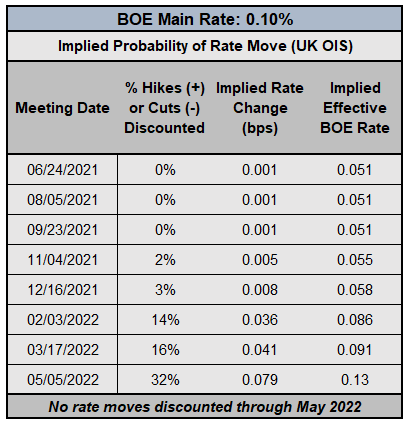

Bank of England Interest Rate Expectations (June 10, 2021) (Table 1)

Threading the needle on BOE Chief Economist Haldane’s comments, the inflation alarm ringing while the UK labor market remains uneasy suggests that stagflation is a growing risk. For now, this equates to the potential for a more rapid withdrawal of asset purchases, even if interest rates are unlikely to move anytime soon. According to overnight index swaps, while there is only a 3% chance of a 25-bps rate hike in 2021, there is a 32% chance of a hike over the next 12-months.

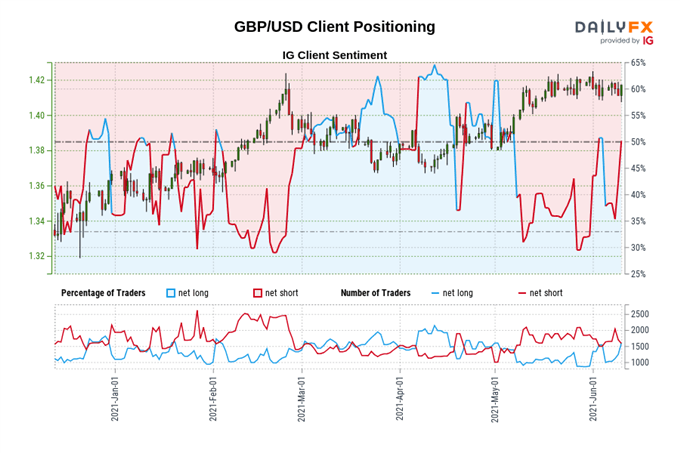

IG Client Sentiment Index: GBP/USD Rate Forecast (June 10, 2021) (Chart 1)

GBP/USD: Retail trader data shows 39.85% of traders are net-long with the ratio of traders short to long at 1.51 to 1. The number of traders net-long is 22.05% lower than yesterday and 21.90% lower from last week, while the number of traders net-short is 8.61% higher than yesterday and 16.34% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bullish contrarian trading bias.

ECB Hints at Divisions Within

Ahead of the June ECB policy meeting, ECB Governing Council member Klaas Knot said that higher yields are welcomed because “what the market is actually doing is pricing that optimism” about a recovery in the second half of 2021. It appears that this attitude regarding the Eurozone’s economic recovery is becoming infectious among ECB policymakers.

At the June meeting press conference, ECB President Christine Lagarde hinted at growing divisions within the Governing Council even as she suggested that inflation “remain subdued” amid “still significant economic slack.” The ECB president noted that at least three individuals (among the 25 decision makers) wanted to scale back asset purchases, and a report emerged after the press conference that there were additional policymakers who expressed concern about continuing large scale asset purchases through thinner markets in the summer months.

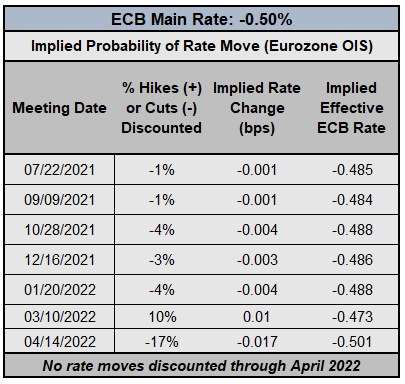

EUROPEAN CENTRAL BANK INTEREST RATE EXPECTATIONS (June 10, 2021) (TABLE 2)

If anything, the September ECB meeting – the next one that will produce a new Staff Economic Projections – will be of interest, seeing as how any bond market volatility over the summer could provoke a significant rethink in ECB policies. Like the Federal Reserve, the other side of summer may mark the beginning of the end of the ECB’s asset purchases (which the BOE and Bank of Canada have already started to scale back, to various degrees).

According to Eurozone overnight index swaps, the ECB still won’t be changing rates anytime soon. In mid-January, there was a 54% chance of a 10-bps rate cut by December 2021; that probability now stands at 3%. Through April 2022, there is now a 17% chance of a 10-bps rate cut.

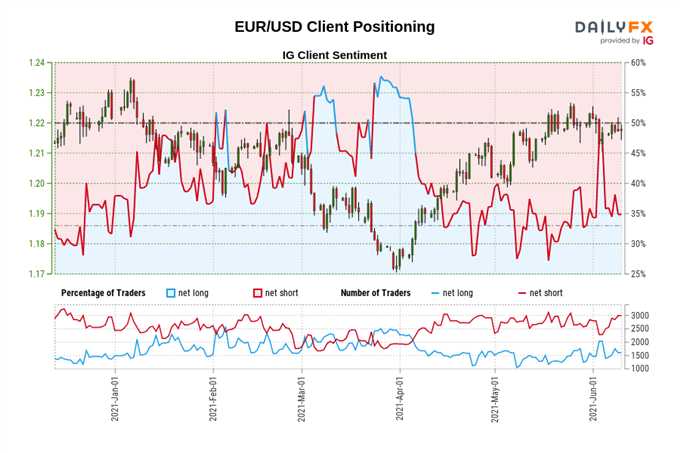

IG Client Sentiment Index: EUR/USD Rate Forecast (June 10, 2021) (Chart 2)

EUR/USD: Retail trader data shows 34.48% of traders are net-long with the ratio of traders short to long at 1.90 to 1. The number of traders net-long is 4.45% lower than yesterday and 22.01% lower from last week, while the number of traders net-short is 6.79% lower than yesterday and 20.15% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.